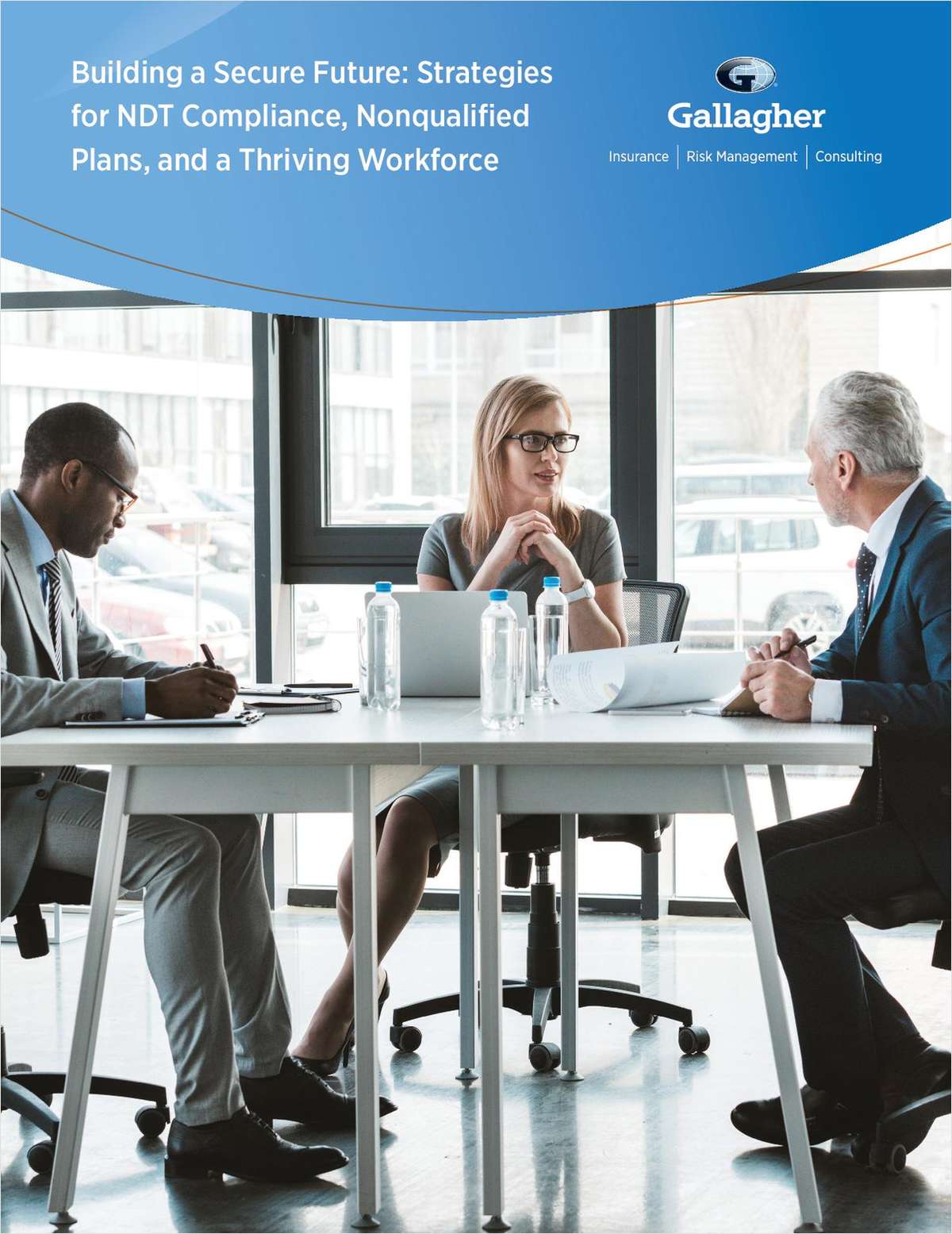

State Sen. Brad Hoylman, D-Manhattan, center, speaks during a news conference Wednesday at the Capitol in Albany, about a senate bill to authorize the release of individual New York state tax returns to Congress. Listening at left is Senate Majority Leader Andrea Stewart-Cousins, D-Yonkers, state Sen. Michael Gianaris, D-Queens, right. (Tim Roske/AP)

State Sen. Brad Hoylman, D-Manhattan, center, speaks during a news conference Wednesday at the Capitol in Albany, about a senate bill to authorize the release of individual New York state tax returns to Congress. Listening at left is Senate Majority Leader Andrea Stewart-Cousins, D-Yonkers, state Sen. Michael Gianaris, D-Queens, right. (Tim Roske/AP)NY State Senate Passes Bill to Disclose Trump Tax Returns

The proposal would allow certain members of Congress to request copies of the president's state tax returns from the New York State Department of Taxation and Finance. It passed along party lines in the Democrat-controlled chamber.

May 08, 2019 at 03:45 PM

6 minute read

The original version of this story was published on National Law Journal

Legislation that would provide an avenue for members of Congress to obtain copies of President Donald Trump's state tax returns took another step toward becoming law in New York on Wednesday after Democrats in the State Senate voted to approve the bill.

