Whistleblowers Share in $262M Settlement With Florida Hospital Chain

The 70-hospital Health Management Associates faced eight whistleblower suits claiming a scheme to inflate profits on unnecessary admissions.

September 26, 2018 at 03:49 PM

5 minute read

The original version of this story was published on Daily Report

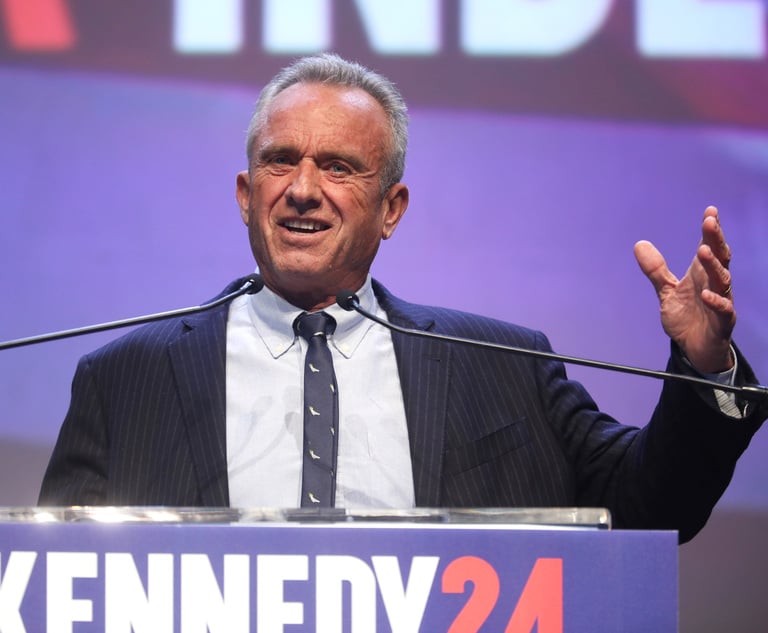

Attorney Marlan Wilbanks

Attorney Marlan Wilbanks

The chief financial officer of two hospitals, an emergency room physician and others didn't know each other when they blew the whistle on a scheme orchestrated by Naples-based hospital chain Health Management Associates to fraudulently boost profits.

But nine years after eight whistleblower lawsuits were filed, they stand to collect for their roles in a $262 million settlement the U.S. Justice Department announced with HMA and corporate parent Community Health Systems, which acquired HMA in 2014 for $3.6 billion.

The scheme dated back to at least 2008 at HMA, which operated about 70 acute care hospitals, mostly in rural communities, the settlement papers said.

The Justice Department said the settlement resolved civil claims and criminal charges stemming from a scheme to defraud Medicare and other federal health care programs. HMA was accused of billing federal programs for inpatient admissions and services that should have been handled as outpatient or observation services in HMA emergency rooms in six states.

The global settlement Tuesday resolves eight whistleblower suits against HMA in Florida, Georgia, Pennsylvania, Illinois, North Carolina and South Carolina. The lawsuits were consolidated as multidistrict litigation in the U.S. District Court for the District of Columbia.

Eric Isicoff and Teresa Ragatz of Isicoff & Ragatz in Miami represented whistleblower Paul Meyer, who joined HMA as a compliance officer after retiring from the FBI, in a case filed in the Southern District of Florida. Isicoff declined comment on the settlement.

Under the terms of the settlement, Carlisle HMA in Pennsylvania, an HMA subsidiary formerly known as Carlisle Regional Medical Center, agreed to plead guilty to a health care fraud conspiracy charge.

HMA and Franklin, Tennessee-based CHS have operated under a corporate integrity agreement with the Justice Department's inspector general since 2014 that required the companies to establish an ethics and compliance reporting program. That agreement allowed the companies to continue to participate in Medicare, Medicaid and other federal health care programs.

CHS acknowledged the settlement, which also resolved kickback allegations against several HMA hospitals, will be paid in October.

Since the merger, “it has been our goal to resolve the government's investigation into all of these allegations which occurred prior to the acquisition and which were already under investigation at the time of the transaction,” Wayne Smith, chairman and chief executive officer of Community Health Systems, said in a statement. “We are pleased to have reached the settlement agreements so we can move forward now without the burden or distraction of ongoing litigation.”

The civil settlement also resolved fraud allegations involving improper physician referrals at two Florida hospitals — Charlotte Regional Medical Center in Punta Gorda and Santa Rosa Medical Center in Milton — and two Pennsylvania hospitals.

Ralph D. Williams was fired by HMA in 2009 after six months on the job after he questioned corporate goals to artificially boost unnecessary hospital admissions. The 30-year accounting veteran filed a false claims action against HMA in Macon, Georgia, that same year, according to his attorney.

Marlan Wilbanks of Atlanta's Wilbanks & Gouinlock said Williams and emergency room Dr. Craig Brummer will each receive 15 percent to 25 percent of about $53 million from the total settlement. Under the False Claims Act, successful whistleblowers receive a portion of the recovered damages associated with the reported fraud.

“The very first steps taken in the $260 million recovery related directly to the fact that Dr. Brummer and Mr. Williams came forward here in Georgia and exposed a scheme that was occurring across the nation,” Wilbanks said.

Williams, the financial chief for Walton Regional Medical Center in Monroe and Barrow Regional Medical Center in Winder, and Brummer did not know each other and were they employed by the same company when they became whistleblowers, Wilbanks said. But both men uncovered the same scheme.

Hospital executives pressured staff to admit ER patients when admission was not medically necessary to collect higher federal reimbursements and artificially boost corporate profits, Wilbanks said. Hospital executives were given ambitious admission goals, and HMA installed software to track whether hospitals were meeting them.

Unnecessary admissions inflated HMA revenue from federal reimbursement, Wilbanks explained. The scheme generated higher profits because hospitals were reimbursed based on inpatient diagnoses, not the length of stay.

HMA “threatened to fire emergency department physicians who didn't meet expectations,” said Susan Gouinlock, Wilbanks' partner and co-counsel. “It was top-down, corporate-driven fraud.”

Williams uncovered the dubious corporate practice shortly after he was hired in April 2009. He commissioned an independent report to analyze hospital admissions from the emergency room. When Williams presented the report to his corporate supervisor, he was told to burn it, Wilbanks said. Williams was fired a short time later.

Corporate executives “didn't want to see the report. They didn't want to change,” Wilbanks said.

Wilbanks called the settlement “a double win” for taxpayers. He cited the end of the practice “of inappropriately putting people in the hospital in a way that wasn't based solely on their medical condition. He also cited a safety concern, saying, “No one should be exposed to hospitalization if it's not solely based on whether that's the place you need to be treated.”

Assistant U.S. Attorney Susan Torres in Miami was among the Justice Department attorneys who signed the criminal settlement agreement.

HMA and CHS were represented by Richard A. Sauber at Robbins, Russell, Englert, Orseck, Untereiner, & Sauber in Washington.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Meta agrees to pay $25 million to settle lawsuit from Trump after Jan. 6 suspension

4 minute read

Attorney Emerges as Possible Owner of Historic Miami Courthouse Amid Delays of New Building

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute readTrending Stories

- 1Newsmakers: Littler Elevates Dallas Attorney to Shareholder

- 2South Florida Real Estate Lawyers See More Deals Flow, But Concerns Linger

- 3General Counsel Accused of Destroying Evidence

- 42,000 Docket Entries: Complex South Florida Dispute Sets Precedent

- 5Incoming Howard University Law Professor Kiah Duggins Among DC Plane Crash Victims

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250