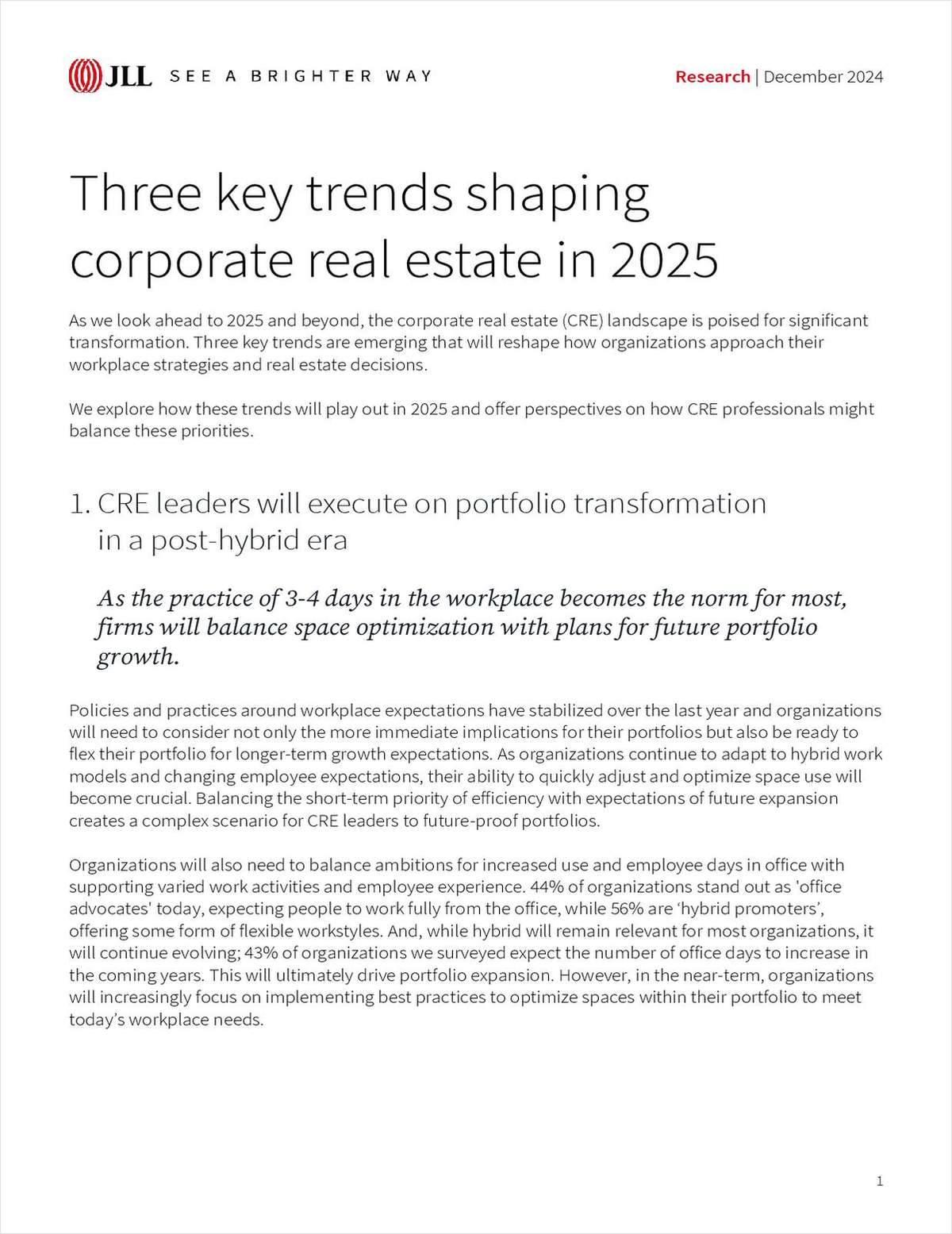

Connecticut State Capitol building in Hartford, CT. Photo by Michael Marciano

Connecticut State Capitol building in Hartford, CT. Photo by Michael Marciano New PILOT Program Improves State-Local Partnership

We continue to endorse the long-term goal of full funding of the PILOT program as a key component of property tax reform.

March 18, 2021 at 05:02 PM

5 minute read

We recently called for better funding of the state's Payment In Lieu of Taxes program (PILOT) as a method of alleviating Connecticut's worst-in-the-country property tax burden (see our August and October 2019 editorials). Therefore, it seems only proper for us to congratulate the General Assembly and Gov. Ned Lamont on their successful passage in March of the first major PILOT reform in decades.

The PILOT program compensates municipalities with state funds for two major types of real property tax losses. The State Property PILOT reimburses municipalities at a statutory rate of 45 percent for state-owned property, such as Department of Transportation garages, public colleges and universities, and state office buildings. The Private Colleges and Non-Profit Hospital PILOT reimbursement rate is set by statute at 77 percent.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

ADVANCE Act Offers Conn. Opportunity to Enhance Carbon-Free Energy and Improve Reliability With Advanced Nuclear Technologies

Trending Stories

- 1Thursday Newspaper

- 2Public Notices/Calendars

- 3Judicial Ethics Opinion 24-117

- 4Rejuvenation of a Sharp Employer Non-Compete Tool: Delaware Supreme Court Reinvigorates the Employee Choice Doctrine

- 5Mastering Litigation in New York’s Commercial Division Part V, Leave It to the Experts: Expert Discovery in the New York Commercial Division

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250