CEO Sentenced to 25 Years for Leading $1.3 Billion Real Estate Ponzi Scheme

Robert Shapiro was accused of fleecing 9,000 investors with a promise of profits on real estate loans, and seniors contributed about $400 million in retirement savings.

October 15, 2019 at 06:06 PM

5 minute read

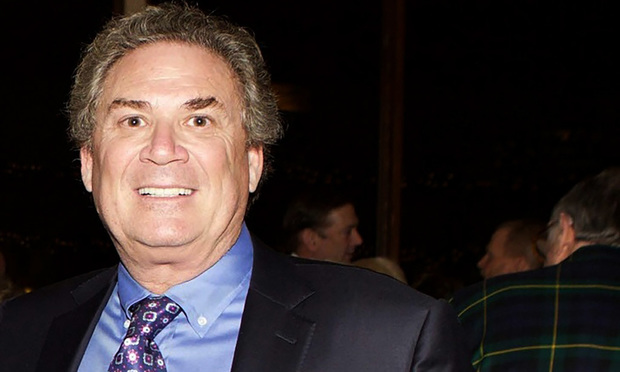

Robert Shapiro of Woodbridge Realty of Colorado/courtesy photo

Robert Shapiro of Woodbridge Realty of Colorado/courtesy photo

A California executive who splurged on charter flights and luxury cars was sentenced to 25 years for masterminding a $1.3 billion Ponzi scheme tied to real estate offerings that bankrolled his lavish lifestyle.

Robert Shapiro, 61, was sentenced Tuesday to the maximum term by U.S. District Judge Cecilia Altonaga on a mail and wire fraud conspiracy and income tax evasion counts.

Shapiro pleaded guilty in August to masterminding a Ponzi scheme that fleeced 9,000 investors, nearly a third of whom are elderly who collectively put $400 million in retirement savings into Shapiro's Woodbridge Group of Cos. LLC and its affiliates.

Prosecutors charged the former Woodbridge CEO led the scheme, promising investments would be placed in low-risk, high-interest rate loans issued on real estate owned by third parties from 2012 to 2017.

The investors were led to believe the loans would generate big profits. In reality, some of the properties didn't exist, and many that did were owned by Shapiro through his network of 270 limited liability companies rather than third parties.

Shapiro was accused of siphoning off $25 million to $95 million for his personal use, including $6.7 million for a home, $3.1 million for chartered flights, $2.6 million for home improvements, $1.8 million for his personal income taxes and $672,000 for luxury cars.

Shapiro's Woodbridge Realty of Colorado hosted a New Year's Eve party for 250 revelers ringing in 2016. The company website boasted of a "mouthwatering display of prime rib, spring lamb, oysters, crab, shrimp — and every type of charcuterie and hors d'oeuvres imaginable" for the party at the private Aspen Glen Club in Carbondale, Colorado.

Shapiro's defense attorney, DLA Piper partner Ryan O'Quinn in Miami, said his client owned up to financially hurting the investors and hopes for the best outcome for them.

"Robert Shapiro has accepted responsibility for the losses suffered by Woodbridge investors," said O'Quinn, who worked on the case with DLA Piper associate Elan Gershoni in Miami. "By doing so, Mr. Shapiro hopes that the bankruptcy estate will be able to focus its efforts and resources to maximize the recovery through the sale of the real estate portfolio."

Woodbridge filed for bankruptcy protection in Delaware in December 2017.

Shapiro admitted that before the bankruptcy filing, he diverted investors' funds to a bank account belonging to his wife, Jeri Shapiro. He also admitted using bank accounts and credit cards in his wife's name to divert money to his family. Federal prosecutors agreed not to prosecute Jeri Shapiro.

Woodbridge, which employed about 130 people, used high-pressure tactics to attract investments by targeting potential victims in person and by phone, online advertisements and email.

The tax evasion count stems from unpaid taxes of over $6 million due from 2000 to 2005.

A 10-count indictment filed last April lists two other co-conspirators, Dane Roseman and Ivan Acevedo.

Roseman was a Woodbridge managing director, and Acevedo was a sales agent for a Woodbridge affiliate.

The indictment charged Shapiro, Roseman and Acevedo with conspiracy and mail fraud. Shapiro and Roseman were charged with two counts of wire fraud, and only Shapiro was charged with a conspiracy to commit money laundering and tax evasion.

Altonaga on Thursday set a two-week jury trial in June for Acevedo and Roseman.

Acevedo's public defender, D'Arsey Houlihan, declined to comment. He is working on the case with Aimee Ferrer.

Roseman's attorneys, Sallah Astarita & Cox partner Jeffrey Cox in Boca Raton and Stern attorney Samuel Stern in Miami, didn't return a request for comment by deadline.

The case, one of the biggest Ponzi schemes charged in Florida, also was the subject of a U.S. Securities and Exchange Commission civil enforcement action against Woodbridge, Shapiro and others.

Sonn Law Group attorney Jeffrey Sonn in Aventura said his firm represents some of the defrauded investors and many are elderly South Floridians.

"Shapiro defrauded thousands of investors, including elderly retirees, out of their nest egg that they needed to support themselves in retirement," Sonn said by email. "I have clients in their 80s and 90s that lost a lot of money."

Shapiro's sentence was "just and fair," Sonn added.

Woodbridge's headquarters was in the Los Angeles suburb of Sherman Oaks, and a major sales office was in Boca Raton. The company also had offices in Colorado, Tennessee and Connecticut.

Related stories:

California's Robert Shapiro Pleads Guilty in $1.3 Billion Real Estate Ponzi Scheme

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Vedder Price Shareholder Javier Lopez Appointed to Miami Planning, Zoning & Appeals Board

2 minute read

Real Estate Trends to Watch in 2025: Restructuring, Growth, and Challenges in South Florida

3 minute read

830 Brickell is Open After Two-Year Delay That Led to Winston & Strawn Pulling Lease

3 minute readTrending Stories

- 1Plaintiff Argues Jury's $22M Punitive Damages Finding Undermines J&J's Talc Trial Win

- 2Bannon's Fraud Trial Delayed One Week as New, 'More Aggressive,' Defense Attorneys Get Ready

- 3'AI-Generated' Case References? This African Law Firm Is Under Investigation

- 4John Deere Annual Meeting Offers Peek Into DEI Strife That Looms for Companies Nationwide

- 5Why Associates in This Growing Legal Market Are Leaving Their Firms

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250