Scott Financial Disclosure Lawsuit Blocked by Appeals Court

Rick Scott, the wealthiest governor in state history, took the issue to the First District Court of Appeal after a Leon County circuit judge refused to dismiss a lawsuit filed by Tallahassee attorney Donald Hinkle.

December 03, 2018 at 02:49 PM

3 minute read

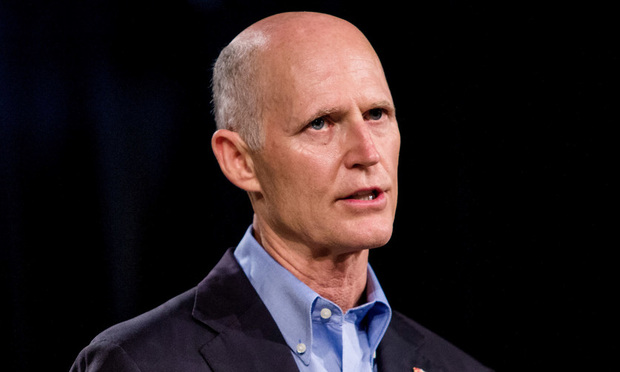

Florida Gov. Rick Scott/photo by Scott McIntyre/Bloomberg

Florida Gov. Rick Scott/photo by Scott McIntyre/Bloomberg

An appeals court blocked a lawsuit aimed at requiring Gov. Rick Scott to disclose more information about his financial assets, saying such issues should be handled by the Florida Commission on Ethics.

Scott, the wealthiest governor in state history, took the issue to the First District Court of Appeal after a Leon County circuit judge refused to dismiss a lawsuit filed by Tallahassee attorney Donald Hinkle. The case centered, in part, on whether Scott should have provided more information about assets in a blind trust when filing state financial-disclosure forms.

A three-judge panel of the appeals court granted what is known as a “writ of prohibition” barring the circuit judge from taking any further action in the case. The five-page ruling agreed with Scott's argument that only the Commission on Ethics “has constitutional authority to investigate Mr. Hinkle's complaint.”

“When the Florida Constitution prescribes the manner of doing something, doing it in a different manner is prohibited,” said the ruling by appeals-court judges Lori Rowe, Timothy Osterhaus and Ross Bilbrey. “And here, where the circuit court has assumed improper authority over a matter outside of its jurisdiction, and with another administrative body having been granted explicit jurisdiction by the Florida Constitution and the statutory scheme to review the complaint, it is appropriate to grant a writ of prohibition.”

State officials, such as Scott, are required to file financial-disclosure forms each year that list information about assets, liabilities and income. Scott, however, placed his assets in a blind trust while in office and, as a result, his disclosures largely lacked details about his wide variety of financial holdings.

In June, Scott filed a state financial-disclosure form showing a net worth as of Dec. 31, 2017, of nearly $232.6 million. In July, as part of his successful U.S. Senate campaign, Scott was required to file a more detailed federal report, which provided a wide range of information about his finances and the finances of his wife, Ann.

Also, Scott filed an updated state financial-disclosure report in September that said he revoked the blind trust on July 25. As a result, the September report provides details about the $232.6 million net worth cited in the earlier report.

Hinkle, a Democratic fundraiser, filed the lawsuit in Leon County circuit court seeking more disclosure after earlier taking complaints to the Commission on Ethics. The commission dismissed his complaints.

Hinkle said in July, as the appeals court heard arguments, that there needs to be “mechanism” to appeal financial-disclosure decisions by the ethics commission.

“I urge the court not to allow the Commission on Ethics to say we're not considering this and that be the end of the road,” Hinkle said.

During the July hearing, Hinkle also rejected the notion that the case was moot because Scott was required to file the broader federal disclosure for his U.S. Senate campaign.

“I don't think it's moot at all,” Hinkle said. “This applies to every officeholder, not just the governor.”

Jim Saunders reports for the News Service of Florida.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Black Box Evidence is Bulletproof': South Florida Attorneys Obtain $1 Million Settlement

2 minute read

University of Florida Drops Title IX Investigation Against Basketball Head Coach

2 minute read

Kirkland & Ellis Taps Former Co-Chair of Greenberg Traurig’s Digital Infrastructure Practice

3 minute readTrending Stories

- 1‘High Demand’: Former Trump Admin Lawyers Leverage Connections for Big Law Work, Jobs

- 2Considerations for Establishing or Denying a Texas Partnership to Invest in Real Estate

- 3In-House AI Adoption Stalls Despite Rising Business Pressures

- 4Texas Asks Trump DOJ to Reject Housing Enforcement

- 5Ideas We Should Borrow: A Legislative Wishlist for NJ Trusts and Estates

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250