The proposal would allow certain members of Congress to request copies of the president's state tax returns from the New York State Department of Taxation and Finance. It passed along party lines in the Democrat-controlled chamber.

The state Assembly, also controlled by Democrats, has yet to schedule a vote on the bill or move it out of committee. They're expected to decide the bill's future in the coming weeks, according to its sponsor in the chamber, Assemblyman David Buchwald, D-Westchester.

State Sen. Brad Hoylman, D-Manhattan, sponsors the bill in the upper chamber, where it rapidly gained support among his colleagues since it was introduced last month. He said prior to the bill passing Wednesday that the legislation is intended to empower Congress to investigate the president as a co-equal branch of the federal government.

“Simply put, no one is above the law and we have a situation in Washington where a co-equal branch of government has requested tax information from the White House and is being stonewalled,” Hoylman said. “It's being stonewalled based on a whole host of legal arguments, but at the end of the day, we know that Congress has the right and the responsibility to oversee the executive branch and they are entitled to that information.”

The vote came just two days after U.S. Treasury Secretary Steven Mnuchin rejected a request from Congress for copies of Trump's federal tax filings. It was the next step in an ongoing conflict between Trump and Democrats, who have decried the president for breaking with four decades of political tradition by failing to disclose his tax returns.

Mnuchin's rejection, while unsurprising, fits into the mechanism that would be created by Hoylman and Buchwald's bill if it becomes law. The legislation would only allow members of Congress to request the president's state tax returns if they've already tried to obtain his federal filings from the U.S. Treasury Department.

Only three lawmakers would have the power to make such a request under the bill: the chairpersons of the U.S. House Ways and Means Committee, the U.S. Senate Finance Committee, and the Joint Committee on Taxation. They would also need to have a legitimate, legislative purpose to make such a request, according to the bill.

There is no requirement in the bill for the state to grant such a request. That would be up to the commissioner of the state Tax Department. The documents also wouldn't be made public under the bill, they would only be sent to the members of Congress for review behind closed doors.

“This principle that we, as legislators, support other legislatures is an important one that I think we, as colleagues, share and we, as New Yorkers, care about,” Hoylman said, referring to Congress.

New York is in a unique position to provide that support to Congress since Trump is a resident of the state. While members of Congress gear up to stage a legal fight against the Trump administration over the release of his tax returns, which could drag on for months or years, the Hoylman-Buchwald bill would allow disclosure of those documents immediately.

“The fact that the Senate is acting is prompting that this is an issue many New Yorkers care about and it interacts with many other issues that I, and my colleagues, care about,” Buchwald said. “It's important that we shine transparency on everything going on right now while the federal government clearly—different branches haven't been able to sort this out.”

Both Buchwald and Hoylman were unconcerned over potential litigation from the president over the bill, which could come in the form of an attempt to enjoin the state Tax Department from disclosing his tax documents to Congress.

“From well before he was president he was known for being a litigious person,” Buchwald said. “The mere fact that a lawsuit is filed is not really a concern, the only concern is the law on the New York side. I think it's important that we make sure what we do is effective, and part of that is addressing constitutional concerns, and our legislating will very much be keeping that in mind.”

Republicans in the State Senate lambasted the bill on the floor of the chamber before it was approved Wednesday. Republican Leader John Flanagan, R-Suffolk, criticized Democrats for bringing the legislation up for a vote without more input from the public.

“There's been no hearings on this, other than maybe in the court of public opinion,” Flanagan said. “I think when I go back to the people I represent, I don't want to have to explain to them that we are now doing this when there are so many other things we should be attending to.”

Flanagan also noted, as did Hoylman earlier in the day, that the procedure implemented through the bill would allow members of Congress to request the state tax returns of anyone in New York, not just the president. Flanagan argued that granting that kind of opportunity to Congress could backfire in the future if the tax documents of other individuals are sought by federal lawmakers.

“What I know about this legislation, in my informed opinion, [is] this should scare the hell out of the average person who lives and resides in the state of New York,” Flanagan said.

The Assembly has the next six weeks after Wednesday to consider the bill before lawmakers are scheduled to leave Albany for the year in June. Buchwald said Assembly Speaker Carl Heastie, D-Bronx, has already committed to discussing the bill among members, but it will be up to the conference as to whether it comes to the floor for a vote.

READ MORE:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Don't Be Afraid to Dumb It Down': Top Fed Magistrate Judge Gives Tips on Explaining Complex Discovery Disputes

Trump's Lawyers Speak Out: 'The President Had the Confidence to Retain Me'

Trump Election-Interference Prosecution Appears on Course to Wind Down

4 minute readTrending Stories

- 1What Are Forbidden Sexual Relations With Clients?

- 2AEDI Takeaways: Demystifying Hype, Changing Caselaw & Harvey’s CEO Talks State of Industry

- 3New England Law | Boston Announces New Dean

- 4Nordic Capital Plans to Acquire IP Management Solutions Provider Anaqua

- 5Criminalization of Homelessness Is Not the Solution

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250