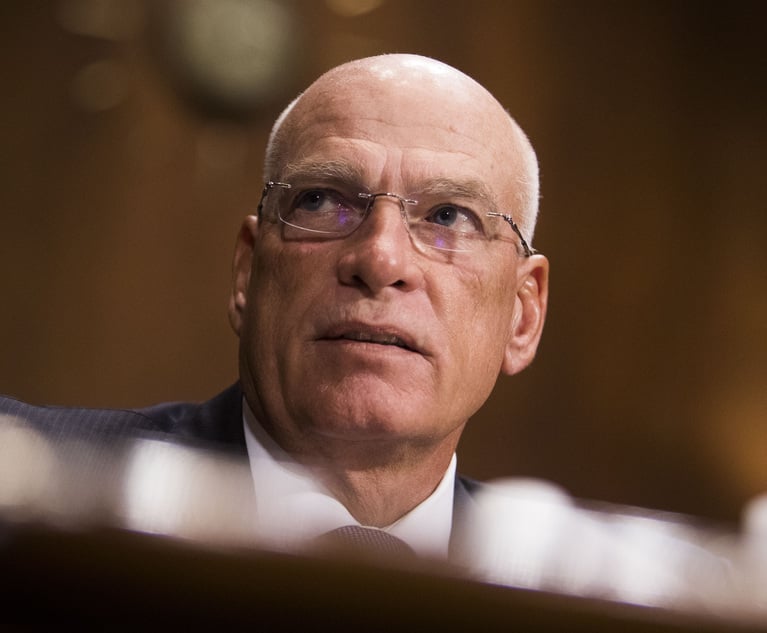

Joseph Blanco, general counsel of Crawford & Co., will take over as president on May 15. (Courtesy photo)a

Joseph Blanco, general counsel of Crawford & Co., will take over as president on May 15. (Courtesy photo)aFrom General Counsel to President: A Q&A With Crawford & Company's Joseph Blanco

Blanco, a former naval officer and Big Law attorney, talks about taking on a new role, why more in-house leaders are being elevated to executive positions and how the coronavirus pandemic has affected his job and industry.

May 01, 2020 at 10:49 AM

7 minute read

For more than three years, Joseph Blanco has served as general counsel of Atlanta-based claims management firm Crawford & Co. But his role will change later this month, when he steps up to serve as president of the company.

Crawford, which is the largest publicly listed independent claims management firm in the world, announced Blanco's promotion earlier this week. The company, which is currently searching for a new top lawyer, also disclosed that its CEO and president, Harsha Agadi, is stepping down to serve as board director. Rohit Verma, the firm's global chief operating officer, will take over as CEO.

Before he joined Crawford, Blanco, a former naval officer, served as the managing partner for Dentons' office in Atlanta. He began his legal career in 2000 at the Atlanta-based firm of McKenna Long & Aldridge, which later merged with Dentons.

Blanco spoke with Corporate Counsel about leaving the legal department for a new role, the trend of in-house leaders being elevated to executive-level positions and how the COVID-19 pandemic has affected his job and industry. The conversation has been edited for clarity and length.

Corporate Counsel: Talk with me about your new role and responsibilities as president.

Joseph Blanco: Rohit [Verma], who is the new CEO, will be primarily external facing and will continue as the primary interface with our business unit. I will take over all of the shared services functions and also focus on working with him on our strategic vision of the company and any inorganic growth through M&A and the like.

We've noticed an ongoing trend of GCs being elevated to executive-level roles. Why do you think that's happening?

I think the world has experienced a tremendous amount of change across geographies and industries. The legal skill set in a lot of ways is not the only skill set that's qualified to deal with those changes by any stretch of the imagination. But it does have a lot of unique characteristics that allow lawyers with other training to manage change.

As GC, we're assuming you worked closely with the CEO and were involved with board meetings and the like.

Yes. I was an adviser to the board and corporate secretary and was a direct report to the CEO.

So this shouldn't be a jarring change for you.

