In First Year After Broad and Cassel Merger, Nelson Mullins Posts Big Financial Gains

The increase in profits per partner, which came as the firm added the 11-office Florida firm and increased its nonequity partner ranks, pushed the firm back over the $1 million mark.

March 10, 2020 at 04:00 PM

5 minute read

The original version of this story was published on Daily Report

James K. Lehman, managing partner with Nelson Mullins Riley & Scarborough. (Courtesy photo)

James K. Lehman, managing partner with Nelson Mullins Riley & Scarborough. (Courtesy photo)

Nelson Mullins Riley & Scarborough posted strong revenue and profit gains in the first full fiscal year after its milestone 2018 combination with Florida firm Broad and Cassel.

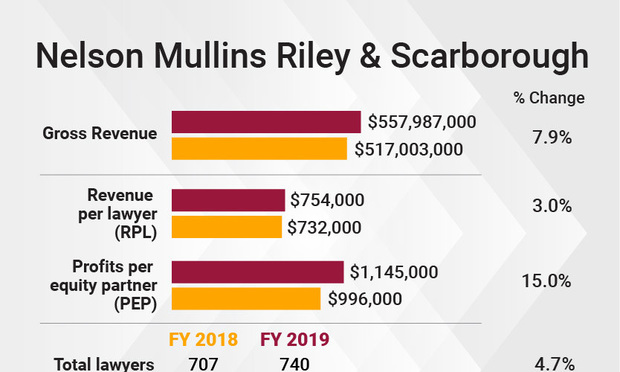

Revenue grew 7.9% to $558 million last year for Nelson Mullins, and net income jumped by 11.2% to $201 million.

That followed significant revenue and profit growth the prior year — a 27.5% revenue jump and a 14.1% jump in net income — after the merger with 150-lawyer Broad and Cassel closed Aug. 1, 2018.

Revenue per lawyer and profit per equity partner had dipped by 3.6% and 9%, respectively, in 2018 as Nelson Mullins absorbed the time and expense of integrating such a large addition in lawyers. But last year both metrics rebounded, with a 3% increase in RPL to $754,000 and a sharp 15% increase in PEP to $1,145,000. The PEP increase, which came as the firm increased its nonequity partner ranks, pushed the firm back over the $1 million mark that it first surpassed in 2017, the year before the combination.

Nelson Mullins' managing partner, Jim Lehman, said strong demand, including additional matters for the combined firm from the merger, aided the integration. "We had a lot of work to refer within the law firm, and that proved the thesis of the combination," Lehman said.

The Broad and Cassel merger, combined with the launch earlier in 2018 of an 11-partner Baltimore office, extended the South Carolina-based firm's footprint along the Eastern Seaboard from Boston to Miami and increased its size by almost one-third, to more than 700 lawyers when the deal closed on Aug. 1, 2018.

Lehman noted that much of the integration effort took place in 2018, after the Broad and Cassel merger took effect on Aug.1 of that year, so it did not drag down RPL or PEP in 2019.

"Any time you do a combination of this size it requires a lot of work by everyone," Lehman said. "Starting on August 1, 2018, we were able to gain momentum, so that by 2019 we were all moving together pretty well. The financial results support the conclusion that the merger is working well."

The Talent

Nelson Mullins continued to expand in 2019, growing to an annual average of 740 lawyers.

Nelson Mullins reported a net 5.9% increase in its total partnership for an annual average of 428 partners. The number of equity partners dipped by 3.3% to 175, while the income partner ranks increased by 14% to 253.

Lehman attributed the slight decrease in equity partners to a few departures and others shifting from equity to income status at age 67, in accordance with the firm's partnership agreement.

The notable increase in income partners, he said, was partly because Nelson Mullins added 35 lateral partners last year (including three as equity partners) who were spread across offices and not in any one large group as with the Baltimore addition in 2018. The firm also promoted 24 lawyers to partner internally.

What's more, some Broad and Cassel lawyers were promoted to income partner, Lehman said, adding Broad and Cassel shifted from its all-equity partnership structure to Nelson Mullins' two-tiered structure in 2018.

The Work

"Both the Florida and Baltimore additions brought on new talent that allowed us to do things we have not done historically or not done at the same level," Lehman said.

The merger deepened Nelson Mullins' real estate, health care and white-collar defense practices—all strong areas for Broad and Cassel — and extended its reach into Florida with Broad and Cassel's 10 offices concentrated in South Florida.

Lehman said the firm's corporate practices performed well, with very strong years for the health care and real estate groups. The firm handled multiple multifamily housing transactions for private equity firm Starwood Capital, and it represented Eli Lilly & Co. on the pharma giant's economic development deal with North Carolina and acquisition of a 100-acre site in Research Triangle Park to build a $474 million manufacturing plant.

Nelson Mullins' M&A team handled 109 transactions with a combined deal value of more than $6.7 billion, Lehman said, adding that tech, health care, energy, manufacturing and financial services were busy industries.

Nelson Mullins' banking practice continued to be busy, closing six bank mergers worth $4.92 billion, which pushed it up four spots to become No. 4 legal adviser in the 2019 S&P league table for the U.S. banking sector.

Lehman added that Nelson Mullins did not have a significant construction practice before the merger and that Broad and Cassel's practice gained work because of its lawyers' new ability to handle matters in other states. Public finance and affordable housing law are two other practices the firm has been able to extend beyond Florida, he said.

The firm also has gained litigation matters from the deal, Lehman said, such as multidistrict litigation in Miami, because of the deeper litigation bench nationally.

The 2019 financial figures are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Winston & Strawn Snags Sidley Austin Cross-Border Transactions Partner in Miami

2 minute read

Initial Steps to Set Up a Fla. Appeal: Your Future Self (or Appellate Attorney) Will Thank You

6 minute read

Divorce Timing Is Everything: Waiting for the New Year May Have Its Advantages

4 minute readLaw Firms Mentioned

Trending Stories

- 1Stevens & Lee Names New Delaware Shareholder

- 2U.S. Supreme Court Denies Trump Effort to Halt Sentencing

- 3From CLO to President: Kevin Boon Takes the Helm at Mysten Labs

- 4How Law Schools Fared on California's July 2024 Bar Exam

- 5'Discordant Dots': Why Phila. Zantac Judge Rejected Bid for His Recusal

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250