Greenspoon Marder Revenues Rise on Deals, Disputes, Pot Policy Moves

Greenspoon Marder's growth was tempered somewhat in 2017, but the firm still increased revenue by double digits.

February 07, 2018 at 01:59 PM

4 minute read

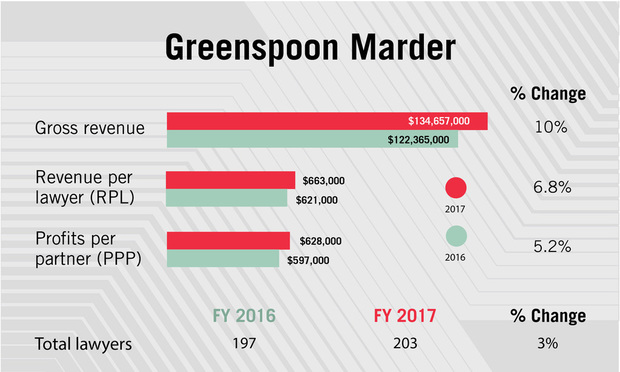

Greenspoon Marder posted double-digit revenue growth yet again in 2017—though the dollars piled up at a slightly more modest clip than in recent years. Gross revenue increased by 10 percent in 2017 to $134.7 million, after rising about 12 percent in 2015 and more than 17 percent in 2016.

Growth in profits per partner also lagged somewhat in comparison with 2016, when PPP was up 10 percent over the prior year. The firm nevertheless saw PPP gains of 5.2 percent last year, with a somewhat smaller pool of equity partners taking home $628,000 on average.

The 203-lawyer firm's net income stayed almost flat at $55.25 million. But revenue per lawyer, which had dipped in 2016, rose in 2017 by 6.8 percent to $633,000.

Co-managing director Gerald Greenspoon attributed the continuing growth in part to the firm's traditional real estate practices and its rising status as a top-ranked adviser to the cannabis industry. But he also cited its robust corporate division—particularly in M&A—and its recently developed IP and long-time commercial litigation practices, which, this year, handled cases for high-profile corporate clients including Landry's Seafood House-Florida and Martha Stewart Living Omnimedia.

“We are pretty much running on all cylinders now. We have quite a number of positive situations,” Greenspoon said.

Greenspoon Marder added five new offices in 2017, for a total of 24 nationwide, and it hired nine partners. Already this year it has continued to add add offices and partners, including most recently Stephan Mallenbaum, who was named an executive partner after joining from Dentons in January.

Onboarding laterals and opening up offices in new cities smoothly and quickly has become a point of pride with the firm, Greenspoon said.

“As a result of years of planning ahead, and building a very large, very sophisticated infrastructure, when we do an expansion into a city the additional cost is minimal. It's incremental,” Greenspoon said. “We bring on the new employees with barely an increase in overall staff that increases the associated costs.”

That seamlessness helps when Greenspoon Marder competes to attract lawyers whom other prowling firms may want to poach as well, he said.

“When we are negotiating with a group, we can tell them we can make it happen quickly and very painlessly,” he said.

The firm's total head count grew 3 percent in 2017, up from 197 to 203 lawyers, but it also shed some equity partners, dropping to 88 from 93 the previous year.

Greenspoon described the contraction in the partnership as “sort of a clean up.”

He said: “We had a number of partners who went into retirement mode. They no longer wanted to be full time.”

In 2018, he said he expects more lawyers to joining, increasing the firm's headcount as much as 10 percent. Greenspoon said he wasn't worried about the impact of new signals from the Department of Justice on marijuana law enforcement, which many law firms with cannabis practices expect to prompt some turmoil.

U.S. Attorney General Jeff Sessions issued a memo this year rescinding prior guidance issued by the prior administration on enforcing federal pot prohibitions. The 2013 guidance, known as the Cole memo, had discouraged federal law enforcement officials from bringing marijuana-related charges in states that have legalized the drug.

“It creates additional opportunity for a firm like ours. It will for a short time create uncertainty, and our clients will reach out to us to ask how to handle that,” Greenspoon said of the policy shift. The firm's lawyers historically have advised “many regulated industries,” including the alcohol and student-lending sectors, Greenspoon said.

“We are quite adept at handling changes in regulations. It's what lawyers are needed for,” he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Winston & Strawn Snags Sidley Austin Cross-Border Transactions Partner in Miami

2 minute readTrending Stories

- 1SurePoint Acquires Legal Practice Management Company ZenCase

- 2Day Pitney Announces Partner Elevations

- 3The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 4Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 5As Litigation Finance Industry Matures, Links With Insurance Tighten

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250