Settlement Ends Insurer's Contract Dispute After $5.5M Arbitration Award

Attorney Richard Robbins said his client, Noble Systems, agreed to a "slightly discounted" settlement after he moved to enforce a $5.5 million arbitration award against Infinity Insurance and its parent, Kemper Corp.

March 29, 2019 at 11:22 AM

3 minute read

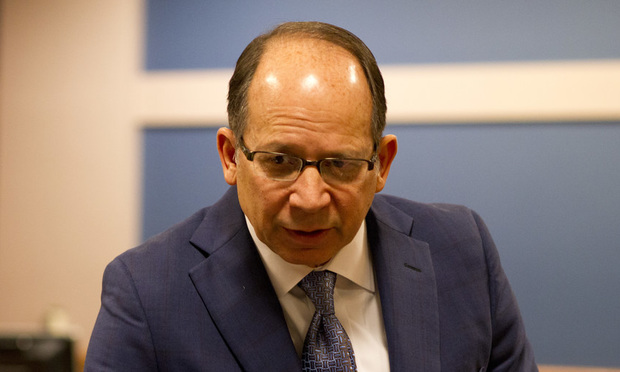

Richard L. Robbins, Robbins Ross Alloy Belinfante Littlefield LLC, Atlanta. (Photo: John Disney/ALM)

Richard L. Robbins, Robbins Ross Alloy Belinfante Littlefield LLC, Atlanta. (Photo: John Disney/ALM)

An insurer paid a “slightly discounted” settlement after an arbitrator ordered it pay more than $5.5 million to a call-center company after the insurer tried to rescind a contract a few months after signing.

The arbitration award included nearly $800,000 in fees for the Robbins Ross Alloy Belinfante Littlefield lawyers who handled the case on behalf of Atlanta-based Noble Systems Corp.

The settlement notice was filed by lawyers for Kemper Corp. Thursday after Noble filed an application to confirm the award last week in U.S. District Court for the Northern District of Georgia.

Kemper and its subsidiary Infinite Insurance had sought about $500,000 in damages, according to the arbitration award.

Firm partner Richard Robbins said the settlement was a “very satisfactory” resolution to the dispute, although he said it was “a little annoying to have to push to confirm the arbitration award.”

“That's the whole point of arbitration, so you don't have to go to court,” said Robbins, who handled the case with firm colleagues Jeremy Littlefield and Daniel Monahan.

The dispute originated with Birmingham-based Infinity, which merged with Kemper last year. Infinity and Kemper were represented by Stephen Cotter, Myrece Johnson and Lauren Woodrick of Swift, Currie, McGhee & Hiers, and Paul Veith of Sidley Austin's Chicago office.

The Daily Report could not obtain a response from a Kemper representative or its lawyers on Thursday.

According to Robbins and court filings, Infinity contracted with Noble in late 2017 to provide software and other technical support for the insurer's call center.

Noble ”negotiated a 60-page contract for months before they signed,” said Robbins. “This is a highly complex, highly customized large-scale system.”

The contract was signed in September 2017; in February 2018, Kemper announced that it was acquiring Infinity.

“Infinity filed a contract challenge eight days later,” said Robbins. “We thought it was because they were in the process of being acquired by Kemper and just didn't want to pay the money.”

Infinity argued that the contract was not binding or, alternatively, that Noble had fraudulently misrepresented its product and breached the contract; it sought $477,080 it paid Noble plus interest, attorney fees and expenses.

Over Infinity's objections Noble sought to enforce the contract's binding arbitration clause, which Atlanta JAMS mediator R. Wayne Thorpe ruled was enforceable.

“The case produced almost 1,400 pages of transcript, more than 500 exhibits, and nearly 300 pages of pre- and post-hearing briefs,” wrote Thorpe in his January ruling in favor of Noble.

Thorpe declared that Infinity had attempted to breach the contract, and awarded Noble $4,448,198 in damages, plus $781,244 in attorney fees and more than $300,000 in prejudgment interest.

The total sum Noble sought to confirm was $5,550,197.

“They just didn't seem to take us seriously, either when we filed the arbitration or when we said we intended to enforce promptly,” Robbins said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Insurer Not Required to Cover $29M Wrongful Death Judgment, Appeals Court Rules

Trying to Reason With Hurricane Season: Mediating First Party Property Insurance Claims

'I Thank You': Attorney Leverages Daily Report Article to Turn $42K Offer Into $600K Settlement

7 minute readTrending Stories

- 1Troutman Pepper, Claiming Ex-Associate's Firing Was Performance Related, Seeks Summary Judgment in Discrimination Suit

- 2Law Firm Fails to Get Punitive Damages From Ex-Client

- 3Over 700 Residents Near 2023 Derailment Sue Norfolk for More Damages

- 4Decision of the Day: Judge Sanctions Attorney for 'Frivolously' Claiming All Nine Personal Injury Categories in Motor Vehicle Case

- 5Second Judge Blocks Trump Federal Funding Freeze

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250