Sidley Austin Fighting Claims the Firm Helped $1.3B Woodbridge Ponzi Scheme

Attorneys for receiver Michael Goldberg, an Akerman partner in Fort Lauderdale, claim several firms helped extend the life of the real estate investment fraud at Woodbridge, which was founded in Boca Raton.

December 03, 2019 at 06:42 PM

4 minute read

The original version of this story was published on The American Lawyer

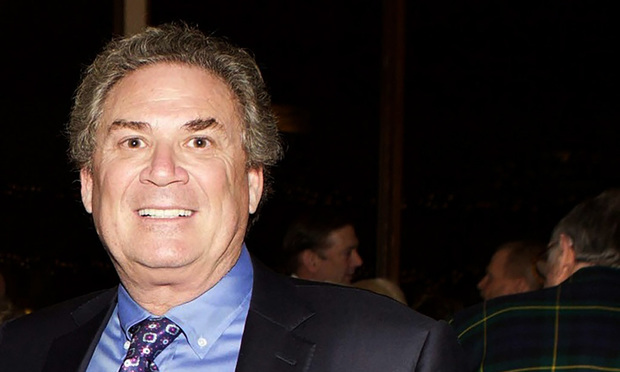

Robert Shapiro of Woodbridge Realty of Colorado. Courtesy photo

Robert Shapiro of Woodbridge Realty of Colorado. Courtesy photo

Sidley Austin is fighting claims that the law firm helped perpetuate the $1.3 billion Woodbridge Ponzi scheme, which had deep roots in South Florida.

A $500 million lawsuit filed on behalf of the receiver, Akerman's Michael Goldberg, alleges Sidley and Washington partner Neal Sullivan were "heavily involved" in the legal matters of Woodbridge Group of Cos., which was led by California executive and imprisoned mastermind Robert Shapiro. Other law firms and more than a dozen attorneys were named in the complaint.

"We believe the claims asserted against the firm and Mr. Sullivan are without merit, and we intend to defend the case vigorously," a spokesman for Sidley said Tuesday. Sullivan is the global leader of Sidley's regulatory and enforcement practice.

Shapiro pleaded guilty to mail and wire fraud conspiracy and income tax evasion and was sentenced in October by U.S. District Judge Cecilia Altonaga in Miami to 25 years in prison.

He promised investors would profit by putting their money into his low-risk, high-interest loans that were issued on real estate owned by third parties. But the real estate either didn't exist or was secretly owned by Shapiro, who siphoned off millions of dollars for catered parties, chartered aircraft, limousines, luxury cars and hotel stays.

Law firms like Sidley prepared documents that extended the fraud, according to the lawsuit filed by Goldberg, Fort Lauderdale-based chairman of Akerman's fraud and recovery practice and the Woodbridge Liquidation Trust receiver.

"The law firms and attorneys that are defendants in this complaint aided and abetted numerous securities violations and fraudulent acts," Goldberg's lawyers wrote in the complaint filed Tuesday in Los Angeles Superior Court. "Some drafted offering documents replete with false statements that they knew were false. Some prepared negligent legal opinion memorandums to be shared with investors. Some assisted Shapiro in concealing his fraud."

In 2015, Sidley allegedly prepared a legal opinion that Woodbridge then used to assure people their investments in the company were legally sound. Goldberg alleged Sidley knew or should have known that its conclusions were heavily contested by state regulators who were probing whether Woodbridge was a Ponzi scheme.

Tthe other law firms named as defendants in Goldberg's 262-page, 62-claim lawsuit include Davis Graham & Stubbs; Halloran & Sage; Balcomb & Green; Rome McGuigan; Bailey Cavalieri; Robinson & Cole; Finn Dixon & Herling; and Haight Brown & Bonesteel, along with lawyers at those firms. Those other firms and lawyers did not respond to requests for comment by deadline.

"We're trying to pick up the pieces for these people and help them recover their massive — and tragic— losses," Louis Miller, a partner at Miller Barondess who is representing Goldberg, said in a statement. "We look forward to facing the defendants in a court of law and holding them responsible for the devastating losses they helped cause."

Woodbridge was founded in Boca Raton, which remained a sales hub for the company after the headquarters moved to the Los Angeles suburb of Sherman Oaks. Shapiro owned property in Palm Beach County and was registered to vote in Florida.

Woodbridge, which collapsed into bankruptcy in December 2017, was one of the biggest Ponzi schemes ever charged in Florida. The Securities and Exchange Commission charged more than 275 limited liability companies under the Woodbridge umbrella were used to defraud more than 8,400 investors, including 2,600 people who invested $400 million in retirement savings.

Read More:

CEO Sentenced to 25 Years for Leading $1.3 Billion Real Estate Ponzi Scheme

California's Robert Shapiro Pleads Guilty in $1.3 Billion Real Estate Ponzi Scheme

Woodbridge Group Slapped With $1 Billion Penalty for Ponzi Scheme

Boca Raton-Based Woodbridge Marketers Face SEC Charges

SEC Claims Florida-Based Woodbridge Group Ran $1.2B Ponzi Scheme

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

4 minute read

US Judge Cannon Blocks DOJ From Releasing Final Report in Trump Documents Probe

3 minute read

Read the Document: DOJ Releases Ex-Special Counsel's Report Explaining Trump Prosecutions

3 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250