Alston Sees Steady Growth, Pushing Firm Over $2M in Profits Per Partner

Alston & Bird saw more gains in revenue and profits per equity partner, but lawyer head count growth slowed.

February 27, 2019 at 04:47 PM

6 minute read

Richard Hays, chairman, Alston & Bird, in Atlanta. (Photo: John Disney/ALM)

Richard Hays, chairman, Alston & Bird, in Atlanta. (Photo: John Disney/ALM)

It was another year of “strong, steady growth,” for Alston & Bird in 2018, said its chairman, Richard Hays, adding that the firm beat its budget for the year.

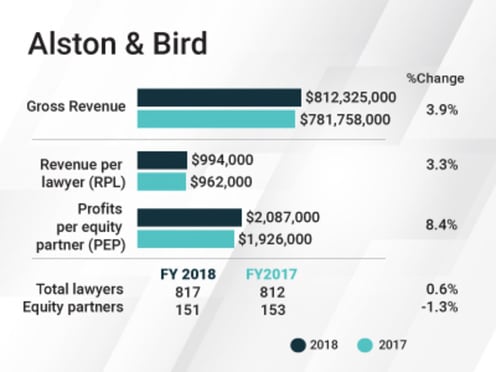

Revenue increased 3.9 percent to $812.3 million, and net income jumped 7 percent to $315.7 million.

That pushed Alston over the $2 million mark in average profit per equity partner, with a $161,000 (8.4 percent) increase to $2,087,000. The gains also boosted revenue per lawyer to just under the $1 million mark, at $994,000 (a 3.3 percent increase).

That said, growth was at a slower rate than in 2017, when Alston increased revenue 7 percent and net income 10.7 percent and total lawyer head count was relatively flat.

“We benefited from the economic growth,” Hays said of 2018. “We saw a spike in some areas that we had seen as areas where clients would need us more. In fact, they did.”

That included the corporate and tax practices, which stayed busy with M&A and financing deals, he said.

In one big deal, Alston is lead counsel to telecom infrastructure giant CommScope in its proposed $7.4 billion acquisition of ARRIS International. The firm also advised Synovus Financial, based in Columbus, Georgia, on its $2.9 billion acquisition of FCB Financial Holdings, which owns Florida Community Bank, the largest community bank in Florida. (Synovus will become the largest bank headquartered in Georgia when BB&T's acquisition of Atlanta-based SunTrust takes effect and SunTrust's headquarters moves to Charlotte.)

In one big deal, Alston is lead counsel to telecom infrastructure giant CommScope in its proposed $7.4 billion acquisition of ARRIS International. The firm also advised Synovus Financial, based in Columbus, Georgia, on its $2.9 billion acquisition of FCB Financial Holdings, which owns Florida Community Bank, the largest community bank in Florida. (Synovus will become the largest bank headquartered in Georgia when BB&T's acquisition of Atlanta-based SunTrust takes effect and SunTrust's headquarters moves to Charlotte.)

Hays forecast a similarly strong 2019, while noting widespread predictions that the economy will soften. “As to the talk of the inevitability of a future recession, it's a question of degree,” he added.

The economy may not be quite as active this year, Hays said, but it depends to some extent on the political maneuvering in Washington, D.C. The recent government shutdown, for instance, did not cause a material impact in Alston's work, he said, but “there is no question that some of the issues that our clients were dealing with the government on slowed during that time.”

“Change and unpredictability are impacting our regulatory practices,” Hays added, noting that client questions over the China trade discussions, for instance, have generated more work.

Hays said expenses increased, including associate pay raises, health care and tech costs. “That has caused us to focus sharply on other efficiencies,” he added, such as office space.

The Talent

Lawyer head count grew at a lesser rate than in prior years, with a net gain of five lawyers, reaching 817. That followed two years of Alston increasing lawyer head count by a net of 30 each year. The firm's total partner count increased by 11 to 369, although the equity partner count went down by two to 151.

While Alston aggressively added partners last year, Hays said a higher number of partner retirements pushed down head count growth, including partners who had delayed retirement following the 2008 recession. The firm recruited 18 lateral partners last year, up from 12 in 2017, and it promoted 21 lawyers to partner, the same number as the previous year.