No. And I was lucky. I came from a background where I was at Dentons beforehand and my practice was in M&A, but it also had a significant corporate governance focus to it. So it's similar to that work that I was doing beforehand.

Is Crawford looking at any major M&A deals right now?

We haven't announced any major M&A transactions. I think, like all companies right now, we're being very prudent and disciplined with respect to our capital allocation. I think we're going to kind of wait for a vision of what's coming around the corner with the current recession. And hopefully it will be a very quick recovery, but we're taking a cautious approach.

To what extent is the pandemic already affecting claims management companies in general?

As an industry as a whole, you're seeing, for the most part, a decline in claims volume. There are pockets of claims that are going up. But it's simply a case of decreased economic activity. And frankly, with the decreased activity, you'll generally see a decline in claims volume. A very simple example that you're seeing play out with respect to a lot of the carriers is that people are not driving cars, therefore they're not getting in car accidents. So you'd necessarily see a trailing off of automobile claims. Similarly, people are at home and although the bathtub may leak people are at home to catch that. You're having fewer escape-of-water type claims.

With the claims that you're seeing, is there a certain common thread that's coronavirus-related?

You're seeing some workplace-related COVID-19 claims. We're also seeing some business interruption claims.

Do they involve force majeure clauses?

Some of them are contracted-related. But ours tend to be more policy-specific—what is the quantum of losses associated with their business interruption? There are millions and millions of different insurance policies. Some of them do cover business interruptions due to pandemics. And when they do we have to assess how much business has been interrupted.

As a GC, how have you been dealing with the new reality?

There's been a lot of change and a lot of just helping with the day-to-day management of the company. That's everything from worrying about how to get things imported into the country through customs, through regulatory things, to getting things out to our field operations. We're operating in 70 countries around the world, so everyone has various needs. We've just seen many changes, from delays in certain governmental programs to dealing with visas that are getting ready to expire. There are just myriad issues that have become quite complicated, and some are novel. We've also been trying to respond from a human resources standpoint. Our business continuity plan is just getting all of those things in place. We were able to transition to about 93-94% of our folks working from home around the globe. But with that comes a huge movement of people. I was already managing our operations in the Philippines, where we went from having two primary locations to moving almost 700 people to work from home over the course of three days.

Looking at the company in a post-COVID world, how do you think this will affect things in terms of flexibility and allowing employees to work remotely?

I don't see the particular changes that we've implemented right now as being permanent. I do see some of the trends and some of our learning in the current environment as things that will greatly help us in moving forward. I think it will create new ways for us to collaborate. The collaboration across geographies has increased. We're sharing lessons learned from around the globe and it's very rapid fire.

What are the most important or surprising things you've learned from this experience so far?

This is going to sound kind of corny, but it's just how much value there is to communicating to our people but also to listening and sharing stories. By doing that I think we've accelerated our pace of innovation. The other thing that sometimes you forget sitting in an office is that people, especially those in a dispersed workforce like we have, have lots of questions. I think our leadership and communications teams have done a great job getting information out to our employees and to try to also centralize communications for our clients. You don't want to inundate people with so much information that they feel like they're drowning in it, but there is this real need to connect to people.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

GC With Deep GM Experience Takes Legal Reins of Power Management Giant

2 minute read

US Reviewer of Foreign Transactions Sees More Political, Policy Influence, Say Observers

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute read

Ex-Red Robin CLO Joins Norton Rose Fulbright After Helping Sell Latest Employer for $4.9 Billion

Law Firms Mentioned

Trending Stories

- 1Call for Nominations: Elite Trial Lawyers 2025

- 2Senate Judiciary Dems Release Report on Supreme Court Ethics

- 3Senate Confirms Last 2 of Biden's California Judicial Nominees

- 4Morrison & Foerster Doles Out Year-End and Special Bonuses, Raises Base Compensation for Associates

- 5Tom Girardi to Surrender to Federal Authorities on Jan. 7

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250