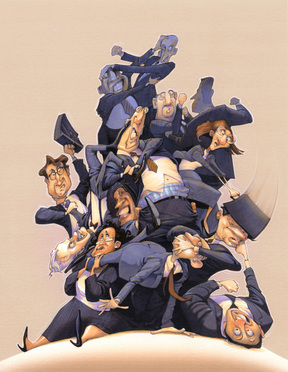

When Companies Sue Their Outside Counsel, It Can Be One Big Brouhaha

The Consumer Financial Protection Bureau (CFPB) has received a complaint every 21 hours for the past five years about a single California fintech company,…

March 01, 2018 at 07:00 AM

11 minute read

The Consumer Financial Protection Bureau (CFPB) has received a complaint every 21 hours for the past five years about a single California fintech company, public records show. But that's far from all the trouble CashCall and its attorneys are facing.

The 15-year-old Orange, California-based online lending company was ordered by the Virginia attorney general's office in January 2017 to pay more than $15 million to consumers who CashCall allegedly deceived into accepting illegally high interest rates on loans with annual rates reaching up to 230 percent.

The company signed a $1.5 million settlement with the New York attorney general in 2014 and paid $1 million in penalties in California in 2009. It has also paid $40 million to regulators in Georgia and $3 million in Washington, D.C. Still, the list of state actions citing CashCall's lending practices goes on. Then, of course, there's the $10.3 million the company was ordered to pay in January to the CFPB—a far cry from the $287 million the bureau originally sought but certainly not pocket change.

After years of fending off legal and regulatory challenges, in 2017, the payday lender decided to file a suit of its own—against its outside lawyers.

In recent months, two other companies, APR Energy and ALPS South, both in Florida, also have filed suits against their outside counsel that have been made public. Each of the three companies has different reasons for suing its attorneys, but all accuse their outside counsel of some form of malpractice.

While their circumstances differ, what all three of these cases show is how unusual it is for a company to take its lawyers to court in the first place. Proving these charges can be challenging, and bringing them can have reputational and business consequences.

“This is very, very rare. It's like going nuclear,” says Jason Winmill, managing partner at Boston legal consultancy Argopoint, who has no direct knowledge of the cases. Winmill says that, when his clients send out RFPs for outside counsel, law firms are required to disclose whether they are or have been engaged in a lawsuit with a client. In his 12 years at Argopoint, he says, fewer than one percent of firms have answered that question affirmatively.

“I've heard it discussed, weighed, debated by major legal departments—but I've never seen the trigger pulled,” he notes. “There are all kinds of steps and interventions that precede the lawsuit. Still, it does happen.” If a client is that dissatisfied with services provided by its firm, it is welcome to get a second opinion or switch law firms, Winmill says. He adds, “None of my Fortune 500 or global clients have ever pursued this avenue.”

CashCall's Plight

Despite the lengthy list of reasons not to initiate a legal fight with outside lawyers, CashCall apparently thought it was worth it. But it was a move that might have backfired for the company and its general counsel.

In April 2017, CashCall sued Katten Muchin Rosenman and named partner Claudia Callaway in the complaint. The company accused the firm of malpractice, claiming that CashCall's tribal business model was constructed as the result of “negligent advice and other legal services provided by an incompetent attorney and her law firm,” according to the complaint filed in California Superior Court. In her firm biography, Callaway says that she has “represented clients before the CFPB since it was established.”

Most of CashCall's problems with regulators center on the tribal business model, built on a partnership with Western Sky Financial, a shell company situated on tribal land of the Cheyenne River Sioux reservation in South Dakota. The partnership was supposedly formed so the lender would be immune to federal and state regulatory scrutiny over interest rate caps. But CashCall experienced the opposite effect.

“Defendants' malpractice destroyed an $870 million consumer lending program, harmed Plaintiffs' other successful businesses, tarnished Plaintiffs' business reputation, and caused Plaintiffs to suffer hundreds of millions of dollars in damages,” CashCall's complaint says.

Callaway and her firm adamantly deny malpractice claims. In Katten's August 2017 response to the CashCall lawsuit, the firm points to several examples of how Callaway apparently tried to convince CashCall not to follow the tribal business model.

Callaway did not respond to requests for comment, but a Katten spokeswoman said in an email, “CashCall made us aware of these allegations long before filing. Then and now, we believe them to be without merit. We will vigorously defend our firm against this matter, and we expect to prevail.”

The CFPB is siding with Katten. In a Nov. 20 posttrial brief filed during its own dispute with the lender, the bureau cites CashCall's accusations. “Defendants' outside counsel warned [Cash Call general counsel Dan Baren] in February 2011 that, if CashCall did not change the structure of the Western Sky program to support an arm of the tribe structure, it would be a 'marquee quarry' for the Bureau,” the CFPB's posttrial brief reads. Rather than relying on Katten, the bureau writes, CashCall “in fact ignored their counsel's advice for years.”

“The court should reject defendants' attempt to portray their conduct as victimless, or worse, to portray themselves as the victims of their own lawyers,” the brief states.

This is not the first time that the firm has been sued for actions related to the CFPB. Katten was sued in November 2016 by Thomas McNamara, the appointed receiver for payday lending entities involved in Consumer Financial Protection Bureau v. Moseley et al. The entities claim that Katten and Callaway, who is not a defendant in the suit but is named throughout the complaint, offered “negligent advice as to the applicability of the Consumer Financial Protection Act of 2010” to the entities' “payday lending business and loan documents,” which resulted in a suit filed by the CFPB.

Michael McCabe, a patent attorney with a private practice in Maryland who represents attorneys in ethics investigations and disciplinary matters but is not involved in the case, says CashCall made a bold decision when it chose to sue outside counsel. With all litigation like this, he says, a company can inevitably expect that it will be “airing all of your dirty laundry” for the public, including competitors, to see.