Alston continued building out its West Coast practice. In Los Angeles, it added environmental litigation partner Jeffrey Dintzer and counsel Matt Wickersham from Gibson Dunn & Crutcher, plus a team of class action lawyers from DLA Piper, including partners Jeffrey Rosenfeld (formerly the Los Angeles managing partner for DLA) and Grant Alexander with counsel Rachel Lowe and senior associate Sean Crain.

In San Francisco, Alston added products liability litigator Steven Selna from Drinker Biddle & Reath, who headed that firm's office.

Alston also invested in its finance practice, adding a five-lawyer team of restructuring lawyers in New York from Andrews Kurth: partners David Hoyt, Kenneth Rothenberg and Russell Chiappetta with counsel Mathew Gray and Jason Cygielman. One impetus for bulking up the firm's restructuring capabilities is the likelihood of an economic downturn, Hays said.

Meanwhile, the firm added from Dentons M&A partner Jeremy Silverman in Atlanta and his Washington colleague, government contracting pro Jeniffer De Jesus Roberts; food and drug partner Angela Spivey from McGuireWoods (where she was the Atlanta partner-in-charge); and cybersecurity partner Lawrence Sommerfeld from the Atlanta U.S. attorney's office, where he'd headed the cybercrime unit.

Among partner departures, Craig Carpenito in New York left to become the U.S. attorney in New Jersey. In Atlanta, Sage Sigler became a federal bankruptcy judge, and Lesley Solomon became the general counsel for an Alston client, CatchMark Investment Trust. Two securities litigators, Lisa Bugni and Jessica Corley, left for King & Spalding.

The Work

Alston's banking practice stayed busy. The firm advised Credit Suisse, Citi, Morgan Stanley, Wells Fargo, Macquarie Capital, Houlihan Lokey and other investment banks on 19 deals worth $57 billion last year. That included representing Credit Suisse, the financial adviser for Pinnacle Foods in its $10.9 billion acquisition by Conagra Brands, as well as Macquarie Capital, the lead financial adviser for CSRA Inc. in its $9.7 billion acquisition by General Dynamics.

Alston with Smith, Gambrell & Russell represented Atlanta-based CatchMark Timber Trust, a publicly-traded REIT, in acquiring 1.1 million acres of east Texas timberland in a joint venture with a consortium of institutional investors for $1.4 billion.

In litigation, Alston represented former British spy Christopher Steele and his company Orbis Business Intelligence, winning the dismissal of a defamation suit brought by three Russian oligarchs in the Superior Court of the District of Columbia over Steele's dossier of alleged ties between the Donald Trump presidential campaign and Russia.

The firm continued to defend Taishan Gypsum Co. against about 4,000 plaintiffs claiming damages from defective drywall in multidistrict litigation pending in the U.S. District Court for the Eastern District of Louisiana. Alston also represents Taishan in all state court actions.

For Delta Air Lines, the firm won the dismissal, after eight years of litigation, of an antitrust class action that claimed price-fixing over baggage fees. The U.S. Court of Appeals for the Eleventh Circuit upheld a district court ruling and in January 2019, and the U.S. Supreme Court denied cert.

In a pro bono case that benefits Georgia lawyers, the firm won a decision for Public.Resource.org from the Eleventh Circuit, which agreed that the annotated version of the Official Code of Georgia is public record and can't be copyrighted by the state, reversing a trial court decision. The non-annotated version is available at no charge online, but the state has been selling the annotated version for $404. The rub was that in Georgia, unlike most states, the annotated version is the authoritative law for citation.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Sunbelt Law Firms Experienced More Moderate Growth Last Year, Alongside Some Job Cuts and Less Merger Interest

4 minute read

12-Partner Team 'Surprises' Atlanta Firm’s Leaders With Exit to Launch New Reed Smith Office

4 minute readTrending Stories

- 1Pro Hac Vice in Georgia: Rule Change for Nonresident Attorneys

- 2The Benefits of E-Filing for Affordable, Effortless and Equal Access to Justice

- 3AI and Social Media Fakes: Are You Protecting Your Brand?

- 4A Primer on Using Third-Party Depositions To Prove Your Case at Trial

- 5‘Catholic Charities v. Wisconsin Labor and Industry Review Commission’: Another Consequence of 'Hobby Lobby'?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250