Supreme Court Ruling Saves Lake Lanier Marinas From $50M Tax Increase

The high-dollar decision turned on a technicality: a missed deadline.

January 31, 2018 at 03:39 PM

3 minute read

Five marina owners on Lake Lanier who saw their local tax bills jump by as much as 3,000 percent—totaling a nearly $50 million increase—will not have to pay that tab, thanks to a ruling Monday from the Georgia Supreme Court. But, the high-dollar case turned on a technicality.

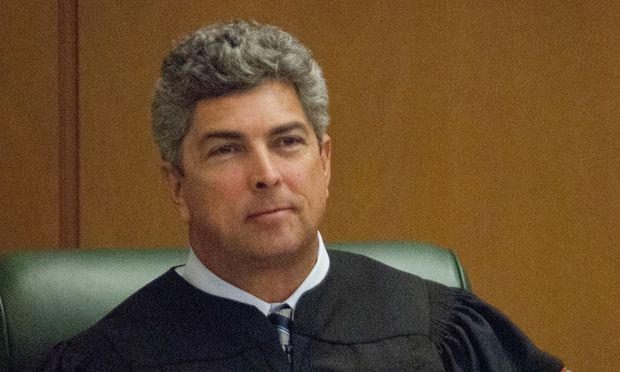

The Hall County Board of Tax Assessors failed to follow state law in scheduling a settlement conference within 45 days of receiving the marinas' notice of appeal, Justice Michael Boggs wrote in a unanimous opinion.

Boggs dispensed with an argument from the board's lawyers, who said the law divests superior courts of their authority. “We disagree,” Boggs wrote in an 18-page opinion. “The requirements imposed by the Act do not remove a case from the jurisdiction of the superior court. Rather, they are part of an administrative procedure that, like many others, imposes threshold conditions before the appeal reaches the jurisdiction of the superior court.”

The decision enforced new rules for an ad valorem tax that went into effect in January 2016. Boggs said a new law “does not change this long-standing administrative process, but simply provides for additional requirements to be met, by both the Board and the taxpayer.”

The Hall County Board of Tax Assessors was represented by Joseph Homans of Fox, Chandler, Homans, Hicks & Mckinnon in Dawsonville.

The marinas' attorneys are J. Ethan Underwood and Lauren Giles of Miles Hansford & Tallant in Cumming.

“We're obviously pleased. This is the result our clients wanted,” Underwood said. But because the decision only addresses procedural questions, the underlying issue of how to tax the docks and other improvements to the lake front property still have to be addressed this year. Conversations about that are in progress, he said.

According to the court, the five marinas lease shoreline property on Lake Lanier from the U.S. Army Corps of Engineers. All five have added, and own, improvements to the marinas such as docks, swim platforms, bathhouses, restaurants and stores, which Hall County assesses for ad valorem taxation. In 2015 the county recalibrated its assessments. The docks and additions previously had been valued and taxed separately as personal property, like automobiles. After the change, they were included within the value of the companies' leasehold interest and taxed as attachments to the realty.

Here's what the marina owners saw when they opened the tax bills in question, according to the court:

- Westrec Properties' tax bill jumped from $161,383 to $4.9 million, nearly a 3,000 percent increase;

- PS Recreational Properties' bill rose from $1.26 million to $24.5 million, a more than a 1,800 percent increase;

- Chattahoochee Parks' bill rose from $396,751 to $13.2 million, more than a 3,200 percent increase;

- March First's bill rose from $845,188 to $4.3 million, more than a 400 percent increase;

- AMP III-Lazy Days' bill rose from $1.23 million to $5.5 million, nearly a 350 percent increase.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

On The Move: Squire Patton Boggs, Akerman Among Four Firms Adding Atlanta Partners

7 minute read

Justice 'Weaponization Working Group' Will Examine Officials Who Investigated Trump, US AG Bondi Says

Trending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250