What Bankruptcy Lawyers Should Know About New Small Business Amendment, From the 1st to Use It in Florida

Though Subchapter V of the Small Business Reorganization Act wasn't designed for a global pandemic, it turns out the two go well together.

July 30, 2020 at 02:24 PM

5 minute read

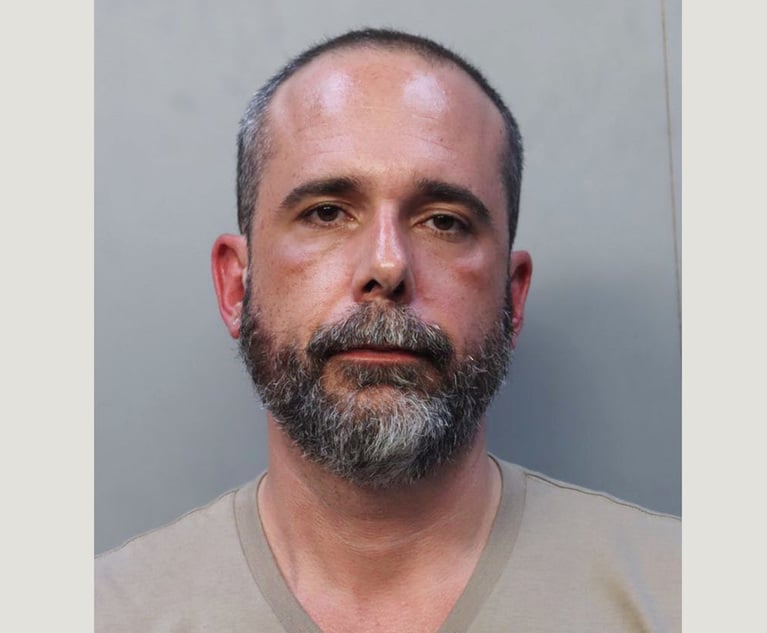

Chad Van Horn, with Van Horn Law Group in Fort Lauderdale. Courtesy photo.

Chad Van Horn, with Van Horn Law Group in Fort Lauderdale. Courtesy photo.

Broward's largest bankruptcy firm, the Van Horn Law Group, says it's the first in the state to complete a Chapter 11 business bankruptcy under a new initiative designed to help small companies survive what is a notoriously costly process.

And though it wasn't created for a global pandemic, it turns out the two go well together.

Subchapter V of the Small Business Reorganization Act passed last summer and took effect Feb. 19. That's around the time Fort Lauderdale attorney Chad Van Horn was helping multimillion-dollar tow truck company Nates Auto Repair & Performance Inc. solve its financial troubles after taking out high-interest accounts receivable loans to cover repairs.

Van Horn's straightforward bankruptcy plan was poised for confirmation, then COVID-19 happened. "Stay at home" orders meant less cars were on the road, resulting in fewer breakdowns that cut revenue in half.

"Well, I guess we're going to have to amend this plan," Van Horn said, as it was back to square one for his client and its roughly 17 creditors.

Negotiations began again in June, and it helped that Subchapter V was created to reduce costs for small-business owners, as Van Horn said many Chapter 11 reorganizations fail because of sky-high admin costs and attorney fees stemming from a litany of requirements.

"It was a long time coming," Van Horn said. "I consider myself a small business owner first, a lawyer second. And we'll do the retainers that are $5,000 or $10,000 for small businesses, but before we came into this space, your minimum retainer is $25,000 to $50,000. And for really small businesses, that's almost impossible to come up with."

Originally for companies with up to $3 million worth of debt, it now covers up to $7.5 million under the Coronavirus Aid Relief and Economic Security Act.

Unlike normal Chapter 11 reorganizations, this one didn't need a vote from creditors to proceed. Instead, a trustee reviewed everything and decided whether it was fair and equitable. And while there's usually a winner and a loser, Van Horn said everyone took a slight loss this time.

"As long as there's fair and equitable treatment, the court can actually confirm the case over objections, because there's no vote," Van Horn said.

Van Horn said it's crucial to talk to the Subchapter V trustee the moment they're appointed, to establish a mutual understanding about where the case will go. Tarek Kirk Kiem was trustee.

"The more communication that you can have with that Subchapter V trustee, the better it's going to be for everybody," Van Horn said. "Because if they're in there blind and if they're doing duplicitous work because of what you're doing, then it's going to cause more admin fees and that's specifically what Congress was trying to avoid by this."

For this novel kind of bankruptcy, it also helped to regularly bring issues before U.S. Bankruptcy Judge Erik Kimball of the Southern District of Florida.

"You might try something, because you're the first one filing it, and he goes, 'Well, actually, I read a law review article from Harvard that said you should do this, that and the other,' and you're like, 'That might be a good idea too, judge,'" Van Horn said.

He said his client has saved about $10,000 per month in vehicle payments, discharged about $900,000 in debt, and was able to use an economic injury disaster loan.

More than 130 Subchapter V cases have been filed in Florida so far, according to Van Horn, who said the success rate isn't great right now, likely thanks to COVID-19. This one finished in about five months, while his average case takes up to a year.

"I think the success rate is going to be much higher, compared to a normal Chapter 11 case, once we have more of an apples-to-apples comparison," Van Horn said.

'Tip of the iceberg'

Joe Pack, Pack Law partner in Miami. Courtesy photo.

Joe Pack, Pack Law partner in Miami. Courtesy photo.This is "just the tip of the iceberg" for Subchapter V, in the eyes of Miami bankruptcy lawyer Joseph Pack.

"You basically get the absolute best of Chapter 11 and then some, in a proceeding that should cost a fraction of what an 11 costs to administer."

Pack has several clients going through the process, which allows business owners to remain in place.

"In a gigantic company in a Chapter 11, there's new owners or the creditors become the owners, and the company can still exist and operate successfully," Pack said. "But when you've got a pizza shop on the corner, or some business where the owner is so critically important, Congress recognized that they should be able to reorganize instead of having to liquidate, because they're the only ones that can keep that business going."

Florida's small businesses are in dire straits, according to Van Horn, who said he worries that bankruptcy won't be the answer for many whose landlords aren't willing to help with lease issues.

"These landlords shouldn't want vacant space right now because people aren't opening restaurants and gyms," Van Horn said. "But some landlords are just stonewalling and I have one client who's never missed a payment and has been there for years. They missed one month's payment, they get an eviction notice."

Read more:

The 'Small Silver Lining' of COVID-19? Law Firms Are Teaming Up

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Auto Dealers Ask Court to Pump the Brakes on Scout Motors’ Florida Sales

3 minute read

Saul Ewing Loses Two Partners to Fox Rothschild, Marking Four Fla. Partner Exits in Last 13 Months

3 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250