President Joe Biden. Credit: Chris Allan/Shutterstock.com

President Joe Biden. Credit: Chris Allan/Shutterstock.com Fighting Gas Prices, US to Release 50 Million Barrels of Oil

President Joe Biden ordered 50 million barrels of oil released from America's strategic reserve to help bring down energy costs, in coordination with…

November 24, 2021 at 10:15 AM

7 minute read

President Joe Biden ordered 50 million barrels of oil released from America's strategic reserve to help bring down energy costs, in coordination with other major energy-consuming nations, including India, the United Kingdom and China.

The U.S. action is aimed at global energy markets, but also at helping Americans coping with higher inflation and rising prices ahead of Thanksgiving and winter holiday travel. Gasoline prices are at about $3.40 a gallon, more than 50% higher than a year ago, according to the American Automobile Association.

The government will begin to move barrels into the market in mid- to late-December. But the action is unlikely to immediately bring down gas prices significantly as families begin traveling for the holidays. Gasoline usually responds at a lag to changes in oil prices, and administration officials suggested this is one of several steps toward ultimately bringing down costs.

Oil prices had dropped in the days ahead of the announced withdrawals, a sign that investors were anticipating the moves that could bring a combined 70 million to 80 million barrels of oil onto global markets. But in Tuesday morning trading, prices shot up nearly 2% instead of falling.

The market was expecting the news, and traders may have been underwhelmed when they saw the details, said Claudio Galimberti, senior vice president for oil markets at Rystad Energy.

"The problem is that everybody knows that this measure is temporary," Galimberti said. "So once it is stopped, then if demand continues to be above supply like it is right now, then you're back to square one."

Shortly after the U.S. announcement, India said it would release 5 million barrels from its strategic reserves. The British government confirmed it will release up to 1.5 million barrels from its stockpile. Japan and South Korea are also participating. U.S. officials say it's the biggest coordinated release from global strategic reserves.

Prime Minister Boris Johnson's spokesman, Max Blain, said it was "a sensible and measured step to support global markets" during the pandemic recovery. Blain added that British companies will be authorized but not compelled to participate in the release.

The actions by the U.S. and others also risk counter moves by Gulf nations, especially Saudi Arabia, and by Russia. Saudi Arabia and other Gulf countries have made clear they intend to control supply to keep prices high for the time being.

As word spread in recent days of a coming joint release from U.S. and other countries' reserves, there were warnings from OPEC interests that those countries may respond in turn, reneging on promises to increase supplies in coming months.

Wyoming Sen. John Barrasso was among Republicans who criticized Biden's announcement. The No. 3 Senate Republican said the underlying issue is restrictions on domestic production by the Biden administration.

"Begging OPEC and Russia to increase production and now using the Strategic Petroleum Reserve are desperate attempts to address a Biden-caused disaster," Barrasso said. "They're not substitutes for American energy production."

Biden has scrambled to reshape much of his economic agenda around the issue of inflation, saying that his recently passed $1 trillion infrastructure package will reduce price pressures by making it more efficient and cheaper to transport goods.

Republican lawmakers have hammered the administration for inflation hitting a 31-year high in October. The consumer price index soared 6.2% from a year ago — the biggest 12-month jump since 1990.

Senate Republican Leader Mitch McConnell of Kentucky tore into the White House in a speech last week, saying the victims of higher prices were middle class Americans. The GOP argument is that the Biden $1.9 trillion coronavirus relief package in March sent too much money into the economy, sending prices up and hurting middle-class and lower-income families.

"The three biggest drivers of the staggering 6.2% inflation rate we logged last month were housing, transportation, and food," McConnell said. "Those aren't luxuries, they're essentials."

The Strategic Petroleum Reserve is an emergency stockpile to preserve access to oil in case of natural disasters, national security issues and other events. Maintained by the Energy Department, the reserves are stored in caverns created in salt domes along the Texas and Louisiana Gulf Coasts. There are roughly 605 million barrels of petroleum in the reserve.

"As we come out of an unprecedented global economic shutdown, oil supply has not kept up with demand, forcing working families and businesses to pay the price," Energy Secretary Jennifer Granholm said in a statement. "This action underscores the president's commitment to using the tools available to bring down costs for working families and to continue our economic recovery."

The Biden administration argues that the reserve is the right tool to help ease the supply problem. Americans used an average of 20.7 million barrels a day during September, according to the Energy Information Administration. That means that the release nearly equals about two-and-a-half days of additional supply.

