A Seat at the Table: Making a Triangle Into a Circle

How to successfully transform the triangle between legal, finance and procurement into a circle—where solid relationships can be built and real work can be done—with each having a “seat at the table.”

March 08, 2019 at 11:52 AM

10 minute read

Photo: Shutterstock.com

Photo: Shutterstock.com

“Know thy client” is more than a business mantra these days—it's an essential truth on the journey from service intermediary to trusted adviser.

This article focuses on how to successfully transform the triangle between legal, finance and procurement into a circle—where solid relationships can be built and real work can be done—with each having a “seat at the table.”

The ability of a company's legal, finance, and procurement departments to build a trusted working relationship ultimately results in real, measurable business impact. This juncture is where internal stakeholder satisfaction, process efficiencies, and increased cost savings become aligned toward a greater return for all.

The Journey

Not so long ago, the separate realms of corporate legal, finance and procurement existed like city-states of Ancient Greece; sovereign states that functioned as small independent countries, consisting of a single city and their respective dependent territories. In this world, for example, Sparta might have to trade with Athens, but their interests remained primarily their own.

Corporate legal departments have historically believed that no one —other than one of their own—could really understand their concerns. Likewise, corporate finance held the purse strings and viewed other business units, including legal, with caution; while procurement was viewed as a wholly-owned subsidiary primarily beholden to finance in its on-going mission to zealously guard the assets of the company.

Right or wrong, the perception created by these beliefs was that legal lived within its own walls and worked according to its own rules, finance guarded the sacred financial statements, and procurement measured and cut unit costs wherever possible, while attempting to “balance” the need to reduce spend against the need to ensure adequate levels of service. This delicate dance all too often creates a factionalized “us versus them” scenario that worked to no one's ultimate benefit.

Most recently, however, a corporate paradigm shift (from this way of thinking) has increasingly become clear. Traditionally seen as a non-revenue center of the business, legal has now become an area of assessment for value and efficiency, given the developing science of quantitative and qualitative analysis being performed within other high-spend corporate functions. Six Sigma and its consulting brethren arrived and gained major influence in spend planning and performance, as companies looked to drive down costs in areas (like legal) where they had feared to tread before. This movement of microscopes even extended to legal service categories with multiple variables, such as litigation and investigations.

Forced into the same room, corporate legal departments began the difficult task of interacting with finance and procurement to identify and assess comparative value, and eventually competitively bid out external legal services it once had the exclusive domain to command under its learned expertise.

No longer afforded its previously enjoyed “cardinal” status, many feared that the corporate legal department was slowly being commoditized and now judged in the same light as all other company business units. Heresy!

The Big Three

The doctrine of “the enemy of my enemy is my friend” has been employed by several nations during turbulent times in human history. We have witnessed disparate actors—despite inherent differences and perspectives—working together to meet and overcome existential threats once they became convinced that their survival depended on mutual cooperation and assistance.

During WWII, President Franklin D. Roosevelt and Prime Minister Winston Churchill were very wary of the Soviet Union under the leadership of Marshal Joseph Stalin. Despite this apprehension, both nations developed policies that supported the creation of a full alliance—the Allied Powers—with the complete understanding that Soviet participation was crucial to victory over the Axis and establishing an enduring peace once the war was over.

Today, ferocious global competition, continuing market disruption and existential financial threats pose very similar challenges to the continued profitable operations of most corporate entities operating anywhere in the world. In many ways, it looks—and feels—like a global conflict that will determine winners and losers in a post-war business world.

As a result, victory over these threats requires similar cooperation—and alliances—between company business units to persevere and triumph in today's fiercely competitive business environment.

Cracking the Seal

At the onset, it is critical to understand that trust must be earned and is not to be assumed. While procurement may have built trust with finance through collaboration across other company business units, that experience typically did not extend to legal.

First and foremost, building trust begins with a simple, yet focused truth: There is no substitute for getting to know your legal stakeholders as people. This goes far beyond the numbers and involves time honored relationship building. That means meeting face-to-face often and listening twice as much as speaking. In particular, procurement professionals must ask themselves a series of questions at the outset of their engagement with legal:

- Who are our legal team members?

- What motivates them?

- How do they perceive value?

- Where did they go to law school?

- Where have they practiced law (before joining our company)?

- How long have they been at the helm of our company?

- How are they viewed as a legal function with our company?

- What is their self-perception of their role within our company?

- What would they like to change (e.g. pain points on both sides of that equation)?

- How can we help them achieve it?

- How can we help them get it done as quickly as possible?

The latter questions offer critical guidance as to how procurement can evolve and eventually be seen as an entity that builds trust and implements positive change that has a collateral impact across all company operations.

Relationship building is not a light touch activity. It requires concerted ongoing efforts to prove out each person's and team's reciprocal value to one another, particularly when doing so with some of the most educated and valued teams such as legal. First steps can be simple and purposeful introductions aimed towards transparency and synergistic purpose.

While there is not one particular way procurement can solve issues for legal and build trust in the process, validating procurement's skill set to legal through partnering opportunities opens the door. Providing legal a research arm for competitive intelligence, improved efficiency processes and practices to extract greater value from outside counsel are a healthy start. By becoming an educator and source of valuable information, procurement can build credibility and is now one step closer to becoming a trusted adviser.

