Despite Closing Asia Offices, Troutman Sanders Sees Revenue and Profit Growth

Troutman recruited 16 lateral partners last year, but it shuttered its roughly 40-lawyer practice in Hong Kong, Beijing and Shanghai, causing head count to decline.

February 20, 2019 at 03:21 PM

6 minute read

Troutman Sanders offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Troutman Sanders offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Troutman Sanders' managing partner Stephen Lewis called 2018 “another great year” for the firm. “We are on a good roll,” he said.

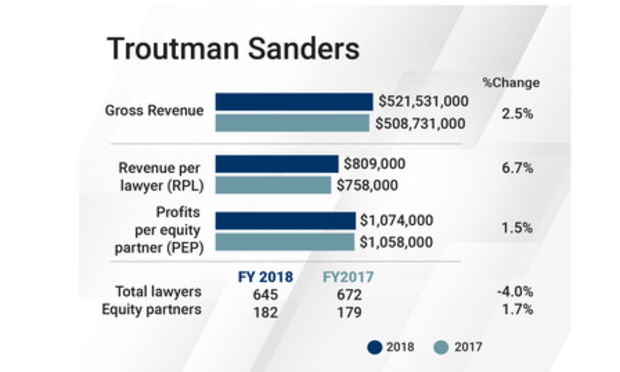

Revenue growth slowed a bit, but net income growth increased. Troutman posted a 2.5 percent increase in revenue to $521.5 million, lower than its 3.8 percent increase in 2017 and a 3.3 percent jump in net income to $195.5 million, up from its 0.5 percent increase in 2017.

With the 3.3 increase in net income, profit per equity partner increased by $16,000, or 1.5 percent, to $1.074 million.

The firm's lawyer head count dipped, in part because it closed its three Asia offices in Hong Kong, Beijing and Shanghai, effective May 31 last year, ending its 21-year-old Asia operations. Troutman had 43 lawyers there and about 90 employees total, including staff.

In all, Troutman's lawyer head count shrank by a net of 27 lawyers, or 4 percent, to 645, while revenue per lawyer increased 6.7 percent, or $51,000, to $809,000. Troutman's overall partner head count dipped by a net of 11 partners to 284, but the firm increased its equity partner head count by a net of three to 182.

In all, Troutman's lawyer head count shrank by a net of 27 lawyers, or 4 percent, to 645, while revenue per lawyer increased 6.7 percent, or $51,000, to $809,000. Troutman's overall partner head count dipped by a net of 11 partners to 284, but the firm increased its equity partner head count by a net of three to 182.

The firm pulled out of Asia because a strategic review concluded there was “not sufficient overlap” between its China practice and its top performance areas, Lewis told the Daily Report in January 2018. The practice was focused on Hong Kong securities and M&A work, Lewis explained, while the firm's areas of strength and focus are middle-market clients, particularly in energy, banking and finance, life sciences and insurance. “Ultimately you have to focus on your strengths,” he said at the time.

Stephen E. Lewis, Troutman Sanders, Atlanta. (Photo: John Disney/ ALM)

Stephen E. Lewis, Troutman Sanders, Atlanta. (Photo: John Disney/ ALM)Lewis also attributed the drop in head count to continued partner retirements, noting that 13 partners retired at the end of 2017. When taking those factors into consideration, he added, the head count dip is “not a material difference.”

The firm continues to grow, Lewis said. It recruited 16 lateral partners last year and has already added five lateral partners in 2019, including two intellectual property litigators in New York, Joe Diamante and Chuck Cantine, from King & Spalding.

Lewis declined to say if Troutman increased rates, but he acknowledged that expenses continued to rise, both for lawyer salaries and space.

Long-term View

Demand was up last year, Lewis said, adding that it “was a continuation of five years of steady growth.”

Over the five years from 2013 to 2018, Troutman's revenue increased 32.4 percent while net income increased 38.2 percent. That produced a 41.1 percent increase in profit per equity partner over the period, from $750,000 to $1.074 million.

“From a Troutman Sanders perspective, we feel good about where we are and where we are heading,” Lewis said. “We're growing, adding talented laterals and doing clients' most important work. Those are the things you like to see.”

That said, he acknowledged, the “wild card” is “what happens to the economy and what impact it will have on the business world and our clients?”

“We try and stay nimble and flexible enough,” he said, to adjust to any shifts in economic conditions.

The Talent

Lewis said that the West Coast and New York continue to be areas of focus for lateral recruitment, adding that “it's no secret that we would like to be in Texas.”

Troutman and Dallas-based Winstead started merger talks last year but ended them in July. Lewis and Winstead chairman David Dawson declined to comment on the status of talks at the time.

“We are patient,” Lewis said.

Last year's 16 lateral partner hires included a five-partner group of insurance litigators from Crowell & Moring. That group included William O'Neill and Leslie Davis, who co-chaired Crowell's insurance/reinsurance group, and Michael Carolan, who all joined in Washington, D.C.; New York-based Jack Thomas, who formerly headed Crowell's London office; and California-based Steven Allison, who headed Crowell's Orange County office.

In Atlanta, Troutman recruited two business litigation partners, David Meadows from King & Spalding and Jim Manley from Dentons. Other lateral partner hires were focused in Washington, New York and California—including Dentons partners Avi Schick, a business litigator, in New York and Randal Lejuwaan, a real estate partner, in San Diego.

In Atlanta, five partners retired. Meanwhile, Jeffrey Cavender became a federal bankruptcy judge, while litigator Scott Farrow decamped for plaintiffs firm Conley Griggs Partin. Jack Jirak became an associate general counsel for client Duke Energy and litigator Kevin Meeks left to start Meeks Law Firm.

The Work

In M&A last year, Troutman, with Herbert Smith Freehills and Hogan Lovells, advised ARRIS International, which supplies video and broadband infrastructure, on its $7.4 billion sale to CommScope. The firm also advised Brink's Co. on its acquisition of rival Dunbar Armored for $520 million in cash.

Troutman advised Atlanta-based fintech company Green Sky, which facilitates online loans for home improvements or elective surgery, on its IPO that raised $874 million.

Troutman's multifamily housing finance practice stayed active, servicing more than $52 billion in transactions for lenders—up from $50 billion in 2017. That included serving as lender's counsel for several large financing transactions, such as mortgage banker Holliday Fenoglio Fowler's $800.45 million refinancing of a 23-property portfolio through Freddie Mac.

The firm continued to represent longtime client Georgia Power Co. in ongoing regulatory issues and litigation over nuclear Plant Vogtle's cost overruns on Units 3 and 4.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trump RTO Mandates Won’t Disrupt Big Law Policies—But Client Expectations Might

6 minute read

Trump's RTO Mandate May Have Some Gov't Lawyers Polishing Their Resumes

5 minute readTrending Stories

- 1Internal Whistleblowing Surged Globally in 2024, so Why Were US Numbers Flat?

- 2In Resolved Lawsuit, Jim Walden Alleged 'Retaliatory' Silencing by X of His Personal Social Media Account

- 3Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

- 4Disney Legal Chief Sees Pay Surge 36%

- 5Legaltech Rundown: Consilio Launches Legal Privilege Review Tool, Luminance Opens North American Offices, and More

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250