Are Municipalities Jeopardizing Their Municipal Bonds By Failing to Take Needed Action to Avoid a Crisis?

Based upon our professional experience, we fear that the failure of municipal entities, which includes cities, towns, counties, hospital districts, water districts, etc., to take immediate action in light of the consequences of the coronavirus pandemic will seriously jeopardize the ultimate payment of outstanding municipal bonds.

June 04, 2020 at 10:12 AM

7 minute read

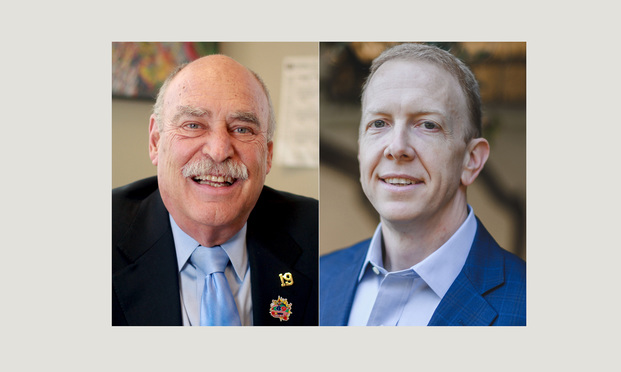

Charles Tatelbaum and Shelby Faubion

Charles Tatelbaum and Shelby Faubion

As professionals whose careers have spanned decades of dealing with issues associated with bankruptcy, turnaround and insolvency situations, we believe that we are in the midst of a significant crisis with respect to the integrity of municipal bonds. Based upon our professional experience, we fear that the failure of municipal entities, which includes cities, towns, counties, hospital districts, water districts, etc., to take immediate action in light of the consequences of the coronavirus pandemic will seriously jeopardize the ultimate payment of outstanding municipal bonds. Since much uncertainty still remains with respect to the level of federal support municipalities may garner, it is unlikely the support will be adequate to offset the significant revenue shortfalls that municipalities have incurred and will continue to incur until economic activity returns to its pre-COVID 19 levels. Elected officials and their administrative executive teams must act now to not only assess their current financial situation, but they must also initiate contingency plans to curtail an insolvency situation and mitigate the impact of the shortfalls. The organizations with the most proactive, experienced and creative teams are most likely to prevail and survive.

Since this may be the first time that the finance team members for the municipalities have ever faced a situation of this magnitude, many municipalities and other organizations need to benefit from the inclusion of experienced turnaround and restructuring professionals to bolster their teams and rely on the expertise of these professionals to assist in navigating through the crisis. With the recent announced furloughs of police, fire and other municipal employees by the city of Miramar within Broward County, and with the Chapter 11 filing of the municipal bond financed student housing project in Gainesville, we believe that these actions are the proverbial tip of the iceberg of the financial tsunami that will impact municipalities, hospital districts, school districts and other Florida projects financed with municipal bonds. Bond rating agencies are making daily announcements concerning the downgrading of previously highly rated (AAA) municipal bonds as a result of the pandemic.

It has been well publicized that municipalities are being severely impacted as a result of the coronavirus pandemic by the concurrent reduction of tax and other revenues and the increased expenses necessitated by maintaining certain essential services, and providing additional services residents and constituents. Since it appears that any help by way of a Congressional enactment may be stalled as a result of the partisan political wrangling, it is absolutely necessary that municipal bond financed entities need to take immediate proactive steps in order to avoid catastrophic results. Since many retirees and pension funds rely on the integrity of municipal bonds, it is incumbent upon municipal leaders to immediately think outside of the box and not consider business as usual in order to solve these once-in-a-lifetime problems.

Too often, because of perceived constraints that would limit the engagement of outside help, municipal employees are left to solve unique and extraordinary problems on their own, often without adequate expertise. As a result, as was seen in the Chapter 9 municipal bankruptcy filings of Jackson County (Birmingham) Alabama, Detroit, Michigan and Orange County, California, when municipal entities wait too long in order to deal with substantial revenue shortfalls, it is the employees, retirees, communities and the bondholders that suffer the consequences.

