A-Rod Unloads on His Wins and Strikeouts in Commercial Real Estate

Baseball great Alex Rodriguez segued from sports to private equity — and acknowledges at least one investment blooper along the way.

February 13, 2020 at 11:28 AM

2 minute read

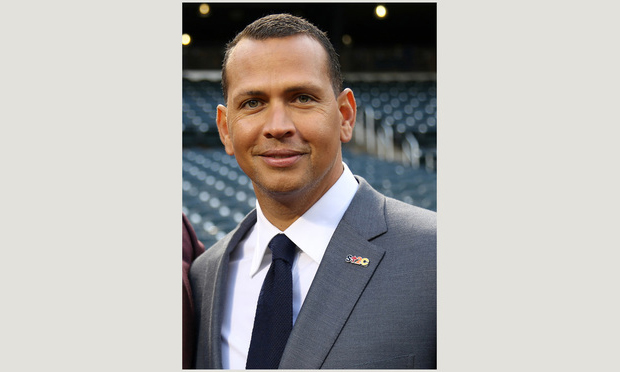

Alex Rodriguez, founder and CEO of A-Rod Corp. Photo: Arturo Pardavila III via Wikimedia Commons

Alex Rodriguez, founder and CEO of A-Rod Corp. Photo: Arturo Pardavila III via Wikimedia Commons

Miami hometown favorite Alex Rodriguez, founder and CEO of A-Rod Corp., made his first real estate move 20 years ago.

The 14-time All Star infielder bought a duplex where he "put in some value add" in the form of blue awnings and cream-colored paint. Best known for his accomplishments on the baseball field, A-Rod shared his insights from business to his baseball career at the Mortgage Bankers Association's CREF multifamily convention in San Diego.

"Success starts starts with people and relationships," Rodriguez said when talking about building his Woodland Hills, California-based business empire, a move he started out of fear. "If you look at macro trends, the numbers were frightening."

The former Yankee, Ranger and Mariner explained fewer than 5% of baseball players have college degrees, and most athletes make 80% of their money in their 20s. He beat the odds with a 22-year Major League baseball career.

"Many have financial trouble after playing, and I wanted to plan for something after my baseball career," he said.

That investment turned into some strategic pivoting, where more than half of his time is spent running his private equity firm while the rest is in entertainment.

What's important to success, according to Rodriquez, is who's around you.

"You are only as good as the five people you surround yourself with," Rodriguez said. "Hiring great people is one of the ways I have been able to be successful."

Real estate has been a mainstay of his business, investing about $400 million of equity in buying multifamily units in secondary markets through Fannie Mae. "They are nothing fancy, but our returns to our LPs have been north of 30%."

But not all have been wins.

One strikeout he mentioned includes a 500-unit portfolio purchased in Tampa at $60,000 a door that overnight was worth about $42,000 per door.

"We ended up cutting a deal with the bank, but I had people at the table with me with experience and a great track record," he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Fowler White Burnett Opens Jacksonville Office Focused on Transportation Practice

3 minute read

How Much Coverage Do You Really Have? Valuation and Loss Settlement Provisions in Commercial Property Policies

10 minute read

The Importance of 'Speaking Up' Regarding Lease Renewal Deadlines for Commercial Tenants and Landlords

6 minute read

Meet the Attorneys—and Little Known Law—Behind $20M Miami Dispute

Trending Stories

- 1'Not the President's Personal Lawyer': Lawyers Share Concerns Over How AG Pick Bondi’s Loyalism to Trump May Impact DOJ

- 2US Judge OKs Partial Release of Ex-Special Counsel's Final Report in Election Case

- 3The Demise of Truth and Transparency in Federal Sentencing

- 4Former Phila. Solicitor Sozi Tulante Rejoins Dechert

- 5'I've Seen Terrible Things': Lawyer Predicts Spike in Hazing Suits

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250