How Grand Plans by an Am Law 200 Firm Unraveled

LeClairRyan's collapse was years in the making. Sources say the firm overpaid some lawyers, created guaranteed contracts, let overhead expenses grow and made other questionable strategic decisions.

August 25, 2019 at 06:00 PM

13 minute read

The original version of this story was published on The American Lawyer

Photo: Shutterstock.com

Photo: Shutterstock.com

Looking back, defections from LeClairRyan over the past two years were a sure sign of the firm's future, or lack thereof. But the seeds of the firm's eventual downfall were planted years before that, in the expansion and compensation decisions during its best years.

According to interviews with former partners and employees, as well as court documents, the firm made a number of missteps, even in years when gross revenue increased, by overpaying underperforming lawyers, letting overhead expenses grow, and making questionable strategic decisions. It missed budget for the first time in 2011 and saw its problems grow as management attempted to change course.

This wasn't, of course, what LeClairRyan's founders had in mind back in the late 1980s, when they set out to establish a competitively priced law firm catering to venture capital clients. As recently as four years ago, Gary LeClair touted this vision, explaining that his firm's business model was built on providing a lower price point than its Am Law 200 competitors and a more valuable service offering than smaller firms.

"As a multi-tier firm, our brand is not 'prestige' and having just the best and brightest. Our brand requires us to staff with the best fit to do the work, and to price the work based on how the client values it," LeClair said in a November 2015 interview with Forbes, just a few months before he would fully step down from firm management, exiting the chairman role in March 2016. He did not respond to requests for comment on this story.

LeClair's outlook seemed optimistic at the time, as he prepared to pass the reins. He fantasized about "sitting in a rocking chair watching my grandchildren play and reading an article about all the great things the firm is doing and not having any mention of our first generation in the article."

But in reality, LeClairRyan was already falling apart.

In A Volatile Market, One Strong Year

LeClairRyan's financial performance year-to-year may not have sounded alarms to the average onlooker.

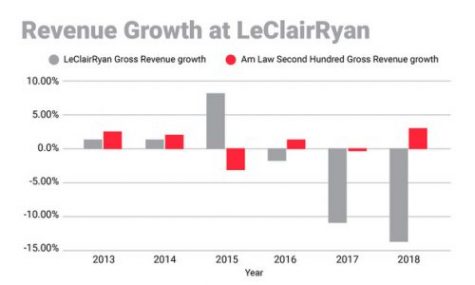

From 2012 (the earliest year in which The American Lawyer collected LeClairRyan's financial data) to 2015, the firm increased revenue each year. When assessing the top line alone, 2015 looked particularly strong, as gross revenue grew by 8.3% to $163 million.

But that's where the firm's growth peaked. And a closer examination suggests that financial pressures were building.

LeClairRyan's revenue growth compared with the industry

LeClairRyan's revenue growth compared with the industryRevenue per lawyer at LeClairRyan was $460,000 in 2012. In 2015, as LeClairRyan celebrated its gross revenue spike of 8.3%, RPL still came out to $460,000, no better than three years before.

During that same three-year stretch from 2012 to 2015, the average RPL of the Am Law Second Hundred increased by 6%.

Despite LeClairRyan's reported increases in profits per equity partner, average partner pay was not growing. Average compensation for all partners at LeClairRyan was $300,000 in 2012. By 2015, it was $295,000, according to ALM Intelligence data.

That was not going unnoticed.

"Each year comp payouts to shareholders and members went down," one former partner said.

At the end of 2015, LeClair transitioned out of the chairman role. A few months later, Erik Gustafson became the firm's CEO, taking over for David Freinberg.

Soon after that, one former partner said, the tone of conversations about the firm began to change. There was talk about how "the ship needed to be righted," the partner said, referring to LeClairRyan's finances. That was in 2016.

The firm was seeking a number of different avenues, but there was also a lack of transparency on how it planned to solve its financial problems, the former partner said. "They kept waiting for a white knight."

The potential solutions included seeking a merger partner. But few firms pursued such a combination with LeClairRyan seriously, sources said.

Last year, in 2018, the average partner's compensation had declined to $264,000, a drop of 12% since 2012.

A Series of Financial Missteps

Even before leadership changed hands in 2016, some pointed to decisions such as overpaying underperforming lawyers and creating too much overhead that led to the lackluster financial metrics.

The firm failed to meet its budget in for the first time in 2011, according to an arbitration award filed in litigation between former partner Michele Craddock and LeClairRyan over claims of gender bias.

The firm missed budget again in 2012, 2013 and 2014, the court filing said.