There is an unfounded belief held by many that municipal bonds are "guaranteed," and even in a bankruptcy case, they must be satisfied in full. Unfortunately, that is not the case. Except for certain types of revenue bonds where the revenue can be used to satisfy principal and/or interest of the bond, general obligation municipal bonds are treated just like any other unsecured claim in a bankruptcy proceeding, and history has shown that the holders of these bonds have fared poorly after long delays in municipal bankruptcy proceedings.

Too often, when business executives and municipal leaders are faced with situations that are critical in nature but outside their scope of knowledge, they react instinctively, but that instinct may not be the proper solution when dealing with the current financial distress with no immediate resolution.

Many years ago, Congress enacted Chapter 9 of the Bankruptcy Code provide a vehicle for municipal entities, other than states, to adjust their debts when revenue is insufficient to meet the critical needs on an ongoing basis. However, as was seen in the Detroit Chapter 9 bankruptcy case, the strict rules of the bankruptcy law provide what many believe to be an imbalance or unfairness in the way that different constituent groups of creditors and bondholders are treated. The same is true for those who are the beneficiaries of pension benefits and healthcare rights. Filing of a Chapter 9 proceeding should be a last resort by a municipal entity, utilized only after all possible other actions have been exhausted.

This mandates that municipal entities seek competent professional legal and financial advice from outside professionals prior to the situation reaching a critical stage. For example, financial advisers can review and restate financial plans and forecasts, running a multitude of scenarios and sensitivity analyses and can help management take actions to improve liquidity while taking a critical view to all assets and the ability to profitably monetize such assets. Financial advisers can also model the impact of cost-containment actions such as delays or pauses to capital improvement projects or planned program expansions as well as halting all contractor/temporary workers, etc. From a legal perspective, it is critically important that elected officials and senior staff for the municipalities fully understand and have access to legal advice to properly weigh the legal alternatives and their possible consequences. For instance, seeking protection under Chapter 9 of the Bankruptcy Code may be an excellent strategic opportunity for a municipality in order to be fair to creditors and bondholders, but seeking bankruptcy relief should never have to be done without sufficient advance strategic planning and adequate consideration.

Experienced advisers can bring proven and creative solutions to address revenue shortfalls of a magnitude that nobody could have predicted. When early intervention occurs, in working with outside professionals, the municipal entity's management team can affect the necessary financial restructuring without having to resort to their dramatic and cost mandates required by the Bankruptcy Code in the Chapter 9 proceeding.

Creditors, taxpayers and bondholders alike should urge elected and appointed municipal officers and employees to immediately take the proactive steps necessary to obtain adequate assistance before it is too late.

Charles M. Tatelbaum is a director of the Fort Lauderdale law firm of Tripp Scott where he chairs the creditors' rights and bankruptcy practice group. He has been concentrating his law practice in the area of complex business litigation, creditors' rights and bankruptcy for more than 50 years.

Shelby Faubion is a resident of Fort Lauderdale and a managing director at Larx Advisors, Inc. Faubion leads the firm's South Florida practice, providing turnaround and restructuring, financial accounting and due diligence and merger and acquisition integration services. Faubion has over 20 years experience providing a variety of financial, accounting and risk management services within public accounting and industry.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Don’t Forget the Owner’s Manual: A Guide to Proving Liability Through Manufacturers’ Warnings and Instructions

5 minute readTrending Stories

- 1Law Firms Report Wide Growth, Successful Billing Rate Increases and Less Merger Interest

- 2CLOs Face Mounting Pressure as Risks Mushroom and Job Duties Expand

- 3X Faces Intense Scrutiny as EU Investigation Races to Conclusion & Looming Court Battle

- 4'Nation Is in Trouble': NY Lawmakers Advance Bill to Set Parameters for Shielding Juror IDs in Criminal Matters

- 5Margolis Edelstein Broadens Leadership With New Co-Managing Partner

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250