R.J. Reynolds Wants Out of Historic Tobacco Settlement With Florida Government. Who Will Foot $100M Bill?

It's a case that demonstrates how the wording of an old contract — even if it is one of the largest court-approved settlements in U.S. history — can come back to haunt its parties later on. And whatever the outcome, someone's going to be unhappy.

June 09, 2020 at 01:40 PM

5 minute read

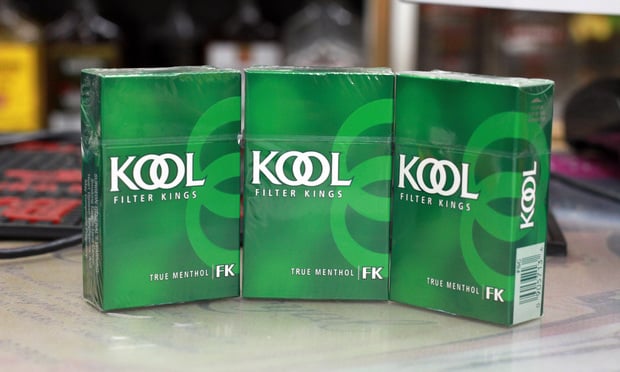

Kool Cigarettes. John Disney/ALM.

Kool Cigarettes. John Disney/ALM.

An $11.3 billion settlement agreement from 1997 between Florida government and a group of tobacco companies was in the spotlight Tuesday when the Fourth District Court of Appeal considered whether R.J. Reynolds should continue paying millions of dollars a year for cigarette brands it no longer owns.

It's a case that demonstrates how the wording of an old contract — even if it is one of the largest court-approved settlements in U.S. history — can later come back to haunt its parties.

And whatever the outcome, someone's going to be unhappy.

In oral arguments via Zoom, R.J. Reynolds Tobacco Co. asked the court to reverse a trial court ruling finding it responsible for all state payments related to Salem, Winston, Kool and Maverick cigarettes.

R.J. Reynolds argued it washed its hands of those brands in 2015 when its parent company sold them to ITG Brands LLC, owned by Imperial Brands. ITG wasn't part of the crucial 1997 settlement in which R.J. Reynolds and other firms agreed to reduce advertising and pay the state $11.3 billion over 25 years in exchange for relief from liability and health costs stemming from smoking-related illnesses.

More than $100 million plus millions of annual payments in perpetuity is at stake, according to R.J. Reynolds, whose attorney Elliot Scherker of Greenberg Traurig in Miami pointed out that the agreement never included a brand transfer clause.

"What it did include was market share as the sole basis for proportional payments under the [Florida Settlement Agreement], cigarettes shipped in the United States," Scherker said. "It cannot be that RLR, which no longer manufactures or ships the acquired brands, is still liable for payments on shipments of those brands."

Scherker argued neither party is responsible because the purchase agreement only transferred R.J. Reynold's protections against liability to ITG, and didn't make it a successor to the settlement.

Scherker said his client still pays attorney fees related to the settlement "because we agreed to do it," and said it has paid Lorillard Tobacco Co.'s share of the settlement money since their $27 billion merger in 2015. But Scherker said nothing in their agreement mentions an obligation to pay the state based on ITG's cigarette sales.

'The end of the entire agreement'

Arguing for the government, Florida Solicitor General Amit Agarwal said that if R.J. Reynolds got its way, "this really would spell the end of the entire agreement."

Agarwal stressed that Mississippi, Texas and Minnesota courts have weighed the same issue and ruled the same way, finding R.J. Reynolds liable as part of its own market share for cigarettes sold under the transferred brands — which he said Reynolds made $7 billion from selling.

"It's undisputed that 16 billion cigarettes a year continue to be sold under the transferred brands and it's also undisputed that since then, no one, not Reynolds, not Imperial, has paid the state even a cent as to those 16 billion cigarettes every year, even though those cigarettes, of course, are causing the exact same problems that the annual payments in perpetuity are intended to provide compensation for," Agarwal said. "As a result, the state in the aggregate has now lost something on the order of $180 million, which could have been used to treat smoking-induced illnesses like lung cancer and heart disease, COPD."

Agarwal conceded, however, that the state doesn't care which party ultimately pays as long as it gets paid.

Counsel to settling defendant Philip Morris USA, Paul Vizcarrondo of Wachtell, Lipton, Rosen & Katz in New York said that as a party to the agreement it has the right to enforce its terms against R.J. Reynolds and ITG, which it claims is a successor.

Vizcarrondo alleged Imperial admitted during Delaware litigation that R.J. Reynolds was conspiring with it to dodge its settlement payments "at Philip Morris' expense."

"Because of the mechanics of the way that the annual payments are calculated, Reynolds' payments are less and Philip Morris' payments are more if Imperial is not a settling defendant under those calculations," Vizcarrondo said.

Elizabeth McCallum of Baker & Hostetler in Washington, D.C., noted that the trial court found her client ITG was not a successor and wasn't obligated to pay Florida. Reversing that, McCallum argued, would mean ignoring state corporate law, which says buyers don't assume liability for what they purchase unless they expressly agree.

McCallum also highlighted that both parties agreed ITG would "use its reasonable best efforts to attempt to reach agreement with Florida to assume obligations of a settling defendant" but claimed the state never followed through with negotiations.

Questions about fault and liability transferred under R.J. Reynolds's and ITG's purchase agreement are currently pending before a Delaware court.

Fourth DCA Judges Spencer Levine, Dorian Damoorgian and Alan Forst sat on the appellate panel, which is yet to rule.

More appeals:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

As Unpredictability Rises, Gov't Law Practices Expect Trump Bump. Especially in Florida

5 minute read

Law Firms Mentioned

Trending Stories

- 1Decision of the Day: Judge Dismisses Defamation Suit by New York Philharmonic Oboist Accused of Sexual Misconduct

- 2California Court Denies Apple's Motion to Strike Allegations in Gender Bias Class Action

- 3US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 4Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 5African Law Firm Investigated Over ‘AI-Generated’ Case References

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250