CFIUS Annual Report Shows Big Jump in Investigations

The latest annual report released Friday by the Committee on Foreign Investment in the United States, the interagency panel at the Treasury Department that reviews transactions for potential national security risks, shows that the number of notices filed increased significantly from 2014 through 2017, and the number of investigations rose dramatically.

November 22, 2019 at 05:29 PM

2 minute read

Anne Salladin of Hogan Lovells in Washington, D.C. Photo: Diego M. Radzinschi/ALM

Anne Salladin of Hogan Lovells in Washington, D.C. Photo: Diego M. Radzinschi/ALM

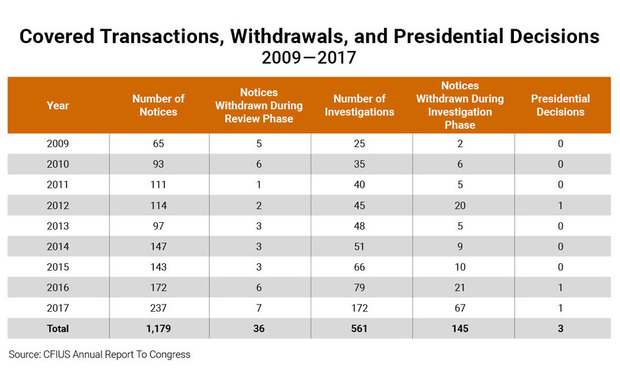

The latest annual report released Friday by the Committee on Foreign Investment in the United States, the interagency panel at the Treasury Department that reviews transactions for potential national security risks, shows that the number of notices filed increased significantly from 2014 through 2017, and the number of investigations rose 237%.

The annual report for 2016 and 2017, the last years for which statistics were published, shows the number of CFIUS notices filed at the panel rose 61% from 147 in 2014 to 237 in 2017. The number of investigations rose from 51 to 172.

Notices filed dipped slightly only in 2015 from the year before to 143, but it was followed by a big jump to 172 in 2016, during the Obama administration and has risen steadily since.

CFIUS Annual Report

CFIUS Annual ReportNotices withdrawn during the investigations phase—which often occurs when the committee has notified parties that it wants more information or likely won't approve a transaction—rose from nine to 67. Presidents rejected three deals on CFIUS recommendations—once in 2012 and again in 2016 and 2017.

The share of transactions reviewed that were in financial services companies rose from 26% to 46% from 2014 to 2017, whereas mining and manufacturing both saw their share of reviewed transactions decline.

Hogan Lovells partner Anne Salladin, who worked for nearly two decades in the Office of the Assistant General Counsel for International Affairs in the Treasury Department, providing with CFIUS legal advice, said: "This report shows what many of us following CFIUS activity for years have long known—oversight of foreign investments into U.S. companies is on the rise. It's just another sign that U.S. companies considering any level of foreign investment must have CFIUS on their radar."

Read More:

US Commerce Department Lags Other Agencies in CFIUS Draft Rulemaking, Lawyers Say

With Data as National Security Threat, Big Law's Appetite for Government Officials Grows

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'The Unheard of Superpower': How Women's Soft Skills Can Drive Success in Negotiations

Tales From the Trenches: What Outside Counsel Do That GCs Find Inexcusable

Venus Williams Tells WIPL Crowd: 'Living Your Dreams Should Be Easy'

The 2024 WIPL Awards: Law Firm Mentor and Mentee Collaboration

Law Firms Mentioned

Trending Stories

- 1Morgan Lewis Says Global Clients Are Noticing ‘Expanded Capacity’ After Kramer Merger in Paris

- 2'Reverse Robin Hood': Capital One Swarmed With Class Actions Alleging Theft of Influencer Commissions in January

- 3Hawaii wildfire victims spared from testifying after last-minute deal over $4B settlement

- 4How We Won It: Latham Secures Back-to-Back ITC Patent Wins for California Companies

- 5Meta agrees to pay $25 million to settle lawsuit from Trump after Jan. 6 suspension

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250