President Joe Biden. Credit: BiksuTong/Shutterstock.com.

President Joe Biden. Credit: BiksuTong/Shutterstock.com. Biden's Student-Loan Relief Adds New Wrinkle to Inflation Debate

While Biden's plan to forgive a portion of student loans will reduce the burden for millions of households, it also pegs January as the end to the forbearance period.

August 29, 2022 at 11:36 AM

5 minute read

Federal GovernmentPresident Joe Biden's plan to forgive a portion of student loans held by tens of millions of people will ripple through the economy as personal spending and savings shift, but no factor will be more closely watched than inflation.

In announcing the plan Wednesday, the White House flagged that the move would have competing impacts. On the one hand, it would reduce overall household debt and potentially provide more spending power. On the other, it offers a timeline to restart payments that have been suspended for more than two years.

Overall, the combination of higher savings and lower debt could drive inflation up by 0.1 to 0.3 percentage points, according to Michael Pugliese, an economist at Wells Fargo & Co. Bloomberg Economics sees the potential to add as much 0.2 percentage points next year, with risk to the upside. Headline inflation last month, as measured by the consumer price index, was 8.5%, near a 40-year high.

"In the grand scheme of things, that's not huge," Pugliese said of the fresh pressures, adding that there are outstanding details that will still influence his estimate. "But inflation right now is at pretty alarming rates. At a time when the economy is already running too hot, it just threatens putting more fuel on the fire."

While Biden and the Democrats are using the debt relief to court younger and progressive voters ahead of the midterms in November, as the party risks losing control of Congress, the decision has also powered criticism that his administration is to blame for a consumer-powered surge in prices, particularly from the $1.9 trillion Covid-19 relief stimulus bill.

The effects of the relief will be felt widely. Of the 43 million federal student loan borrowers eligible to benefit, about 20 million will have their debt completely eliminated, according to White House estimates, with 90% of help going to those who earn less than $75,000 a year.

The loan forgiveness will likely counter any deflationary impact from the recently passed Inflation Reduction Act, Beth Akers, a senior fellow at the American Enterprise Institute, said on Bloomberg Radio's Balance of Power.

"It's actually not hugely inflationary," said Akers, a former staff economist in the Council of Economic Advisers under George W. Bush. "This will increase the inflationary pressure, but it's still not a game changer in terms of the inflation debate."

The Committee for a Responsible Federal Budget, a fiscally conservative group that lobbies for deficit reduction, also flagged that the debt relief could undermine the IRA's disinflationary impact. It said Biden's plan will likely cost up to $600 billion, and could add 0.15 percentage points to the Federal Reserve's preferred inflation gauge upfront, with additional pressure over time.

What Bloomberg Economics Says…

"The student-debt forgiveness program will boost income and aggregate demand, and hence inflation… At a time that the Fed is trying to cool demand to bring down inflation, this new fiscal stimulus means the Fed will have to even do more next year, or keep interest rates in restrictive territory for longer."

–Anna Wong and Andrew Husby, economists

The bigger drivers for consumer prices in the coming months will remain "the interplay between the strong labor market and rising interest rates," said Blerina Uruci, US economist at T. Rowe Price Associates. "At the margin the loan forgiveness will help a subset of the US consumer."

As for the broader impact on the economy, the extended pause on repayments and overall lightened debt load will support consumption, but "it still comes down to how eager people will be to spend in the current environment of high inflation and rising interest rates," said Sal Guatieri, senior economist at BMO Capital Markets. "The actions will temper the downside risks to the US economic outlook."

While Biden's plan to forgive a portion of student loans will reduce the burden for millions of households, it also pegs January as the end to the forbearance period. This means that millions of debt holders with more than $10,000 of loans or income levels outside of the government plan's parameters will have to resume payments for the first time since March 2020, leaving less leftover for discretionary spending.

Student loan debt exceeds $1.7 trillion, according to the Fed, and is second only to mortgage balances as the largest component of US household debt.

Biden stressed that the plan is targeted toward working and middle class households. The $10,000 in debt relief for most student-loan holders will be doubled for those who received Pell Grants. More than 90% of those grants have gone to families with incomes less than $60,000 a year.

The loan forgiveness will have more of a long-term effect on household wealth, rather than an immediate effect on spending, said economist Arin Dube, professor at the University of Massachusetts Amherst. School debt often restrains first-time homebuyers, so eliminating the debt could free up spending in the future, he said.

"There are solid reasons to oppose the policy or support the policy," he said. "But inflation to me is not a big part of the issue. This is transfer of debt from private to government essentially, and this is going to be spread out."

–With assistance from Molly Smith.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

6 minute read

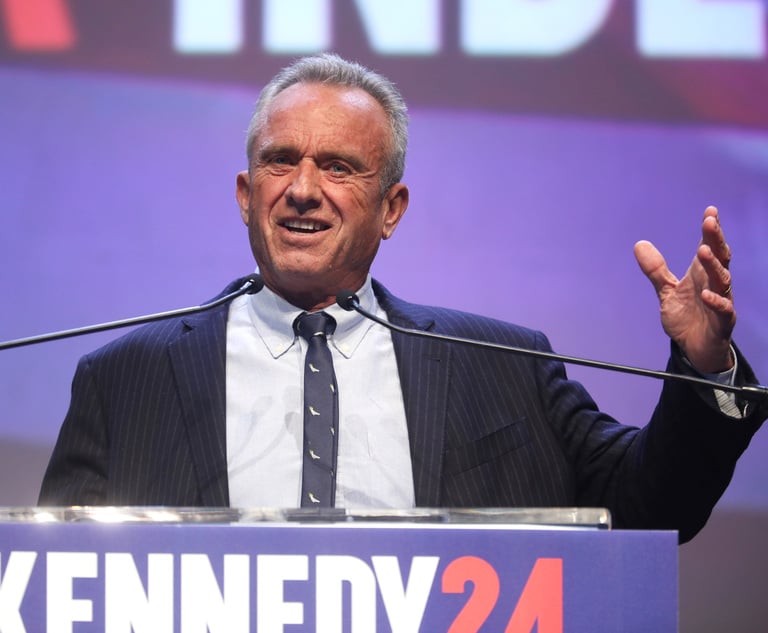

RFK Jr. Will Keep Affiliations With Morgan & Morgan, Other Law Firms If Confirmed to DHHS

3 minute readLaw Firms Mentioned

Trending Stories

- 1Gunderson Dettmer Opens Atlanta Office With 3 Partners From Morris Manning

- 2Decision of the Day: Court Holds Accident with Post Driver Was 'Bizarre Occurrence,' Dismisses Action Brought Under Labor Law §240

- 3Judge Recommends Disbarment for Attorney Who Plotted to Hack Judge's Email, Phone

- 4Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 5Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250