After a Profitable Year, Burr & Forman Busy With Merger Integration Efforts

Burr's CEO, Ed Christian, said new client opportunities are starting to materialize from the merger, effective Jan. 1.

April 30, 2019 at 05:17 PM

4 minute read

Ed Christian, with Burr & Forman in Atlanta. (Courtesy photo)

Ed Christian, with Burr & Forman in Atlanta. (Courtesy photo)

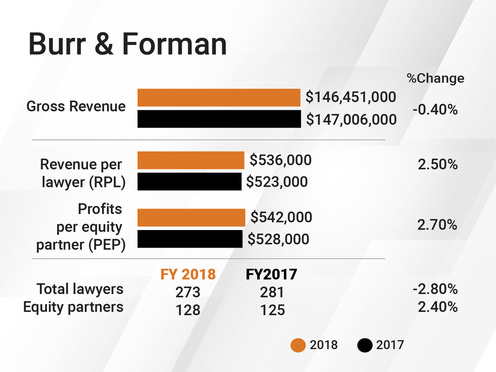

Birmingham-based Burr & Forman reported flat revenue in 2018 but a solid increase in net income, ahead of its merger with South Carolina's McNair Law Firm.

The merger, which took effect Jan 1, created a new regional Southeastern giant, with roughly 360-lawyers and 19 offices in eight states. The firm's partners are now busy with integration efforts, including spotting new business development opportunities.

Last year, Burr's revenue decreased slightly, by 0.4%, to $146.45 million but revenue per lawyer increased 2.5% to $536,000, in part because of a slight decline in average annual lawyer head count by eight lawyers to 273.

Net income increased 5.3% to $69.29 million, which increased profit per equity partner by 2.7%, even though the firm added a net of three equity partners to reach 128.

The firm's CEO, Ed Christian, said the firm exceeded budget. Transactional practices performed well, he said, with a slight increase in revenue from the corporate and tax group and strong performance by the intellectual property and health care practices.

The litigation practice performed about the same as the prior year, and the bankruptcy practice has not seen the activity of past years due to the strong economy, he said, noting that bankruptcy, like litigation, tends to be countercyclical.

Despite the continued talk of a possible economic slowdown, Christian, like many other law firm leaders, said he has not yet seen any signs. “We keep seeing that the economic numbers are up. Things remain strong,” he said. “There is a lot of money out there looking for deals, at least on the corporate side.”

The firm is hoping its combination with McNair will lead to more growth. Burr's acquisition of McNair on Jan. 1 increased Burr's size by about 25%.

Christian said the Burr and McNair partners have put together a “lengthy document,” listing all the Burr client opportunities in North Carolina and South Carolina and matching them with the McNair ones. “It's a couple of inches thick,” he said, and includes details on which attorneys have which client relationships.

W. Lee Thuston, who is known for his economic development work attracting automakers to Alabama, is leading the matchmaking.

Thuston was Burr's managing partner for 13 years, but he initiated a succession process a couple of years ago that resulted in the election of Christian to CEO and Atlanta managing partner Erich Durlacher to president, both new positions. Thuston took on a new role as chairman.

Christian forecast that this year will be devoted to integration. “In 2020, I think we will see the positive effects of the merger,” he said. “We are seeing the opportunities materialize that we thought might be there.”

“I see an email just about every day about some opportunity for legacy Burr or legacy McNair, which either firm wouldn't have been able to jump on if separate,” he added. “I remain very optimistic.”

The merger comes after a busy year in lateral movement. Burr added six lateral partners in 2018, including three in Atlanta, where the firm has an almost 40-lawyer office. The firm landed a five-lawyer group in Atlanta from Stites & Harbison last year. Bankruptcy partners Paul Durdaller and Brian Levy with counsel Valerie Richmond joined its creditors rights and bankruptcy practice, while partner Christine Tenley and associate Nina Maja Bergmar joined the labor and employment practice.

But Burr lost a nine-lawyer Tampa team, including five partners, to Florida firm Gunster ahead of the merger. The team included litigators William Schifino Jr., John Schifino and Daniel Dietrich, and real estate partners Scott Brown and Iden Sinai. William Schifino, who is heading Gunster's Tampa office, told the Daily Business Review that he wanted a “Florida-focused” firm for his practice.

Among its deal work, last year, Burr represented private equity firm Brentwood Associates in acquiring a majority interest in Afterburn Holdings, which operates or oversees 20 Orangetheory Fitness franchises.

Burr also advised SeniorSelect Partners, an insurance-holding company owned by nursing home operators and other long-term care providers in Alabama, in launching a new health insurance Medicare Advantage plan, Simpra Advantage. It advised Spain's X-Elio in the financing and acquisition of a 66MW solar energy facility.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

12-Partner Team 'Surprises' Atlanta Firm’s Leaders With Exit to Launch New Reed Smith Office

4 minute read

After Breakaway From FisherBroyles, Pierson Ferdinand Bills $75M in First Year

5 minute read

On the Move: Freeman Mathis & Gary Adds Florida Partners, Employment Pro Joins Jackson Lewis

6 minute readTrending Stories

- 1How ‘Bilateral Tapping’ Can Help with Stress and Anxiety

- 2How Law Firms Can Make Business Services a Performance Champion

- 3'Digital Mindset': Hogan Lovells' New Global Managing Partner for Digitalization

- 4Silk Road Founder Ross Ulbricht Has New York Sentence Pardoned by Trump

- 5Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250