One reason these suits are uncommon, he says, is that the law firms don't want to suffer reputational harm any more than the companies do, so they will resolve problems with their clients before litigation even becomes a possibility. Plus, he says, “it chews up a lot of otherwise billable time to defend these types of matters.” Despite the distraction, McCabe says a lawyer might have “a natural instinct to defend yourself and preserve your reputation.”

Baren, who has been general counsel at CashCall since 2003, hasn't emerged unscathed from the ongoing litigation. In Katten's response to the lawsuit, the firm points to several times Baren allegedly contradicted himself in testimony provided to agencies such as the CFPB, misstated his involvement in setting up the tribal business model and even mocked a warning letter sent to CashCall by the Maryland attorney general.

“Baren was responsible for the negotiation and drafting of virtually every CashCall agreement for both the bank lending and tribal lending programs,” Katten's response brief reads. “Baren frequently ignored the advice of Katten, and on his own, crafted and devised documents that were problematic and flawed.”

Baren and his attorneys, Jennifer Keller and Timothy Alger, who are representing CashCall in its suit against Katten, declined to comment.

Turning on Their Lawyers

Four months after CashCall sued Katten, thousands of miles across the country, ALPS South, a St. Petersburg, Florida-based medical device company, sued its outside counsel at Shumaker, Loop & Kendrick in state and federal court for allegedly bungling patent applications filed on behalf of the company. Ronald Christaldi, a partner at Shumaker, is not a named defendant but is mentioned—and is the target of much blame—throughout the complaint.

In its 2017 suit, ALPS accused Shumaker's team of mishandling litigation from years earlier brought against a competitor that was accused of infringing on ALPS patents for prosthetic liners and sleeves in ALPS South LLC v. The Ohio Willow Wood Co. ALPS South was first awarded $15 million in that 2012 case, but the ruling was later overturned.

The firm also was accused of missing a deadline to file for an international patent application. In its suit, ALPS alleges that patent protection “is diminished in value and/or may be lost or invalidated in many foreign countries.” Missing the deadline also allowed ALPS' competitors time to “freely commercialize,” the suit says.

Neither the firm nor Christaldi responded to requests for comment, but the firm's managing partner, Julio Esquivel, told The Tampa Bay Times that “we have full faith in our partners and will continue to vigorously defend our firm. … It is very disappointing that a long-standing client would react in this fashion to collection on a significant amount rightly owed to our firm.”

Patrick Dekle, who is representing ALPS in the case, did not respond to a request for comment.

Not surprisingly, even the deepest and most lasting relationships between a company and outside lawyer can be damaged irreparably when lawsuits fly. Sterling Miller, general counsel of Marketo Inc., who has held roles in-house and in private practice, says he doesn't know personally of any companies that sued their outside counsel. Those that consider it, he says, quickly change course. “You have to give this a lot of thought and be sure that you want to lose that relationship with that firm,” Miller says.

Shumaker filed a countersuit against ALPS, in which the law firm claims to be owed $2.64 million in legal fees and associated costs. This scenario—a law firm suing a client over unpaid fees—is much more common than a client suing a firm over subpar service. It tends to be more of a winning formula, as well. “With a billing issue, the facts can be proven pretty easily,” Miller says. “It's much more difficult and complicated to prove malpractice.”

In a separate suit, APR Energy puts the work of its outside counsel into question. The Jacksonville, Florida-based company filed a suit on Aug. 31 alleging that Baker McKenzie's Australian arm committed malpractice and breach of fiduciary duty when it performed due diligence connected to the lease of turbine sets APR planned to use in Australia.

“At all relevant times, Baker represented itself as having the necessary expertise, experience and knowledge needed to advise plaintiffs, in Florida, of the intricacies of Australian law upon which representations plaintiffs reasonably relied on, to their detriment,” APR's complaint says.

In an emailed statement to Corporate Counsel, a spokesman for Baker McKenzie said, “The suit has no merit and we've filed a motion to dismiss the case.” He declined to comment further, citing the firm's policy against commenting on pending litigation.

Meanwhile, APR's outside general counsel Harold “Ed” Patricoff says the company suffered out-of-pocket losses exceeding $200 million when the firm failed to disclose a title defect. Patricoff says the company tried to resolve its issues out of court but “they were not willing to resolve the matter with us in any way so our next logical step was to bring a lawsuit.”

Patricoff says it was “a very serious decision” for APR to sue. At the time, Baker McKenzie was representing APR in the U.S., Indonesia and Singapore. “Shortly after we made the decision to bring a legal claim against them, we terminated the relationship as quickly as we could from a practical standpoint.”

The suit could have been avoided if Baker McKenzie had “admitted their mistake, refunded the fees and helped make the client whole for damages,” Patricoff says. “It's like an auto accident. You rear-end somebody, you damage the car and you injure the person, you apologize and pay for any damage you caused.”

As lawyers interviewed for this article repeated, actions against outside counsel are rare, and few have reached a public resolution. For the few cases that have gone forward, the lawyers are unaware of any that have made it to trial. Most cases get settled, McCabe says. “This is one where you'd especially want to reach a settlement,” he says.

CashCall, ALPS or APR could very well reach private settlements with their former outside counsel. Or this already rare breed of cases might just reach something even more unusual—a verdict.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Wells Fargo and Bank of America Agree to Pay Combined $60 Million to Settle SEC Probe

Amex Latest Target as Regulators Scrutinize Whether Credit Card Issuers Deliver on Rewards Promises

After 2024's Regulatory Tsunami, Financial Services Firms Hope Storm Clouds Break

Financial Watchdog Alleges Walmart Forced Army of Gig-Worker Drivers to Receive Pay Through High-Fee Accounts

Trending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250