Lael Brainard, vice chair of the Federal Reserve. Photo: Al Drago/Bloomberg

Lael Brainard, vice chair of the Federal Reserve. Photo: Al Drago/Bloomberg Fed's Brainard Sees Need for Regulation Around Crypto Assets

Federal Reserve Vice Chair Lael Brainard alluded to the recent collapse of algorithmic stablecoin TerraUSD as well as Tether's dipping below its intended one-to-one peg to the dollar, saying "these events underscore the need for clear regulatory guardrails."

May 26, 2022 at 01:39 PM

2 minute read

Federal Reserve Vice Chair Lael Brainard said growth in new digital assets and the recent pressure some of them have seen highlights the need for better regulatory guardrails around these instruments.

"The recent turmoil in crypto financial markets makes clear that the actions we take now — whether on the regulatory framework or a digital dollar — should be robust to the future evolution of the financial system," Brainard said in testimony prepared for a House Financial Services Committee hearing on Thursday.

She alluded to the recent collapse of algorithmic stablecoin TerraUSD as well as Tether's dipping below its intended one-to-one peg to the dollar, saying "these events underscore the need for clear regulatory guardrails."

The Fed issued a discussion paper on central bank digital currency in January, calling it a "first step" in public discussion with stakeholders. The Fed has made no commitment to issue a digital dollar, though Brainard's previous comments on the topic suggest she views such a step as strategically important for the U.S. to both have a say in global standards and assure the dollar's status as the anchor currency in the international payment system.

"In future states where other major foreign currencies are issued in CBDC form, it is prudent to consider how the potential absence or presence of a U.S. central bank digital dollar could affect the use of the dollar in global payments," Brainard said. "U.S. CBDC may be one potential way to ensure that people around the world who use the dollar can continue to rely on the strength and safety of the U.S. currency to transact and conduct business in the digital financial system."

Brainard also said the Fed must be attentive to the risk that a digital dollar replace some bank liabilities in the financial system.

"Accordingly, if the Federal Reserve were to move forward on CBDC, it would be important to develop design features that could mitigate such risks, such as offering a non-interest bearing CBDC or limiting the amount of CBDC a consumer could hold or transfer."

Craig Torres reports for Bloomberg News.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

6 minute read

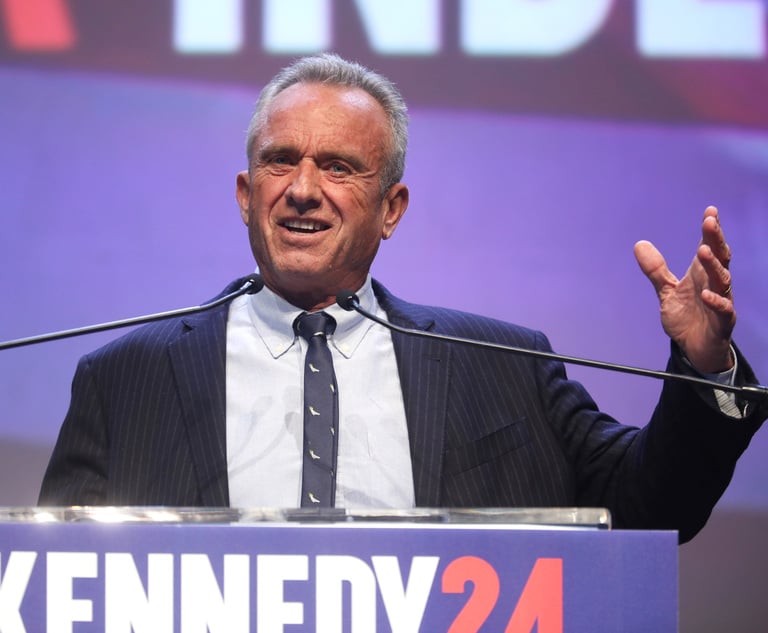

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute readTrending Stories

- 1Robinson & Cole Adds to Immigration Team in Philly

- 2DC Circuit Revives Firefighters' Religious Freedom Litigation in Facial Hair Policy Row

- 3‘High Demand’: Former Trump Admin Lawyers Leverage Connections for Big Law Work, Jobs

- 4Considerations for Establishing or Denying a Texas Partnership to Invest in Real Estate

- 5In-House AI Adoption Stalls Despite Rising Business Pressures

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250