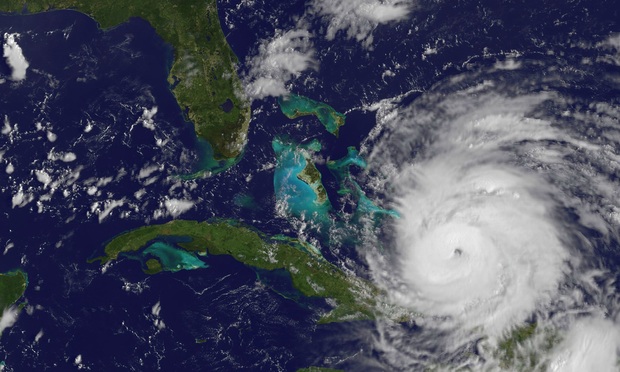

With nearly a decade since Florida experienced any major hurricanes, it is easy to lose sight of how our insurance market evolved from the post-Hurricane Andrew flight of private insurers from the state to the 2002 birth of nonprofit Citizens Property Insurance Corp. as the state-run “insurer of last resort.”

Today, with nearly a quarter of Florida homeowner policies underwritten by Citizens, its explosive growth over the years has become a potential financial albatross for the state. Citizens could become responsible for the payment of billions of dollars in claims if a major hurricane strikes Florida, causing a depletion of the insurer’s cash and resources built up over the years without a major storm.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]