Wells Fargo's Moving to Resolve Another 'Phantom Accounts' Whistleblower Case

Wells Fargo & Co. was negotiating a settlement as recently as last month with Laura Worzella, a former senior vice president in charge of Wells Fargo's operations in the Denver area. Worzella claimed she was unlawfully fired in retaliation for refusing to accept the bank's widespread practice of opening accounts without customer consent. Federal investigators dismissed her complaint.

February 05, 2018 at 02:06 PM

6 minute read

A Wells Fargo bank in Washington, D.C. (Photo: Diego M. Radzinschi / ALM)

A Wells Fargo bank in Washington, D.C. (Photo: Diego M. Radzinschi / ALM)

Wells Fargo & Co. was negotiating a settlement as recently as last month with a former executive in Colorado who claimed she was unlawfully fired in retaliation for refusing to accept the bank's widespread practice of opening accounts without customer consent.

Lawyers for the bank notified the U.S. Labor Department in January that settlement talks with Laura Worzella, a former senior vice president in charge of Wells Fargo's operations in the Denver area, were ongoing. Worzella was fired in June 2017.

Investigators with the Labor Department's Occupational Safety and Health Administration dismissed Worzella's whistleblower complaint in November after finding there was sufficient evidence supporting Wells Fargo's position that it had fired her for reasons unrelated to what she called the “phantom account” scandal. Worzella, represented by the Denver-based attorney Elizabeth “Booka” Smith, appealed the decision, keeping her claims against Wells Fargo alive, according to public records The National Law Journal obtained.

Smith did not respond to requests for comment on Worzella's case. A lawyer for Wells Fargo, Littler Mendelson shareholder Darren Nadel in Denver, did not immediately return a message seeking comment. Wells Fargo declined to comment on Worzella's case.

In a January filing at the Labor Department, Worzella and Wells Fargo said they “remain cautiously optimistic that the matter will resolve on or before January 26, 2018.” It was unclear whether the two sides reached a settlement or if negotiations are still continuing. Worzella has until late February to file her objections to the OSHA decision.

Almost two years after reaching a $185 million settlement over allegations that it opened up to 2.1 million potentially unauthorized accounts, Wells Fargo is facing continued scrutiny from financial regulators.

On Friday, citing “widespread consumer abuses,” the Federal Reserve reached a consent order with Wells Fargo barring the bank from growing beyond the the $1.95 trillion in assets it had at the end of 2017 without first getting permission from regulators. The Fed said Wells Fargo would also be replacing four board directors in 2018.

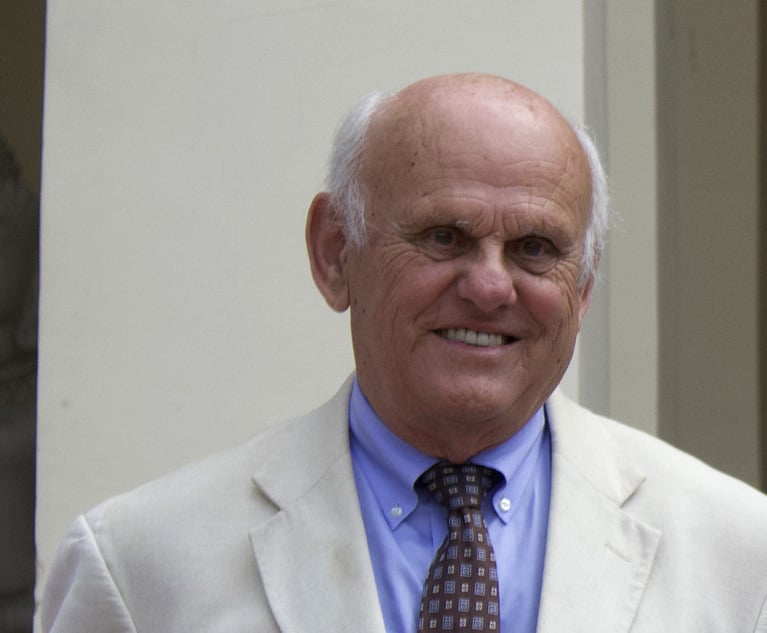

“We take this order seriously and are focused on addressing all of the Federal Reserve's concerns,” Timothy Sloan, Wells Fargo's president and chief executive officer, said in a statement.

