Disruptive Technology, Part 3: Managing the Risks, Reaping the Rewards

Legal executives may not always have a full understanding of how disruptive technology is being used in the company.

July 15, 2019 at 01:00 PM

6 minute read

Sergey Nivens/Shutterstock.com

Sergey Nivens/Shutterstock.com

This article is the third in a three-part series exploring executives' perspectives on disruptive technologies in the financial services industry. Previous installments looked at how the industry is using these technologies, and the specific areas where executives see potential risk.

In the recent survey conducted by ALM's Corporate Counsel on behalf of Winston & Strawn, financial services executives reported that the pervasive use of disruptive technologies in their industry is introducing new risks to their organizations. To continue to innovate with new technologies, companies will need to find ways to address this increased risk profile. That may not be easy, but it's not impossible. “There are regulatory and legal risks involved, but they are not insurmountable,” says Winston litigation partner Danielle Williams. “Financial services companies can identify those risks and manage them so that they can take advantage of the opportunities.”

Many are doing just that—and taking steps to keep up with the legal and regulatory challenges created by disruptive technology. The industry already has strong compliance capabilities, of course. Nevertheless, six out of 10 companies have revised their compliance programs or created new programs in response to evolving technology-driven risks. These changes include training, the purchase of new compliance tools, the hiring of external experts, conducting global risk assessments, and revisions to policies. In addition, 78% say they are protecting disruptive technology innovations from IP theft through patents, trademarks, trade secret protection, and copyrights, as well as formulating IP strategies for technology.

Looked at another way, however, those findings also mean that four out of 10 companies have not modified or improved their compliance programs. In addition, only slightly more than one-third have a comprehensive IP strategy in place to protect technology innovations. In other words, there is room for improvement—and with the rapid advancement and deployment of disruptive technologies, not changing is likely to mean falling behind.

For a number of those respondents, it is possible that their companies are not pursuing digital technology initiatives and therefore do not see a need to adjust their compliance efforts. But executives may not always have the full picture. Even in companies where executives believe there are no disruptive technology initiatives under way, “it's likely that some group somewhere in the company has already begun working with platforms leveraging this technology without even realizing it, or is moving in that direction,” says Susannah Torpey, a partner at Winston & Strawn.

“For example, executives may not even realize at this point that their chatbots are becoming more sophisticated as a result of better AI,” Torpey says. “There is often a significant disconnect between those charged with overseeing compliance and the engineers designing or leveraging new technology. Even if executives are not yet seeing the results, their employees may already be participating in blockchain consortia or standard-setting organizations where sensitive information could be inadvertently exchanged or are developing new technology that could exclude competitors. Compliance is critical even when new technology is only just being developed or explored, because it is much more expensive to redesign tech on the back end than to ensure its design is pro-competitive from the start.”

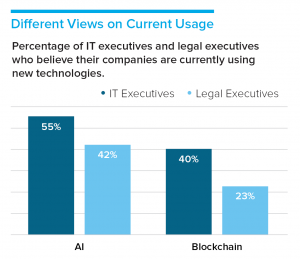

Some of the survey's findings support the notion that legal executives may not always have a full understanding of how disruptive technology is being used in the company. For example, 42% of legal executives said their companies are using AI, but 55% of IT executives—who are presumably closer to such technology initiatives—said that was the case. Similarly, 23% of legal executives said that their companies were using blockchain, compared to 40% of IT executives. “It may not always be obvious to the legal department when disruptive technologies are being used—they might be baked into applications, working in the background, or quietly being used by a single business unit,” says Basil Godellas, head of Winston's Financial Services Regulatory Practice. “So the legal department needs to stay in close contact with other areas to track these uses.”

Some of the survey's findings support the notion that legal executives may not always have a full understanding of how disruptive technology is being used in the company. For example, 42% of legal executives said their companies are using AI, but 55% of IT executives—who are presumably closer to such technology initiatives—said that was the case. Similarly, 23% of legal executives said that their companies were using blockchain, compared to 40% of IT executives. “It may not always be obvious to the legal department when disruptive technologies are being used—they might be baked into applications, working in the background, or quietly being used by a single business unit,” says Basil Godellas, head of Winston's Financial Services Regulatory Practice. “So the legal department needs to stay in close contact with other areas to track these uses.”

In spite of the growing prominence of disruptive technologies, their use in the industry is still in its early stages—and continues to evolve. As the role of the technology expands, legal departments can work with IT and the business to help understand the rapidly evolving risks and rewards involved. In doing so, financial services companies should be aware that disruptive technologies can be a double-edged sword. That is, they can both increase risk and provide a means to alleviate it. For example, blockchain could increase antitrust risk because it requires companies to cooperate in consortia to set up processes. But it could also reduce antitrust risk by enabling more companies to participate in supply chains or by dispersing market power across companies and countries.

Legal departments can play a vital role in helping financial services companies realize the promise of fintech and disruptive technology. To that end, says Michael Loesch, co-chair of Winston's Disruptive Technology Task Force, “legal and compliance teams should work hand in hand with the business side to make sure they understand how the technology is being used and head off any regulatory or legal issues before they become a problem. Companies have to balance current operations and risk portfolios with plans to take advantage of opportunities—and play defense against regulators as new risks emerge.

“You have to keep developing your knowledge in this space and update your compliance infrastructure as you go,” Loesch adds. “Disruption can be a good thing or a bad thing, depending on whether you are driving it or just being affected by it. Being proactive about keeping up to date is key to being a disruptor rather than a disruptee.”

Amanda Groves is co-chair of Winston's Complex Commercial Litigation Practice. She has successfully represented consumer product companies, national retailers, and lending institutions in consumer protection cases since 1996.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A Blueprint for Targeted Enhancements to Corporate Compliance Programs

7 minute read

Three Legal Technology Trends That Can Maximize Legal Team Efficiency and Productivity

Corporate Confidentiality Unlocked: Leveraging Common Interest Privilege for Effective Collaboration

11 minute readTrending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250