Vaping Product Sales in Middle East, South America May Cause Hardships for Tobacco Industry In-House Counsel

The countries with the highest levels of regulation are Saudi Arabia, Oman, Lebanon, Brunei, Egypt, Iran and Qatar, and Brazil, Uruguay and Venezuela also have strict regulations on e-cigarettes and vaping devices, according to a recent ECigIntelligence report.

May 20, 2019 at 07:27 PM

3 minute read

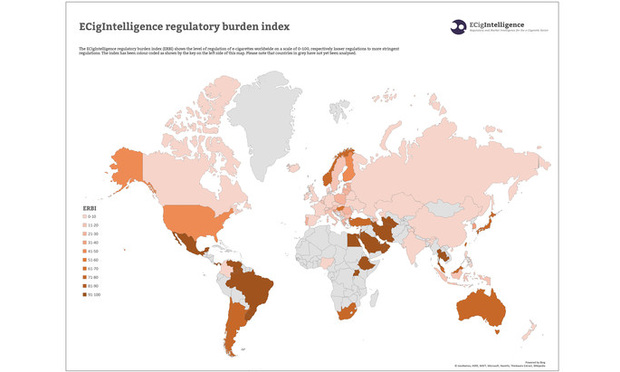

ECigIntelligence regulatory burden index. Courtesy of ECigIntelligence

ECigIntelligence regulatory burden index. Courtesy of ECigIntelligence

Whether it's flavor bans or bans on vaping products, doing business in the Middle East and South America may be difficult, according to a regulatory burden index published by ECigIntelligence last week. But in-house counsel should look for medical regulatory exceptions or watch where the bans are lifting to help their companies expand business.

ECigIntelligence, a London-based market research company for the e-cigarette industry, rated each country on the map from lowest to highest in variables of 10; 90-100 being the highest and 0-10 being the lowest.

The countries with the highest levels of regulation are Saudi Arabia, Oman, Lebanon, Brunei, Egypt, Iran and Qatar. Brazil, Uruguay and Venezuela also have strict regulations on e-cigarettes and vaping devices. There are winds of change on e-cigarette regulation in the Middle East, said ECigIntelligence editorial director Barnaby Page. He added because of the United Arab Emirates' influence in the Gulf Cooperation Council, those bans may be lifted in other Middle Eastern countries.

“Most notably, in the [United Arab Emirates] we've recently seen a policy change when the country decided to allow the commercialization of e-cigarettes after a long-standing ban,” Page said.

Gregory Conley, president of the American Vaping Association, a nonprofit that advocates for the use and regulation of vaping devices, said one of the issues companies face in those markets are finding ways to change the laws.

“One impediment to that is the Framework Convention on Tobacco Control. Virtually every country but the U.S. has ratified it,” Conley explained.

The World Health Organization Framework Convention on Tobacco Control bars tobacco companies from engaging with governments, which means some of the larger vaping companies could face issues when trying to lobby to change the laws.

“Juul is now one-third owned by Altria. So when it comes to negotiations with international governments they could be considered a tobacco company,” Conley explained.

He said the larger companies in these countries have gone the route of asking for forgiveness rather than permission. However, that is not feasible for smaller retailers or distributors in those restrictive countries.

Many of the countries that have banned vaping devices have their origins in old pharmaceutical regulations.

“Some of these laws were not put in place to deter vaping, but instead are relics of pharmaceutical regulations where products that contain nicotine, but aren't intended for smoking or chewing, have to go through a medical approval process,” Conley said.

Page said these exceptions are rarely given to companies to allow them to sell in certain countries.

“In practice no supplier actually takes that route, and the chances of regulatory approval, if they did, might be small,” Page said.

Page noted while some countries do have more restrictive regulations, enforcement may be more relaxed.

“It's also worth noting that our regulatory index does not at present capture how aggressively legal restrictions are enforced, and that in some instances the regulatory framework is not supported in practice due to the lack of enforcement,” Page said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Crypto Industry Eyes Legislation to Clarify Regulatory Framework

SEC Official Hints at More Restraint With Industry Bars, Less With Wells Meetings

4 minute read

Trump Fires EEOC Commissioners, Kneecapping Democrat-Controlled Civil Rights Agency

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250