According to the filing, LeClairRyan had pointed to its own financial problems—such as problematic compensation packages for its lawyers—to defend against Craddock's claims that she was paid unfairly.

"The firm's leadership acknowledged that the 'raise culture' of 'paying more in compensation than [it] should be paying … resulted in (the firm's financial) shortfalls,'" the arbitration award said.

According to the Craddock decision, the firm used subjective and objective criteria to determine compensation, including hours worked, origination, matter management and team leadership. The firm described its compensation system as a "'relatocracy,'" the filing said, referring to the connection between each lawyer's contribution to firm values and execution of its strategy, which "is not determined by the rigid application of a formula.'"

The compensation system wasn't a big hit. Some sources told ALM that the system, described as complicated and murky, paid certain partners more than they were worth—inconsistent with the firm's competitive price points for clients.

Many shareholders suffered six-figure cuts to their compensation when the firm missed budget in 2012, the filing said. In 2014, some attorneys were fired.

It was only a matter of time until the unwanted shareholder attrition began.

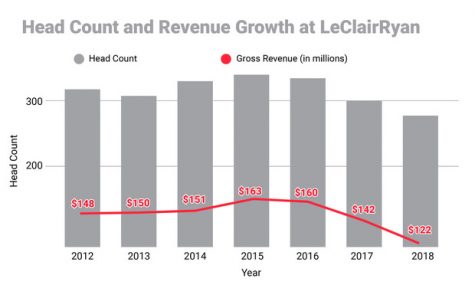

LeClairRyan's head count and revenue growth in the years before its demise

LeClairRyan's head count and revenue growth in the years before its demiseSources with knowledge of the firm also pointed to high infrastructure costs making the firm's financial situation worse.

They said LeClairRyan suffered from high overhead costs, particularly with regard to real estate, which became increasingly difficult to pay for as more of that office space emptied.

Eventually, landlords and vendors were going unpaid, sources said.

For instance, California tax consultant Capital Credits Group filed a lawsuit against LeClairRyan seeking $99,500 in unpaid fees. Capital Credits identified tax credits and savings for the firm in relation to its California offices between 2009 and 2014, the complaint said.

Sources said LeClairRyan's lease obligations became increasingly difficult to manage when partners left the firm and office space went unused. In the case of some departures, like the group in Rochester that joined Pepper Hamilton earlier this year, the defection brought relief, as Pepper Hamilton took over the office space.

But in Williamsburg, for example, debt to a landlord resulted in litigation. The four lawyers in that office left for Gordon Rees Scully Mansukhani in February. The landlord is seeking over $374,000 in rent—according to a confession of judgment filed in July, the law firm failed to pay the amounts due under a promissory note.

LeClairRyan also owed UnitedLex money. As part of an arrangement that created the joint venture ULX Partners, the firm was obligated to pay UnitedLex to use the staff that had formerly been LeClairRyan employees. But the law firm had become unable to make those payments, according to sources.

Asked about LeClairRyan's struggles and its relationship with UnitedLex, a spokeswoman for UnitedLex said in an emailed statement, "LeClairRyan remains a client of UnitedLex and the company will continue to provide support as needed."

Digging for Cash

As the firm struggled with its budget, it continued to go to partners for money.

Several years ago, the firm made a major push to encourage partners to buy preferred stock in LeClairRyan—it was billed as an investment, which at one time promised an 8% dividend, sources said. At one point, the firm was requiring certain partners to buy preferred stock.

Capital contribution requirements also increased over a period of several years, growing to $100,000 for new partners to buy in.

One former partner estimated that at least 50 lawyers contributed up to $100,000 in capital, and these lawyers have not been paid back. "We're essentially out the money," the former partner said. Multiple sources said partners who left LeClairRyan haven't been repaid their capital for several years.

Last year, the firm changed its corporate structure to become a partnership instead of a corporation. Records from the Virginia Secretary of State show that LeClairRyan PLLC was created March 4, 2018. LeClairRyan, a professional corporation, is listed as "converted."

Sources said that change would allow the firm to pass its losses onto partners, essentially cutting their compensation for the year, and allowing those partners to get the tax benefits of claiming that loss in exchange.

But throughout the struggles of recent years, certain individuals did get paid.

LeClair and several others had guaranteed contracts, or "golden parachutes," in which they were promised a high level of compensation upon stepping down from leadership positions, sources said. The exact terms of these contracts were unclear to most within the firm.

"Even when the partners weren't getting paid, they were getting paid," one former partner said, referring to those select members of firm leadership.

Additionally, multiple former partners said, certain individuals were getting bonuses as an incentive to stay with LeClairRyan, even though the firm's debt was climbing.