Timothy Sloan, CEO of Wells Fargo, testifies before the Senate Banking Committee, on Tuesday, October 3, 2017. (Photo: Diego M. Radzinschi / ALM)

Timothy Sloan, CEO of Wells Fargo, testifies before the Senate Banking Committee, on Tuesday, October 3, 2017. (Photo: Diego M. Radzinschi / ALM)Wells Fargo's settlement talks with Worzella come as the bank grapples with a wider whistleblower problem connected to the sales practices scandal. After agreeing to the 2016 settlement with the Consumer Financial Protection Bureau and other regulators, Wells Fargo disclosed that it was facing many whistleblower-retaliation claims filed with the Labor Department and in state courts.

In January, Wells Fargo reached a confidential settlement with a fired employee whom the Labor Department had ordered the bank to reinstate and pay $577,500 in back wages, damages and legal fees. Gibson, Dunn & Crutcher and Seyfarth Shaw represented Wells Fargo at various stages of that investigation.

In Worzella's case, OSHA investigators did not recommend similar relief. According to a copy of the OSHA decision, investigators found there was “no evidence” showing that the firing of Worzella was connected to the sales practices scandal.

Worzella argued she was fired for refusing to condone the opening of “phantom accounts” and later identified herself, during the bank's internal investigation into the scandal, as an outspoken whistleblower and victim of retaliation. Her attorney, Smith, said in administrative filings last year that Worzella chose to file her complaint with the Labor Department after failing to “resolve this matter directly with Wells Fargo.”

Wells Fargo said the firing stemmed from an investigation into three complaints that had been filed anonymously against Worzella between October and November 2016—the months immediately following the $185 million settlement.

Two of the complaints alleged that, at a women's leadership conference, Worzella commented that taking four months of maternity leave would be a “complete career derailer.” A third complaint claimed that Worzella had retaliated against an employee for wanting an open position outside Worzella's team.

Worzella conceded that, during the conference, she said employees who take maternity leave would miss out on promotion opportunities but said her remarks had been taken out of context.

In April 2017, Worzella was interviewed as part of a separate internal investigation into the sales practices scandal. In an interview conducted by an unidentified outside firm, Worzella “disclosed ongoing problems associated with fraud, phantom accounts and her unwillingness to participate in these types of practices,” according to the OSHA order. Worzella also “identified several upper level managers who allegedly encouraged employees to participate in fraudulent banking activities,” the decision states.

Worzella was fired two months later. OSHA found there was “no evidence” that the senior employee relations consultant who decided to fire Worzella “had any knowledge” of the information she provided during the internal investigation into the sales practices scandal.

“The timing between [Worzella's] protected activity and adverse employment action does suggest temporal proximity; however, there was no evidence of animus,” OSHA Regional Administration Gregory J. Baxter said in an order.

Wells Fargo, according to Baxter, demonstrated the bank “would have taken the same adverse action in the absence of [Worzella's] protected activity.”

Read more:

Wells Fargo, Ending Its Appeal, Settles Whistleblower's $577K Retaliation Case

Inside Wells Fargo's Quest Against a Whistleblower Awarded $577K

C. Allen Parker, Wells Fargo GC, Helps Restore Integrity to Embattled Financial Giant

Whistleblower Problem at Wells Fargo Could Grow Substantially

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

4th Circuit Upholds Virginia Law Restricting Online Court Records Access

3 minute read

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute readTrending Stories

- 1No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 2Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 3Meet the New President of NY's Association of Trial Court Jurists

- 4Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

- 5Freshfields Hires Ex-SEC Corporate Finance Director in Silicon Valley

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250