Disruptive Technology, Part 1: Understanding the Risks and Rewards

A look into a new generation of disruptive technologies working their way into financial service firms.

June 27, 2019 at 04:42 PM

6 minute read

Legal Tech

Legal Tech

This article is the first in a three-part series exploring executives' perspectives on disruptive technologies in the financial services industry.

The financial services industry has always been quick to embrace technology-based innovation, from ATMs to online banking. That trend continues, as fintech and a new generation of disruptive technologies, such as artificial intelligence (AI), blockchain, and biometric security, find their way into financial services firms.

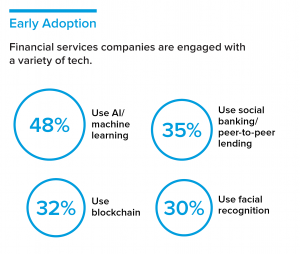

Today, 73% of financial services companies are using one or more disruptive technologies, according to a recent survey of industry executives conducted by Corporate Counsel in conjunction with Winston & Strawn. The study found that companies are drawing on a variety of these technologies. AI, cited by 48%, tops the list, with respondents making use of AI technologies ranging from machine learning and chatbots to automated fraud detection, dynamic credit assessments, and algorithmic trading. In addition, 35% are using social banking/peer-to-peer lending technologies, 32% are using blockchain, and 30% are using facial recognition (see Graphic 1).

Today, 73% of financial services companies are using one or more disruptive technologies, according to a recent survey of industry executives conducted by Corporate Counsel in conjunction with Winston & Strawn. The study found that companies are drawing on a variety of these technologies. AI, cited by 48%, tops the list, with respondents making use of AI technologies ranging from machine learning and chatbots to automated fraud detection, dynamic credit assessments, and algorithmic trading. In addition, 35% are using social banking/peer-to-peer lending technologies, 32% are using blockchain, and 30% are using facial recognition (see Graphic 1).

While the use of these technologies is widespread, it is not uniform across the industry. Some companies have moved forward relatively quickly with the new technologies, while others have yet to get started. “Financial institutions in general have been early adopters of disruptive technology, but there is some disparity across companies in terms of comfort levels and how deeply they have embedded disruptive technologies into their businesses,” says Susannah Torpey, a partner at Winston & Strawn.

The findings also show that financial services executives have high expectations for disruptive technologies and anticipate they will help their companies compete and grow. At the same time, however, they are not blind to the legal and regulatory risks they could bring. The potential impact of disruptive technology is expected to be widespread and deep, but it is not yet fully understood—and technology and the regulatory environments are both evolving. All of this increases concern about risk.

While the industry has dealt with evolving technology for decades, things are fundamentally different—and more challenging—this time around. “Technological change is not new. But that change is now faster, and the technology is more complex and more pervasive,” says Basil Godellas, head of Winston's financial services regulatory practice. “So keeping up with evolving legal and regulatory risks is now more critical than ever.”

Putting Disruptive Technology to Work

For financial services companies, customers are a key focus of disruptive technology initiatives, which is perhaps to be expected in an industry where customer experience is a key competitive factor. About four out of 10 say they are using it to improve customer service and provide easy access to products and services—witness the growing use of chatbots to assist customers. But companies are applying it to more back-office-oriented processes as well, with one-third citing each of three areas—increasing process efficiency, streamlining regulatory compliance, and creating new data-powered products. Altogether, more than three-quarters of companies are using disruptive technology in one or more of these areas. “We see they are using AI, for example, to do things like work with customers or in loan underwriting,” says Danielle Williams, a litigation partner at Winston. “But they are also using it for fraud protection and surveillance. They are really embracing all facets of AI, on both the external and internal sides.”

