Genetic Information Bill Gets Quick House Committee Backing

Florida would become the first state to have a law preventing insurers from using genetic information in making policy decisions if incoming House Speaker Chris Sprowls' proposal is ultimately passed by the Legislature and signed by the governor.

January 17, 2020 at 12:14 PM

5 minute read

Rep. Chris Sprowls, R-Clearwater/photo courtesy of the Florida House of Representatives

Rep. Chris Sprowls, R-Clearwater/photo courtesy of the Florida House of Representatives

Incoming House Speaker Chris Sprowls had little trouble convincing members of a House health-care panel to approve legislation that would prohibit life-insurance, long-term care insurance and disability-insurance companies from using customers' genetic information in changing, denying or canceling policies.

Florida would become the first state to have such a law if Sprowls' proposal is ultimately passed by the Legislature and signed by Gov. Ron DeSantis.

Members of the House Health & Human Services Committee passed Sprowls' bill (HB 1189) without any debate, and committee Chairman Ray Rodrigues, R-Estero, praised Sprowls for introducing the bill.

"I think our privacy is important. And I think it's equally important to be a visionary, to look forward and I'm happy that Florida is going to be the state that leads the way on this issue," Rodrigues said.

Insurance industry lobbyists, who opposed the measure, sat quietly, agreeing to waive their speaking time.

Curt Leonard, regional vice president for state relations for the American Council of Life Insurers, said his association had expressed concerns on the issue for the past two years.

"We've expressed our concerns with Speaker Sprowls and other interested parties on this issue going back to 2018. So there's no point in repeating the same things over and over again, in the interest of the committee's time," Leonard said. "That being said, we do share the speaker-designate's [Sprowls'] concerns about privacy. I think it's a concern for everybody."

The bill will have to clear the Commerce Committee before it would be ready to go to the full House. Sprowls, R-Palm Harbor, is slated to become speaker after the November elections.

Hours before the committee considered the bill, supporters launched a website dubbed Protecting Our DNA and a Facebook page.

The website also includes a petition and animated digital video helping to explain the issue.

Sprowls told reporters after the meeting that the social media campaign was launched to educate the public.

"I think most people, myself included up until a couple years ago, [weren't] aware that if you had gotten a genetic test, that was something that your insurance company could get. I think when you tell people who've said they have 23andMe or who have had a genetic test in a clinical setting, whatever the reason, they had no idea that they have this massive liability by giving it to their insurance companies," he said. "So it's part about raising the awareness for people that it's a danger and that this bill will help close the loophole and garner support. We want them to know about the bill. We want them to be educated on the topic."

In addition to preventing insurers from using the information in making policy decisions, Sprowls' bill also would block the companies from requiring or soliciting genetic information from applicants.

Sprowls said insurance companies have for years been able to sell policies without having access to the genetic data.

Insurance carriers "have been successful without access to genetic information. They have been able to provide affordable coverage to consumers without genetic information. Insurance is about spreading risk, not guaranteeing the outcomes or rewards to the (carriers). And affordable life, disability, and health insurance should not be available simply to the genetic elite," Sprowls said.

Florida Chief Financial Officer Jimmy Patronis, who helps oversee the insurance industry, also backs efforts to pass legislation. In a statement issued after the vote, Patronis, said "As DNA testing becomes more popular through companies like 23andMe and AncestryDNA, we must ensure that your genetic code is not used against you."

Federal law already prevents health insurers from using genetic information in underwriting policies and in setting premiums. But the prohibition doesn't apply to life insurance or long-term care coverage, which Sprowls described as a "massive loophole."

Florida isn't the only state to look at the issue. California, New Jersey, and New York require insurers to get informed consent when requesting genetic testing for life or disability insurance, according to a Florida legislative staff analysis.

Also, Massachusetts prohibits unfair discrimination on the basis of genetic information or tests and prevents requiring applicants or existing policyholders to undergo genetic testing. In Arizona, life and disability insurance carriers are prohibited from using genetic information for underwriting or ratemaking unless supported by an applicant's medical condition, medical history and either claims experience or actuarial projections.

It's unusual for incoming House speakers and Senate presidents to file bills under their names. But Sprowls, a cancer survivor, said it's an "honor" to do so.

While Sprowls' influence looms large in the House, he must convince the Florida Senate to go along. For that, Sprowls said he will look to Sen. Kelli Stargel, R-Lakeland, to spearhead the issue.

"I leave the Senate in her capable hands," Sprowls said.

Senate President Bill Galvano, though, told The News Service of Florida that he supports a potential compromise on the issue.

Leonard said a compromise would authorize consumers to "use their private information any way they want to. And that might include them wanting to share their genetic science or genetic testing information," he said. "So we don't like the idea that consumers will be handcuffed in how they use that information."

Christine Sexton reports for the News Service of Florida.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

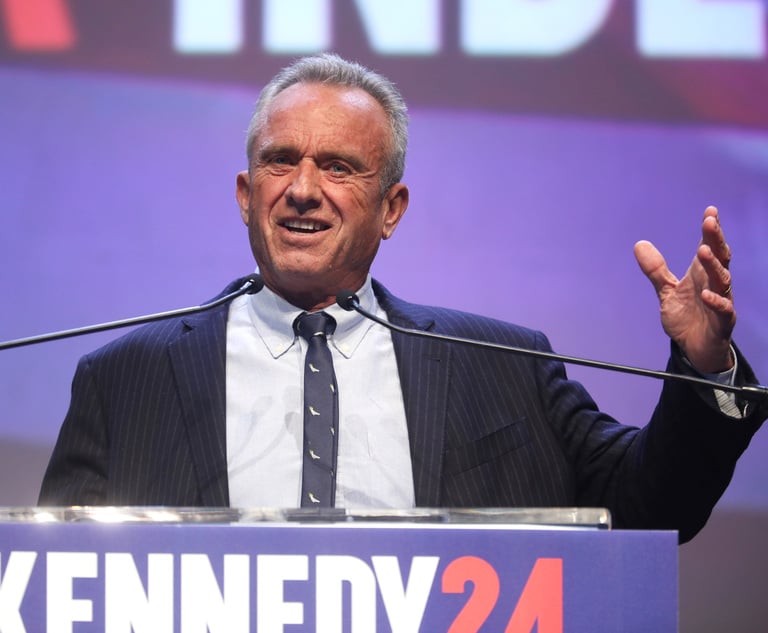

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute read

Attorneys, Health Care Officials Face Nearly $80M RICO Suit Over Allegedly Fabricated Spreadsheet

Amid Growing Litigation Volume, Don't Expect UnitedHealthcare to Change Its Stripes After CEO's Killing

6 minute readTrending Stories

- 1Haynes and Boone Expands in New York With 7-Lawyer Seward & Kissel Fund Finance, Securitization Team

- 2Upstart Insurer That's Wowing Industry Hires AIG Legal Exec to Help Guide Global Expansion

- 3Connecticut Lawyers in Spotlight for Repping FBI Agents

- 4SEC Sued for Failing to Reveal Records Involving Simpson Thacher Attorney

- 5Lawsuit Accuses University of California of Racial Discrimination in Admissions

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250