The coronavirus pandemic roiled energy markets. As closures began in April, 2020, demand collapsed and oil futures prices turned negative. Energy traders did not want to get stuck with crude that they could not store. But as the economy recovered, prices jumped to a seven-year high in October.

U.S. production has not recovered. Energy Information Administration figures indicate that domestic production is averaging roughly 11 million barrels daily, down from 12.8 million before the pandemic started.

Republicans have also seized on Biden's efforts to minimize drilling and support renewable energy as a reason for the decreased production, though there are multiple market dynamics at play as fossil fuel prices are higher around the world.

Biden and administration officials insist that tapping more oil from the reserve does not conflict with the president's long-term climate goals, because this short-term fix meets a specific problem, while climate policies are a long-term answer over decades.

They argue that the administration's push to boost renewable energy will eventually mean less dependence in the U.S. on fossil fuels. But that's a politically convenient argument — in simple terms, higher prices reduce usage, and significantly higher gasoline prices could force Americans into less reliance on fossil fuels.

"The only long term solution to rising gas prices is to continue our march to eliminate our dependence on fossil fuels and create a robust green energy economy," Senate Democratic Leader Chuck Schumer said in support of the release.

The White House decision comes after weeks of diplomatic negotiations. Biden and President Xi Jinping of China talked over steps to counter tight petroleum supplies in their virtual meeting earlier this month and "discussed the importance of taking measures to address global energy supplies," according to the White House.

The Department of Energy will make the oil available from the Strategic Petroleum Reserve in two ways; 32 million barrels will be released in the next few months and will return to the reserve in the years ahead, the White House said. Another 18 million barrels will be part of a sale of oil that Congress authorized.

White House Press Secretary Jen Psaki said Monday evening the White House would keep tabs on the oil companies and watch for price gouging "when there's a supply of oil or the price of oil is coming down and the price of gas is not coming down."

Josh Boak and Colleen Long report for the Associated Press. AP writers Cathy Bussewitz and Charles Sheehan contributed from New York, Jill Lawless from London and Matthew Daly and Ellen Knickmeyer from Washington, D.C.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

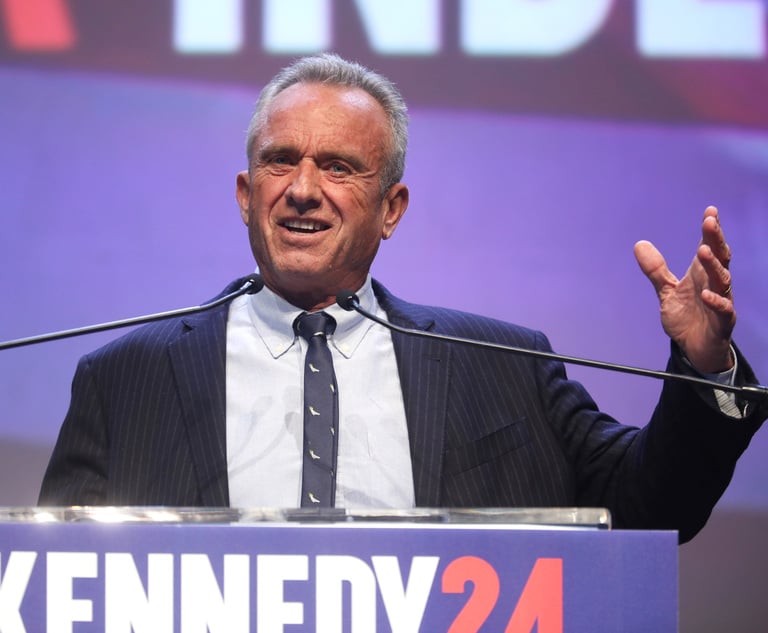

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute read

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute read

US Judge Cannon Blocks DOJ From Releasing Final Report in Trump Documents Probe

3 minute read

As Unpredictability Rises, Gov't Law Practices Expect Trump Bump. Especially in Florida

5 minute readTrending Stories

- 1US Judge Dismisses Lawsuit Brought Under NYC Gender Violence Law, Ruling Claims Barred Under State Measure

- 24th Circuit Upholds Virginia Law Restricting Online Court Records Access

- 3Lawsuit Against Major Food Brands Could Be Sign of Emerging Litigation Over Processed Foods

- 4Fellows LaBriola LLP is Pleased to Announce that Alisha Goel Has Become Associated with The Firm

- 5Law Firms Turn to 'Golden Handcuffs' to Rein In Partner Movement

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250