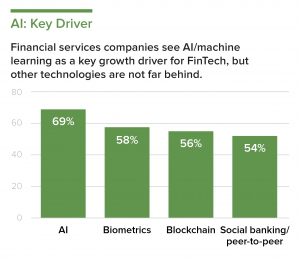

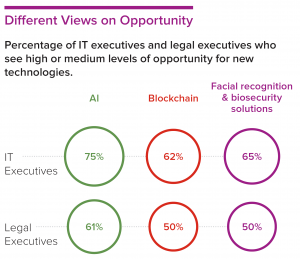

Companies' experience with the technology has presumably been fairly positive, given their expectations for the future. When asked what technologies will drive growth, 69% cited AI. But other technologies are not far behind, with 58% seeing growth potential in biometric security technologies, 56% in blockchain, and 54% in social banking/peer-to-peer lending. Disruptive technology will bring “better market share and higher customer service,” said one respondent, while another saw broad benefits and noted, “I strongly feel that the current way things are done will change greatly in the near future” (see Graphic 2). Interestingly, IT executives were more likely than legal executives to see high or medium levels of opportunity for AI (75% vs. 61%), blockchain (62% vs. 50%), and facial recognition and biosecurity solutions (65% vs. 50%), a reflection, perhaps, of greater familiarity with the potential of disruptive technology (see Graphic 3).

Companies' experience with the technology has presumably been fairly positive, given their expectations for the future. When asked what technologies will drive growth, 69% cited AI. But other technologies are not far behind, with 58% seeing growth potential in biometric security technologies, 56% in blockchain, and 54% in social banking/peer-to-peer lending. Disruptive technology will bring “better market share and higher customer service,” said one respondent, while another saw broad benefits and noted, “I strongly feel that the current way things are done will change greatly in the near future” (see Graphic 2). Interestingly, IT executives were more likely than legal executives to see high or medium levels of opportunity for AI (75% vs. 61%), blockchain (62% vs. 50%), and facial recognition and biosecurity solutions (65% vs. 50%), a reflection, perhaps, of greater familiarity with the potential of disruptive technology (see Graphic 3).

But not all financial services companies are jumping at these opportunities. Indeed, 27% report that they are not implementing disruptive technologies at all. Some respondents pointed to a lack of maturity with the technology as a deterrent. Many others cited regulatory uncertainty around the new technology. But the most-cited obstacle was the risk associated with cybercrime and data breaches, a long-standing and familiar challenge in the industry. “Technological disruption could cause huge issues with data security breaches and compromises,” says one respondent. “This could cause businesses to be severely impacted and even fail.”

In general, companies see a fair amount of legal and regulatory risk around disruptive technology. For many, this is based on real-world experience, with half the companies reporting that they have already encountered substantial legal or regulatory challenges on that front. Considering the guidance U.S. regulatory agencies have issued in the last year, this is not surprising. For example, the U.S. Securities and Exchange Commission, California Franchise Tax Board, Office of the Comptroller of the Currency, Financial Crimes Enforcement Network, Consumer Financial Protection Bureau, Internal Revenue Service and Federal Trade Commission have all addressed blockchain-based cryptocurrencies in the past 18 months, at least noting their consideration of whether and how to regulate cryptocurrencies and related activities. In addition, the DOJ Antitrust Division has filed several criminal enforcement actions alleging antitrust conspiracies related to electronic foreign exchange trading platforms.

“The uptick in the use of disruptive technologies is coming at a time when the antitrust agencies here and abroad, as well as class action plaintiffs, have pivoted to focus intensely on the banking and tech industries, which means increased risks relating to fintech are unlikely to escape scrutiny,” notes Torpey.

The next installment of this series looks at where executives believe technology is driving increased legal and regulatory risk.

Kathi Vidal is managing partner of Winston & Strawn's Silicon Valley office. A nationally recognized IP litigator, she represents clients from the Fortune 100 to startups.

Michael Loesch counsels clients on CFTC and SEC investigations and compliance matters leveraging more than 14 years of federal experience serving in senior leadership positions at the CFTC and the SEC.

Amanda Groves is co-chairwoman of Winston & Strawn's complex commercial litigation practice. She has successfully represented consumer product companies, national retailers, and lending institutions in consumer protection cases since 1996.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

AI Disclosures Under the Spotlight: SEC Expectations for Year-End Filings

5 minute read

A Blueprint for Targeted Enhancements to Corporate Compliance Programs

7 minute read

Three Legal Technology Trends That Can Maximize Legal Team Efficiency and Productivity

Trending Stories

- 1Looking to the Future of the FDA and Its Impact on Drug Regulation in 2025

- 2Pennsylvania Firms Join Partnership Promotion Parade

- 3Swift Currie, Parker Poe Among Southeast Firms Adding New Partners

- 4Trusting Your Instincts (and Second-Guessing Anyway)

- 5Kirkland, Cleary, King & Spalding Among the Latest to Add DC Laterals

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250