Targeting the Opportunity

With an estimated $239 billion annual cost for civil lawsuits in the U.S. alone for 2017, $48 – $120 billion is attributable to discovery. Procurement teams that partnered with legal and finance reported saving 21 percent in annual legal spend, driving out $10 – $25 billion in cost, according to a 2018 Buying Legal Council survey.

Death of Outdated Unit Rate Analyses

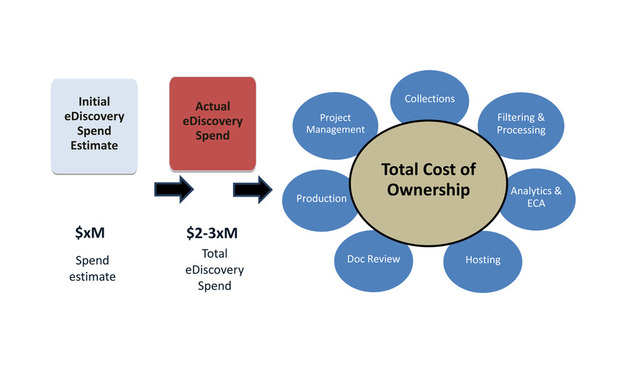

As corporate legal, finance, and procurement departments amassed more knowledge and experience in working together, collaborating with key external partners, an interesting result was observed: driving down project task unit rates separately (versus identification of key total project efficiency metrics) dis-incentivized good behavior from outside providers. Said another way “seeking the lowest unit rates for every project line item (as a primary selection criteria) conversely increased total project spend.”

What could possibly be the reason for total project cost rising when every individual project unit rate was driven down to the bone? The answer was ultimately not surprising: “As providers were forced to lower all individual project unit rates, they became incentivized to act inefficiently in order to push more units through the project to preserve any remaining margin and maximize revenue.”

What are the lessons learned?

- Identify the true measure of total cost of ownership;

- Focus on only key metrics for overall project efficiency (see data reduction/cull rate below);

- Partner with experienced and reputable providers to share some level of that total cost of ownership and project efficiency exposure (Skin in the Game – https://www.law.com/corpcounsel/sites/corpcounsel/2018/01/19/skin-in-the-game-how-to-reach-appropriate-fee-agreements/?slreturn=20180808203903), and;

- Analyze whether to make, buy, or rent some combination of the two.

Using eDiscovery as an example, total cost of ownership equals the sum total of all project costs from collection, processing/hosting, review and production, divided by the data throughput. This definition results in a total cost per gigabyte and is your true measure of eDiscovery total cost of ownership.

Understanding the data reduction (cull) rate (measured from post-initial data collection, filtering, de-duping and de-nysting to what percentage of the data corpus is then promoted to managed document review) is also a critical project efficiency metric to track and police, as it can profoundly reduce total project cost at an attainable 90% data cull rate and above. Providers can guarantee this and should be held accountable to do so.

How do you gather the data you need? Start with the total amount spent on eDiscovery:

- eDiscovery Providers

- Technology

- Document review

- Outside Counsel

- Document Review

- eDiscovery tasks

- eDiscovery technology costs

- Total amount of discovery data

- Gigabytes collected, ingested, hosted, reviewed, produced, etc.

- Establish a baseline of your total project cost per gigabyte of data.

Building the Alliance

How do these alliances—post formation—get taken to the next level?

By partnering with an experienced and dedicated 3rd party service provider team (properly aligned with a client's overall business goals), corporate finance, legal, and procurement departments are able to track and – when necessary – police total project spend at a matter and portfolio level. By combining the talents of a dedicated corporate multi-disciplinary team with an experienced and well regarded third-party services provider, best practices can be consistently applied by all parties—including outside counsel—so that the desired service level commitments are achieved.

Next, conduct a spend analytics process, combined with electronic invoice review/auditing, to ensure playbooks and guidelines are created for service and project delivery (reviewed and updated with regularity) that consistently follow the rules of the road to achieve the targeted spend reduction.

To institutionalize the changes being implemented and cement the alliance, outside counsel convergence and captured provider initiatives can complete the initiative and deliver extremely powerful business impact in conjunction with these new controls.

It is also imperative for senior legal management to fully support all of these efforts, with their commitment to evangelizing new processes internally within the legal department and externally with outside counsel for maximum impact.

Some Final Thoughts

The objective of legal, finance, and procurement building a trusted relationship is very attainable based upon ongoing value-add investment in the working relationships together. The business impact of this achievement ultimately results in increased process efficiencies, more successful joint initiatives, the alignment of mutual interests to decrease spend, and the fortified ability to solve for the continued challenges ahead.

Dan Panitz, UnitedLex VP, Global Legal Solutions, is an experienced attorney based in New York with more than 20 years of combined legal, technology and corporate advisory experience. Having worked with SEC Enforcement and NASD (now FINRA) Arbitration, Dan also holds Anti-Bribery & Corruption specialty certifications for the PRC, UK and the US and is a former adjunct professor on Computers and the Law.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A Blueprint for Targeted Enhancements to Corporate Compliance Programs

7 minute read

Three Legal Technology Trends That Can Maximize Legal Team Efficiency and Productivity

Corporate Confidentiality Unlocked: Leveraging Common Interest Privilege for Effective Collaboration

11 minute readTrending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250