Bank of America to Pay $3.4M Whistleblower Settlement Over Foreclosure Practices

The lawsuit alleged the bank was using rubber-stamped promissory note endorsements in violation of a consent judgment.

January 29, 2018 at 03:31 PM

4 minute read

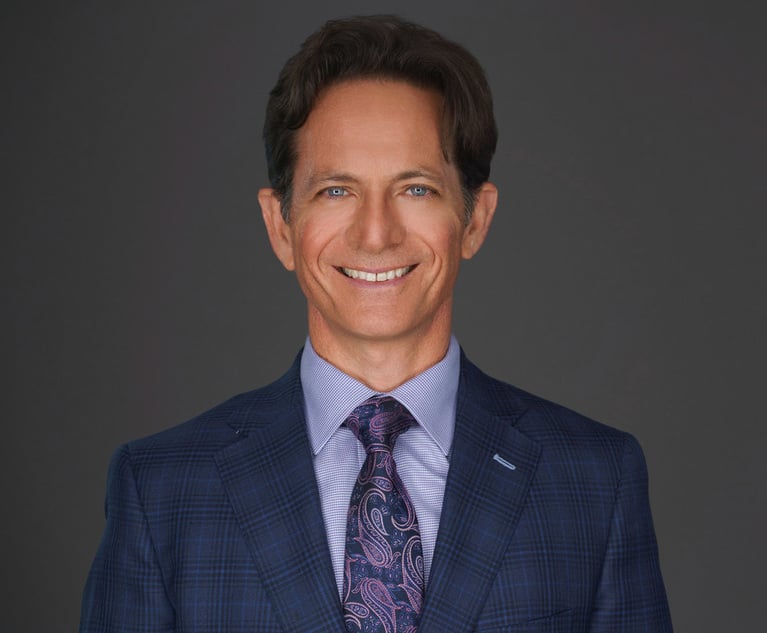

Bank of America agreed to pay $3.4 million to the federal government to settle whistleblower claims filed by Miami attorney Bruce Jacobs.

The Jan. 5 agreement stems from allegations that the bank didn't meet documentation standards for foreclosures and bankruptcies even after agreeing to do so as part of a $25 billion consent judgment involving Bank of America and four other mortgage servicers.

“Instead of intending to comply with the servicing standards for foreclosures as provided in the … consent judgment, the defendants intended to commit new misconduct by presenting misleading and deceptive documentation in foreclosure actions promptly after April 4, 2012, and they have done so regularly since then,” the Jacobs Keeley attorney's complaint alleged.

Bank of America declined to comment on the agreement or the underlying complaint. The settlement contains no an admission of wrongdoing or liability.

Jacobs, who has made it his mission to hold mortgage lenders' feet to the fire for alleged foreclosure abuse, filed the False Claims Act lawsuit after a close examination of his own mortgage documents.

The attorney said he looked at a copy of a promissory note included in the foreclosure complaint he faced in 2012 and found what appeared to be an endorsement from the original lender to Countrywide Home Loans Inc.

There was an endorsement with no specific endorsee from Countrywide, a mortgage lender purchased when it was failing in 2008 by Bank of America. The bank was on the hook for $1.3 billion in civil penalties when Countrywide was prosecuted for selling bad loans to Fannie Mae and Freddie Mac.

Jacobs alleged the signatures didn't line up with a copy of the promissory note he requested from Countrywide back in 2008, which had no endorsements, according to the whistleblower lawsuit. One signature was from a person who left Countrywide in 2006, Jacobs claimed.

The attorney said he uncovered a “practice of misleadingly filing copies of promissory notes bearing rubber-stamped endorsement signatures that were not legally authorized by the purported signatories” even though its $2.4 billion portion of the 2012 consent judgment barred the bank from using anything other than “competent” evidence in foreclosure cases.

Bank of America used the foreclosures involving allegedly rubber-stamped endorsements to seek Federal Housing Administration mortgage insurance benefits, Jacobs claimed.

“Defendants deny specifically that they pursued foreclosures in reliance on unauthorized rubber-stamped endorsements,” the bank said in its answer to the complaint. “Defendants further deny that erroneous allegations of this supposed conduct were not publicly disclosed.”

The bank also argued Jacobs was trying to relitigate foreclosure proceedings that ended long ago.

“Defendants' standing to foreclose on the mortgages was settled as a legal matter at the time of the foreclosure action when the homeowners in the underlying foreclosure actions either did not contest defendants' standing at the time of foreclosure or unsuccessfully did so,” the bank argued.

The federal government declined to intervene in the case in 2016 but reentered the case this month to sign off on the settlement reached in October. Trial was set to begin trial Feb. 5 before U.S. District Judge Ursula Ungaro in Miami.

Jacobs said he and his attorneys could not comment on the case. Attorneys for Jacobs, the relator, were Jacobs' law partner Court Keeley, Lilly Ann Sanchez of The LS Law Firm in Miami and Benedict Kuehne of the Law Offices of Benedict P. Kuehne in Miami. Assistant U.S. Attorney James Weinkle represented the government.

Ungaro approved attorney fees of $1.5 million for the Jacobs Keeley firm, plus $100,000 in costs.

Bank of America was represented by WilmerHale attorneys Matthew Martens in Washington and Andrea Robinson in Boston and Christine Manzo of Liebler, Gonzalez & Portuondo in Miami.

Case: United States of America, ex. rel., Bruce Jacobs v. Bank of America et al

Case No.: 1:15-cv-24585-UU

Description: False Claims Act

Filing date: Dec. 14, 2015

Settlement date: Jan. 5, 2018

Judge: U.S. District Judge Ursula Ungaro

Plaintiffs attorneys: Assistant U.S. Attorney James Weinkle, Miami; Bruce Jacobs and Court Keeley, Jacobs Keeley, Miami; Lilly Ann Sanchez, The LS Law Firm, Miami; Benedict Kuehne, the Law Offices of Benedict P. Kuehne, Miami

Defense attorneys: Matthew Martens, Washington, Andrea Robinson, Boston, WilmerHale; Christine Manzo, Liebler, Gonzalez & Portuondo, Miami

Settlement amount: $3.4 million

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Million-Dollar Verdict: Miami Jury Sides With Small Business

Automaker Pleads Guilty and Agrees to $1.6 Billion in Payouts

'I've Seen Terrible Things': Lawyer Predicts Spike in Hazing Suits

Trending Stories

- 1Troutman Pepper, Claiming Ex-Associate's Firing Was Performance Related, Seeks Summary Judgment in Discrimination Suit

- 2Law Firm Fails to Get Punitive Damages From Ex-Client

- 3Over 700 Residents Near 2023 Derailment Sue Norfolk for More Damages

- 4Decision of the Day: Judge Sanctions Attorney for 'Frivolously' Claiming All Nine Personal Injury Categories in Motor Vehicle Case

- 5Second Judge Blocks Trump Federal Funding Freeze

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250