Miami Attorney Wins $1.67 Million Against Ex-Patriot National CEO

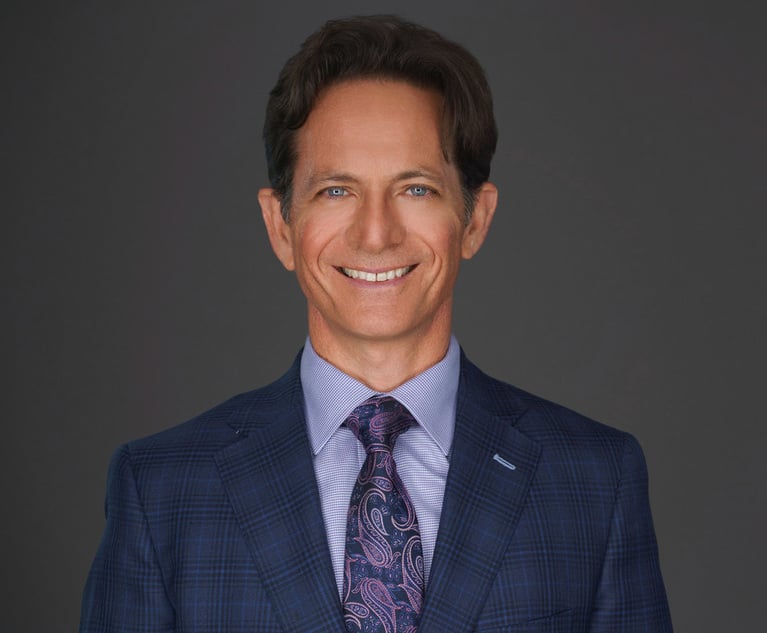

Ralf R. Rodriguez represented four plaintiffs seeking full payment of promissory notes signed by Steven Mariano, former head of Patriot National Inc. and Guarantee Insurance Co.

May 21, 2018 at 01:42 PM

4 minute read

Miami litigator Ralf R. Rodriguez secured a $1.67 million consent judgment with businessman Steven Mariano, former head of insurance services provider Patriot National Inc. and workers' compensation firm Guarantee Insurance Co.

Rodriguez is of counsel at Foley & Lardner in Miami, where he focuses on commercial litigation, business torts, risk assessment and management, insurance claims and white-collar criminal defense.

But this time, he represented lenders James Parker, Timothy R. Tonachio, James W. Wilde and the Michael and Ivette Babylon Revocable Trust, who sued the CEO of a once-publicly traded company now seeking bankruptcy protection.

His clients sued an embattled Mariano, who founded Patriot National in 2003 but resigned as its head in 2017 to serve in a consulting role. By the end of 2017, news reports indicated the company had laid of about 250 workers and was facing delisting from the New York Stock Exchange, where it had traded for up to $7 per share before dropping to 27 cents. In December, Reuters reported the company did not intend to fight the NYSE's decision to delist it, and by January, Patriot National filed for bankruptcy protection in Delaware.

The corporate bankruptcy filing did not stay the Broward Circuit Court suit against Mariano, who also faces litigation from investors who allege fraudulent misrepresentation over Guarantee Insurance Co.'s insolvency.

On Nov. 27, 2017, Guarantee Insurance consented to liquidation in Leon Circuit Court after state regulators learned it did not meet a requirement for financial reserves to cover potential claims. The Florida Department of Financial Services' Division of Rehabilitation and Liquidation became its court-appointed receiver.

Mariano owned Guarantee Insurance and positioned it as Patriot National's biggest client. He had just taken Patriot National public when news broke of Guarantee Insurance's insolvency.

The companies and Mariano's troubles mounted when Rodriguez's clients sued in June 2017 alleging the CEO had defaulted on a bridge loan and four promissory notes.

The plaintiffs claimed Mariano signed promissory notes with each of them in February 2016. They say he agreed to make four monthly interest-only payments beginning in March, with each note due in full by June 30, 2016. But their four-count complaint alleged default on all four promissory notes, of $500,000, $400,000, $250,000 and $150,000. They sought late charges and interest on the alleged defaults.

“He didn't pay any of those loans, and we ended up having to file a lawsuit against him,” Rodriguez said.

Mariano's attorney, Russell R. O'Brien of Conrad & Scherer in Fort Lauderdale, did not respond to a request for comment by deadline. But his court pleadings show he denied the default and provided three defenses for the failed business deals.

“The promissory notes referred to in the complaint as the Babylon Trust note, Parker note, Tonachio note and Wilde note are unenforceable due to the plaintiffs' failure to pay the excise tax on promissory notes” under state law, according to the answer and affirmative defenses.

Mariano also argued the plaintiffs failed to provide a written demand for payment before filing suit as required in the promissory notes. He also claimed the notes contained unenforceable provisions under Florida law.

The court record suggests a hard-fought case with Mariano claiming in a motion for a protective order that the plaintiffs refused to schedule a deposition. He claimed their inaction led him to file an emergency motion for a protective order to avoid potential sanctions for not providing the deposition.

But fast forward to April, and it seemed Mariano was the one in the hot seat over his deposition.

Court filings show Broward Circuit Judge Jeffrey Levenson entered a show-cause order against Mariano after the plaintiffs' fourth motion to compel Mariano's deposition and an April 24 court appearance.

Rodriguez said Mariano agreed to resolve the case after multiple failed attempts to depose him.

“He consented to a judgment because the court was going to sanction him,” Rodriguez said. “He was not in compliance with numerous court orders.”

Now, Rodriguez and his clients are turning their attention to collection efforts.

“We're in line with all the creditors trying to see how we're going to get that judgement satisfied,” he said.

Case: The Michael and Ivette Babylon Revocable Trust et al. v. Steven M. Mariano

Case no.: CACE-17-011330 (09)

Description: Foreclose on promissory notes

Filing date: June 13, 2017

Consent judgment date: June 1, 2018

Judge: Broward Circuit Judge Jeffrey Levenson

Plaintiffs attorney: Ralf R. Rodriguez, Foley & Lardner, Miami

Defense attorney: Russell R. O'Brien, Conrad & Scherer, Fort Lauderdale

Judgment amount: $1.67 million

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Automaker Pleads Guilty and Agrees to $1.6 Billion in Payouts

'I've Seen Terrible Things': Lawyer Predicts Spike in Hazing Suits

Florida Retention Ponds Scrutinized in Lawsuit After Latest Child Drowning

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250