New Fort Lauderdale Apartments in Opportunity Zone Promise Attainable Rents

The Six13 is being built with help from a $19.3 million loan as well as city Community Redevelopment Agency funds and opportunity zone investments.

April 16, 2019 at 01:35 PM

3 minute read

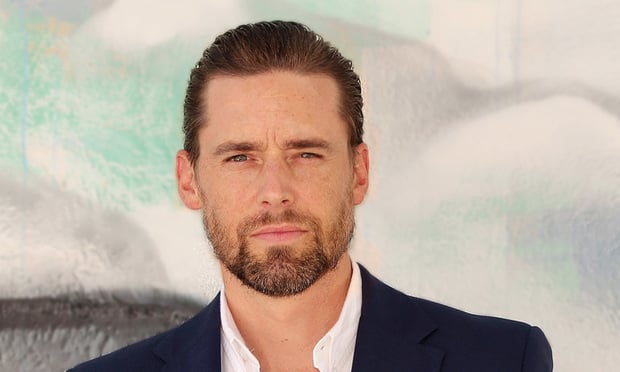

Jeff Burns is CEO and principal of Affiliated Development in Fort Lauderdale. Courtesy photo

Jeff Burns is CEO and principal of Affiliated Development in Fort Lauderdale. Courtesy photo

Construction started on The Six13 apartment building in Fort Lauderdale after the developer secured $19.3 million in project financing.

Affiliated Development LLC, a Fort Lauderdale-based multifamily developer, obtained the loan from City National Bank on April 4 for the six-story development, which will have 142 one- and two-bedroom units.

The Six13, named for its location at 613 NW Third Ave. in the Progresso Village neighborhood, will have a 197-space garage and 5,991 square feet of ground-floor commercial space, including a restaurant.

Like other apartment projects rising in South Florida urban cores, it will have out-of-the-box amenities such as a gated dog park, a residents-only bike-share program, co-working space and a fourth-floor pool with cabanas.

But unlike other new apartment projects, it won't come with the sometimes cost-prohibitive rents as Affiliated has vowed Thee Six13 will be more attainable.

The developer is considering average rents of $1,500 to $1,700 a month for one bedroom and $1,700 to $1,900 for two bedrooms, said Jeff Burns, CEO and principal of Affiliated.

The prices are all less than the $1,902 average for Fort Lauderdale for March across apartment sizes reported by multifamily information provider Rent Café. While affordable housing is an issue across South Florida, this Fort Lauderdale average was higher than both Miami at $1,702 and West Palm Beach at $1,455.

“A lot of these people who are going to live there have a high income. They are making a good living. It's just that this is one of the most cost-burdened places in the entire country because our income-to-cost-of-living discrepancy is higher than anywhere else in the country,” Burns said.

The planned rents are good news for residents who work in Fort Lauderdale's urban core but can't afford to live there, Burns said.

“We wanted to provide them an opportunity to live close to where they work, close to where they play,” he said.

Exactly how is Affiliated able to offer the cheaper rents at a time of rising land and construction costs? Part of the financing for the $40.3 million project is $7 million in gap funding from the Fort Lauderdale Community Redevelopment Agency.

“Without the CRA funding, we would not be able to offer this kind of a discount to the tenants,” Burns said.

The project also is in an opportunity zone, a state-designated distressed areas where investors can grab tax advantages.

While the opportunity zone doesn't necessarily translate to lower rents, it was how the developer secured the remaining $14 million in financing.

The so-called OZ program created by the federal Tax Cuts and Jobs Act of 2017 allows investors to defer paying taxes on the capital gains they invest in opportunity zones, while areas that could use the help get the financial boost.

The federal program dictates that investors place their capital gains in a qualified opportunity zone fund.

Affiliated went about the structure differently. It created a qualified opportunity zone business and met individually with investors, who created their own opportunity zone fund to invest in the project, Burns said.

“It was a group of investors we put together, and that includes us,” he said.

The Six13 units are set to be delivered next spring

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Fowler White Burnett Opens Jacksonville Office Focused on Transportation Practice

3 minute read

How Much Coverage Do You Really Have? Valuation and Loss Settlement Provisions in Commercial Property Policies

10 minute read

The Importance of 'Speaking Up' Regarding Lease Renewal Deadlines for Commercial Tenants and Landlords

6 minute read

Meet the Attorneys—and Little Known Law—Behind $20M Miami Dispute

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250