Report: US Tort System Costs $429B, With Plaintiffs Getting Just 57 Percent

The U.S. Chamber of Commerce's Institute for Legal Reform released the report on Wednesday at its annual summit, along with a white paper that called on Congress to reform securities laws.

October 26, 2018 at 12:01 PM

6 minute read

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System.”

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System.”

U.S. tort system costs totaled $429 billion in 2016, or 2.3 percent of the nation's gross domestic product, but plaintiffs got just 57 cents on the dollar. That's according to report released on Wednesday by the U.S. Chamber of Commerce's Institute for Legal Reform at its annual summit in Washington, D.C.

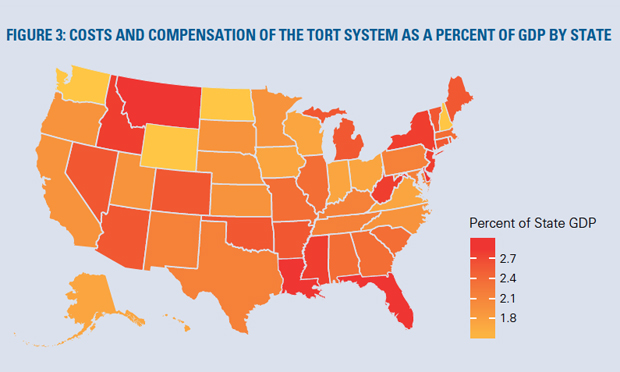

The report, called “Costs and Compensation of the U.S. Tort System,” gave a state-by-state breakdown of costs that also included insurance payouts and legal fees to both defense and plaintiffs attorneys.

“Historically, we have the most expensive tort system in the world, but cost does not equal value when little more than half of each dollar goes to plaintiffs,” said Institute for Legal Reform President Lisa Rickard in a statement on Wednesday. “Our tort system totaled about $3,330 per household—or almost double the average cost of putting gas in your car—an alarming trend when you consider that over 40 cents per dollar go to attorneys' fees and other costs.”

The group also released a white paper, prepared by Mayer Brown partner Andrew Pincus in Washington, D.C., on the growth of securities class action filings. Citing the findings of other reports, such as Cornerstone Research and Stanford Law School's Securities Class Action Clearinghouse, that paper found that shareholders filed lawsuits in 85 percent of mergers and acquisitions worth more than $100 million.

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System”

Source: U.S. Chamber of Commerce Institute for Legal Reform report “Costs and Compensation of the U.S. Tort System”The white paper, called “A Rising Threat: The New Class Action Racket That Harms Investors and the Economy,” encouraged Congress to enact the first reforms in securities laws since the Private Securities Litigation Reform Act of 1995, which has failed to stem a new wave of shareholder cases.

“Securities class action lawsuits are spiraling out of control: Plaintiffs' lawyers are filing more meritless lawsuits than ever before,” Rickard said in a statement. “This scam forces companies to provide a few meaningless disclosures and to pay fees to plaintiffs' lawyers, while shareholders get nothing.”

The Chamber's Institute for Legal Reform released both reports while outlining emerging trends at its 20th annual summit. Those trends included third-party litigation financing, class actions in Europe and “locality litigation,” or the practice of cities and counties bringing lawsuits, such as the majority of the cases brought over the opioid epidemic.

The American Association for Justice, the nation's largest plaintiffs' bar organization, discounted the findings of the Chamber's reports.

“The Chamber's claims on the costs of litigation have no basis in reality and include items tangentially associated with litigation, like insurance companies' administrative costs and profits,” wrote AAJ spokesman Peter Knudsen. “Then, on the same day, they advocate curbing the ability of shareholders to hold a company accountable if it defrauds its investors. These 'reports' serve as more proof that the Chamber will do and say anything to make sure that unscrupulous pharmaceutical companies, big banks, and large corporations are never held accountable in court.”

“This is another effort by the Chamber of Commerce to limit liability, so as to permit businesses that hurt people to escape being held accountable; or, in the guise of tort 'reform' to limit their exposure for the harm that they cause,” said Richard Newman, Executive Director of the American Museum of Tort Law in Winsted, Connecticut. “Others have done a more detailed analysis of past offerings by the Chamber,” he added, pointing to Joanne Doroshow's work on the website at the Center for Justice & Democracy.

“But in real world terms, the pro-business organization tries to assure everyone—while maintaining a straight face—that crippling or destroying the system that makes bad businesses pay when they kill or cripple someone, will somehow be in everyone's best interest. Sort of like the fox solemnly assuring the chickens that he is really a watchdog, looking out for everyone,” Newman said.

Bryan Quigley, senior vice president of strategic communications at the Institute for Legal Reform, said the tort costs study is the most comprehensive since a 2011 report by Towers Watson (now Willis Towers Watson). He said the report's goal isn't to recommend fixes but to provide data to back up many of the Chamber's concerns, some of which are at the heart of legislative proposals.

“We believe this is really a foundational set of data for what we do in terms of advocating for a better civil justice system,” Quigley said.

The tort costs report was based on insurance claim data compiled by The Brattle Group, which is a consulting firm, and the Alabama Center for Insurance Information and Research at the University of Alabama's Culverhouse College of Business.

The report, which looked at litigation brought under both common laws and statutory laws, found that $250 billion of the 2016 tort costs came from a broad range of commercial and personal liability claims. Another $160 billion came from automobile accident claims, and medical malpractice litigation accounted for $19 billion.

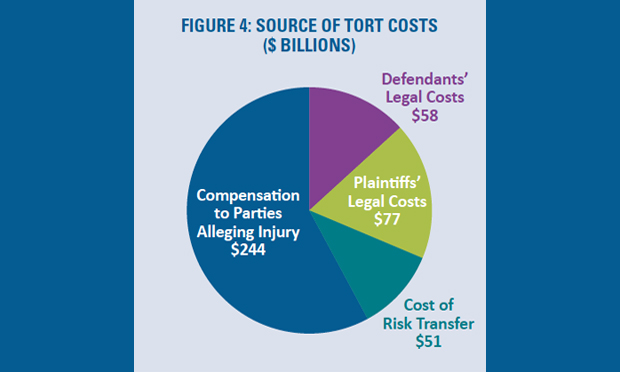

The report revealed what it deemed an inefficient legal system. Of the $429 billion total, $244 billion went to compensate plaintiffs, but plaintiffs lawyers got $77 billion, defense lawyers $58 billion, and $51 billion covered insurance costs.

“If you break down the cost component, our study shows only 57 cents of every dollar is actually getting to the victims,” Quigley said. “The rest goes to plaintiffs and defense costs, or administrative and transfer costs. All the costs are not going to the people who purportedly the system is there for: the plaintiffs themselves.”

The report has a breakdown of each state's tort costs as a percentage of its gross domestic product. The report found that states with the most-expensive tort systems had costs up to 2.1 times larger than the least-expensive states. Wyoming, for instance, was the least expensive, with costs of 1.6 percent its gross domestic product, while Florida had the highest at 3.6 percent. Other states with the most expensive tort systems were New Jersey (3.1 percent), New York (2.9 percent) and Delaware (2.7 percent).

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Preparing for Change? These Leaders Have Already Done It. Plus, Managing Partner Survey Results

8 minute read

False Claims Act Causation Standard Continues to Divide Federal Courts

5 minute readTrending Stories

- 1Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 2CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 3Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 4Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

- 5The Week in Data Jan. 21: A Look at Legal Industry Trends by the Numbers

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250