2 Real Estate Moguls and Their Jet: Craig Robins Exposed to Punitive Damages in Beef With Ugo Colombo

A state appeals court allows Colombo, a pioneer in developing luxury Miami real estate, to seek punitive damages from Robins, the Design District developer, in a case involving a once co-owned jet.

August 10, 2018 at 03:09 PM

5 minute read

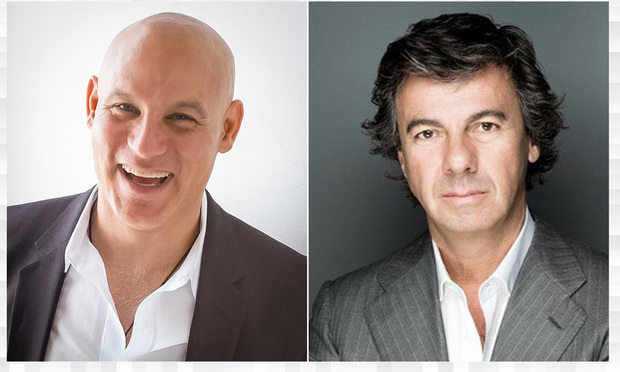

Miami Design District developer Craig Robins, who also is CEO and president of Dacra Development Corp., and developer of high-end residential and commercial projects in Miami Ugo Colombo, founder of CMC Group LLC.

Miami Design District developer Craig Robins, who also is CEO and president of Dacra Development Corp., and developer of high-end residential and commercial projects in Miami Ugo Colombo, founder of CMC Group LLC.

Design District developer Craig Robins lost his fight to stop another big name in Miami real estate, Ugo Colombo, from seeking punitive damages in a drawn-out case over the private jet they once jointly owned.

The Third District Court of Appeal denied Robins' petition after a lower court allowed Colombo to amend his lawsuit against Robins to seek punitive damages. The three-judge panel on Wednesday unanimously affirmed a decision by Miami-Dade Circuit Judge Barbara Areces.

Colombo, a pioneer in developing luxury Miami condominiums, and Robins, who gained fame for reviving Miami Beach's tired Art Deco properties, didn't return requests for comment by deadline.

Robins' attorney, Dennis Richard of Richard & Richard in Miami, isn't deterred by the decision.

“We plan to defeat Colombo's claims and recover against Colombo,” he said.

This is the latest action in the decadelong fight that started with the two real estate moguls co-owing a $22 million Bombardier Challenger.

Colombo bought the jet with an $18.5 million Bank of American loan in May 2007, and Robins, CEO and president of Dacra Development Corp., became a co-owner later that year, according to court filings. Colombo owned the jet through UC Challenger LLC, affiliated with CMC Group, until Robins bought a half interest in UC Challenger using his Dacra affiliate CL36 Leasing LLC.

Robins assumed a $9.25 million loan, and Colombo's loan was cut to that amount. The two also signed agreements evenly splitting jet maintenance and dividing operating costs based on usage, Colombo has argued in court filings.

But Colombo accused Robins of defaulting, including skipping payment for a $200,000 round-the-world trip, as a way to wiggle out of his contract and have Colombo pay Robins' share, according to a second amended third-party complaint filed in 2015.

“Over time, Robins grew 'tired' of owning the aircraft and paying the heavy financial obligations he had assumed,” according to the complaint.

Bank of America sued Colombo and UC Challenger in 2013, claiming a default on the loan and an interest-rate swap agreement, Colombo argued in court.

For his part, Robins countersued saying Colombo and two UC Challenger managers purposely didn't sell the jet under a forbearance agreement with the bank and, despite multiple offers, filed for Chapter 11 bankruptcy as a way to sell the plane to a Colombo company, according to his 2015 lawsuit.

The jet was sold in the bankruptcy proceeding.

Robins listed breach of fiduciary duty and aiding and abetting breach of fiduciary duty counts.

Colombo's lawsuit against Robins Dacra and CL36 listed breach of fiduciary and contractual duties, aiding and abetting breach of fiduciary duty, tortious interference, contribution and indemnity and breach of contract counts.

He then sought to add punitive damages. Areces agreed this year, and the Third DCA upheld the decision.

The appellate court disagreed with Robins' argument that he didn't have an opportunity to have his say in a 30-minute hearing on the punitive damages motion. Although the hearing was short, Judge Kevin Emas wrote for the panel that nothing stopped Robins from making his case.

“Nor did petitioner lodge any objection to the court's procedure or assert at the hearing that it was in any way foreclosed from presenting argument in opposition to the motion to amend,” Emas wrote with Judges Barbara Lagoa and Ivan Fernandez concurring.

In a court filing against opposing punitive damages, Robins also argued Colombo lacked a basis to seek punitive damages and instead relied on pejorative characterizations of Robins such as calling him a “weasel” and saying “he stabbed his partner in the back.”

The appellate court said it's not allowed to determine whether the evidence was sufficient to allow for a punitive damages claim.

Coffey Burlington partners Kendall Coffey and Jeffrey Crockett represented Colombo on appeal.

“The claim is that Craig Robins deceitfully conspired to harm Ugo Colombo, his partner. The trial court found that Colombo's case presented a reasonable basis for the recovery of punitive damages against Robins personally,” the attorneys said in an emailed statement. “Robins appealed this decision but lost, and faces punitive damages in a jury trial.”

“Colombo's counsel's construction of the opinion is nonsense,” Richard responded. He declined further comment.

Areces also denied Robins' motion for summary judgment on Colombo's lawsuit.

Emas speculated Robins didn't speak against punitive damages with the summary judgment motion pending.

“It appears from a review of the hearing transcript that petitioner decided to 'keep his powder dry' to await argument on his summary judgment motion that immediately followed,” the judge wrote, “believing that a favorable ruling on summary judgment would render moot respondents' request to amend the complaint.”

The case brought another big name in South Florida real estate into the picture. Turnberry Management III Inc., an affiliate of developer Jeffrey Soffer's Turnberry Ltd., was hired to manage the jet and sued Dacra, prompting Robins to sue Colombo, claiming he is behind the Turnberry lawsuit.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Fowler White Burnett Opens Jacksonville Office Focused on Transportation Practice

3 minute read

How Much Coverage Do You Really Have? Valuation and Loss Settlement Provisions in Commercial Property Policies

10 minute read

The Importance of 'Speaking Up' Regarding Lease Renewal Deadlines for Commercial Tenants and Landlords

6 minute read

Meet the Attorneys—and Little Known Law—Behind $20M Miami Dispute

Trending Stories

- 1Being a Profession is Not Malarkey

- 2Bring NJ's 'Pretrial Opportunity Program' into the Open

- 3High-Speed Crash With Police Vehicle Nets $1.6 Million Settlement

- 4Embracing a ‘Stronger Together’ Mentality: Collaboration Best Practices for Attorneys

- 5Selling Law. How to Get Hired, Paid and Rehired

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250