Innovation? Or Desperation?

In the wake of mass defections, LeClairRyan did not find a solution that allowed it to survive. But it wasn't for a lack of trying.

"Everything they did to try to advance their business backfired," said the leader of another large law firm who has knowledge of LeClairRyan but asked not to be named.

Anyone who has been watching LeClairRyan over the past couple of years will remember that the firm announced a deal with UnitedLex in 2018, launching ULX Partners. As a part of this deal, about 300 LeClairRyan employees became employees of ULX, the two entities said at the time. The new entity would provide back-office and support staff services to law firms looking to outsource those functions, and LeClairRyan was intended to be just the first law firm of many to sign on.

"Sign the offer letter with ULX Partners, or leave. Those were our options," one former LeClairRyan employee said.

Some sources said the deal was attractive in theory. During negotiations with UnitedLex, in the deal that ultimately created ULX Partners, there was a condition on the table that would allow partners to get their capital contributions back, sources said, but that was pulled before the deal came to fruition.

The creation of ULX Partners was not the first time that LeClairRyan paired up with UnitedLex. In November 2013, UnitedLex took over LeClairRyan's discovery operations. At the time, the two entities stated that about 400 attorneys and support staff from LeClairRyan would become UnitedLex employees.

In 2018, when the formation of ULX Partners was announced, UnitedLex CEO Dan Reed stressed that ULX Partners was not just an extension of the previous arrangement with LeClairRyan. And he expressed confidence that ULX Partners would grow.

"If we don't reach 10,000 employees in the next five years then I'm not doing something right," he said.

But in October 2018, certain ULX staff members including file clerks and assistants, former employees of LeClairRyan, were laid off, sources said. One former partner estimated that about one-fifth of staff lost their jobs.

UnitedLex did not respond to requests for comment on the layoffs, nor the earlier e-discovery arrangement.

Former litigation head Elizabeth Acee became the firm's president in 2019. As groups of partners continued to leave LeClairRyan, Acee stood by the firm's strategic direction.

"It is not accurate to say that we don't expect the firm to be in existence in 2019 because we think we're building law firm 2.0 and we'll be stronger," she said in a February interview with The American Lawyer. She did not respond to a request for comment on this story.

Around the same time Acee was making pledges about the firm's future, LeClairRyan leaders were taking steps toward establishing a new firm called Novellus. Some LeClairRyan partners even received offer letters to join the new entity. It would consist of LeClairRyan's remaining rainmakers, and it would maintain strong ties with UnitedLex, ALM has reported.

One former partner said at that point, things had become "desperate."

At the same time, sources said, the firm was still open to merger possibilities, but in each case, the conversation quickly turned from a possible combination to a picking-off of the strongest remaining groups.

A Firm Closes

In late July, Fox Rothschild, a one-time potential merger partner, announced that it would be hiring a group of aviation lawyers from LeClairRyan. In the same week, Williams Mullen announced that it hired LeClair after bringing on several of his colleagues earlier this year.

Within the next few days, more partners learned what some had already guessed: that the firm was working toward dissolution.

A week after ALM reported on the firm's dissolution plans, LeClairRyan officially acknowledged in a release Aug. 7 that it would in fact be winding down, "in the best interests of our clients, colleagues and creditors."

In the days that followed, firms including Clark Hill, K&L Gates and Fox Rothschild continued to pick off groups.

The entity hasn't filed for bankruptcy proceedings, but certain liabilities are already the subject of litigation.

Sources pointed to several problems as reasons why partners left LeClairRyan, but they all agreed on one thing: no one factor alone led to the firm's demise.

As one former partner put it: "There's a million little scandals" to blame.

Jack Newsham and Christine Simmons contributed to this story.

Read More:

LeClairRyan Leaders Moved to Launch New Firm as Partners Left

Rivals Scoop Up LeClairRyan Lawyers as Clock Ticks on Dissolution, Insurance Coverage

LeClairRyan to Shut Down, Ending Three-Decade Run

LeClairRyan Takes Steps to Dissolve as Its Lawyers Seek New Homes

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trending Stories

- 15th Circuit Considers Challenge to Louisiana's Ten Commandments Law

- 2Crocs Accused of Padding Revenue With Channel-Stuffing HEYDUDE Shoes

- 3E-discovery Practitioners Are Racing to Adapt to Social Media’s Evolving Landscape

- 4The Law Firm Disrupted: For Office Policies, Big Law Has Its Ear to the Market, Not to Trump

- 5FTC Finalizes Child Online Privacy Rule Updates, But Ferguson Eyes Further Changes

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250