Hartford Lawyer Faces 3 Years in Prison After Pleading Guilty to Filing False Tax Returns

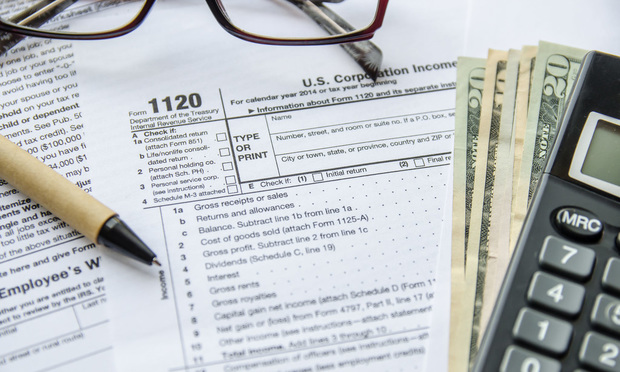

Solo practitioner Justin Freeman has pleaded guilty to filing false tax returns over the three-year period from 2010-2012. He underreported more than $1 million and faces upward of three years in prison when he is sentenced in February.

November 29, 2018 at 11:28 AM

3 minute read

1120 IRS Tax Form. (Photo: RomanR/Shutterstock.com)

1120 IRS Tax Form. (Photo: RomanR/Shutterstock.com)

A Hartford-based attorney specializing in family law, personal injury and criminal defense has pleaded guilty to substantially underreporting the income he received from his law practice over three years.

Justin Freeman, 46, pleaded guilty Wednesday to a federal tax charge: one count of filing a false tax return.

Judge Kari Dooley of the U.S. District Court for the District of Connecticut will sentence Freeman Feb. 20 in Bridgeport.

Freeman, a Manchester resident, faces a maximum of three years in prison and a fine of up to $840,000 when he is sentenced.

The solo practitioner, who ran The Law Offices of Justin C. Freeman has, according to the government, paid $419,259 in back taxes and agreed to cooperate with the Internal Revenue Service to pay all outstanding taxes, interest and penalties.

According to the Nov. 28 plea agreement between the government and Freeman, the attorney reported $476,228 in total taxes for 2010 but actually earned hundreds of thousands more: $860,041. For 2011, he reported $410,002 in total income while earning nearly $1.1 million, and in 2012 he reported $529,673 but took in $696,559.

According to the plea agreement, hammered out between the government and signed off on by Freeman and his attorney, James Cowdery of Hartford-based Cowdery & Murphy, Freeman waived his right to be indicted when he pleaded guilty. He also agreed to say he signed, under penalty of perjury, a 1040 IRS Form that he caused his tax preparer to prepare and file with the IRS. “Freeman signed those tax returns and caused them to be filed with the IRS willfully, that is, with the specific intent to violate the tax laws,” the plea agreement states.

The 11-page plea agreement also states that the court may impose a term of supervised release of not more than one year to begin with any term of imprisonment. If Freeman violates the condition of the supervised release, the plea agreement states, “he may be required to serve a further term of imprisonment of up to one year per violation pursuant to the U.S. Code with no credit for time already spent on supervised release.”

On his website, Freeman calls his practice “real-world law for real-world people.”

Cowdery declined to comment on the matter Thursday.

The case was investigated by the IRS Criminal Rights Division. It will be prosecuted by Assistant U.S. Attorney Susan Wines. The disclosure of the plea agreement was made by John Durham, U.S. attorney for the District of Connecticut and Kristine O'Connell, special agent in charge of the IRS Criminal Investigation in New England.

Tom Carson, spokesman for the office of U.S. Attorney for the District of Connecticut, declined to comment on the matter Thursday.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'They Are Never Going to Learn': Geico Not Protected by Litigation Privilege

3 minute read

K&L Gates Files String of Suits Against Electronics Manufacturer's Competitors, Brightness Misrepresentations

3 minute read

Eleven Attorneys General Say No to 'Unconstitutional' Hijacking of State, Local Law Enforcement

3 minute readTrending Stories

- 1Midsize Firm Bressler Amery Absorbs Austin Boutique, Gaining Four Lawyers

- 2Bill Would Allow Californians to Sue Big Oil for Climate-Linked Wildfires, Floods

- 3LinkedIn Suit Says Millions of Profiles Scraped by Singapore Firm’s Fake Accounts

- 4Supreme Court Agrees to Hear Lawsuit Over FBI Raid at Wrong House

- 5What It Takes to Connect With Millennial Jurors

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250