Partner Profits Hit $3M at King & Spalding After Decade of Growth

The firm hit new highs in revenue and profits per equity partner as it continued making high-profile hires from the Trump administration.

February 07, 2020 at 02:25 PM

8 minute read

Robert Hays, with King & Spalding in Atlanta. September 11, 2018. (Photo: John Disney/ALM)

Robert Hays, with King & Spalding in Atlanta. September 11, 2018. (Photo: John Disney/ALM)

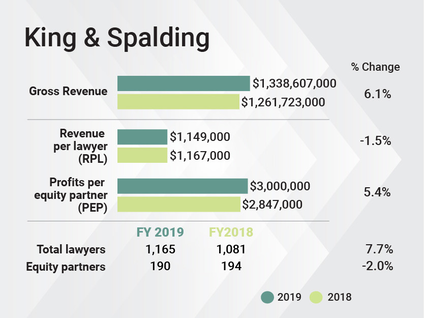

King & Spalding's profits per equity partner hit $3 million for the first time in 2019 as the firm boosted revenue 6.1% to $1.34 billion and net income increased 3.2% to $569.7 million.

Chairman Robert Hays said the real milestone was the firm's success in doubling its revenue and profits per equity partner over the past decade—a goal he said King & Spalding set in 2009 in the aftermath of the financial crisis.

"Last year marked the 10th year in a row—every year since the financial crisis—where we were able to grow both our top line and bottom line each year. Not many firms are able to say that," Hays said, adding that the firm ended the year with no debt.

In 2009, King & Spalding reported $677.3 million in revenue and PEP of $1.47 million. Like most large firms, however, it did not double its equity partner ranks in the intervening decade. It reported 190 equity partners for 2019, compared with 148 in 2009.

King & Spalding expanded its overall lawyer head count at the same rate last year as in 2018, but its partner ranks grew more sharply. Lawyer head count increased 7.7% to 1,165 lawyers, consistent with a 7.4% increase in lawyers the prior year. The net number of equity partners dipped slightly from 194 to 190, but the number of income partners expanded by 20.2% (44 partners) to 262, giving the firm a total of 452 partners.

King & Spalding expanded its overall lawyer head count at the same rate last year as in 2018, but its partner ranks grew more sharply. Lawyer head count increased 7.7% to 1,165 lawyers, consistent with a 7.4% increase in lawyers the prior year. The net number of equity partners dipped slightly from 194 to 190, but the number of income partners expanded by 20.2% (44 partners) to 262, giving the firm a total of 452 partners.

The $3 million in PEP represents a 5.4% increase from $2,847,000 in 2018, but the head count additions caused revenue per lawyer to dip 1.5% to $1,149,000.

The 2019 increases of 6.1% in revenue and 3.2% in net income were at a slower rate than for 2018, when King & Spalding posted increases of 10.8% in revenue and 9.3% in net income.

Hays acknowledged that double-digit growth in revenue and net income are more difficult to achieve as a firm gets larger, but he said King & Spalding does not discount for that. "It tends to take the ambition away a bit," he said. "We're unwilling to make more modest our targets."

"That can be kind of daunting, but I don't think it is for our people. They're excited about that challenge," he said.

The Work

Several billion-dollar deals and big litigation matters drove King & Spalding's revenue growth last year.

King & Spalding represented Total System Services, the country's largest payments processor, in its $21.5 billion merger with Global Payments. While TSYS, headquartered in Columbus, Georgia, is a longtime King & Spalding client, for mergers of that size companies traditionally choose Wall Street firms, so the engagement marked a further step toward the firm's goal of handling more blockbuster M&A deals. By contrast, Atlanta-based Global Payments chose Wachtell, Lipton, Rosen & Katz in New York as its legal adviser for the merger.

In other billion-dollar deals, King & Spalding advised Xerox on its $2.3 billion sale to Fujifilm of the last 25% of Xerox's holdings in a long-standing joint venture between the companies to sell printers and copiers, ending the alliance. As part of the deal, Fujifilm agreed to drop its $1 billion lawsuit against Xerox for backing out of a merger with it in 2018.

King & Spalding advised Americold Realty Trust in its $1.24 billion acquisition of Cloverleaf Cold Storage, a Blackstone portfolio company, and it advised a Japanese insurance holding company, T&D Holdings, in its joint purchase with Carlyle Group of a majority interest in Fortitude Group Holdings from AIG for $1.8 billion. It also advised Cortland Partners, a multifamily real estate investor and developer, in its $1.2 billion acquisition of Pure Multi-Family REIT.

One of the firm's largest litigation matters was its ongoing representation of Equifax in multidistrict litigation in the Northern District of Georgia over a massive 2017 data breach affecting more than 147 million consumers. The litigation, which included more than 400 cases, led to a $1.4 billion settlement agreement in December—the largest-ever for a data breach.

In another big data breach case, Capital One in August engaged King & Spalding to defend it in nearly 40 class actions brought over a breach announced in July. The suits allege Capital One failed to secure personal information, including Social Security numbers, for 100 million U.S. customers and six million in Canada.

The firm's tort and products liability defense team, one of its core practices, stayed busy defending Johnson & Johnson against claims that asbestos in J&J's talcum powder products caused mesothelioma and defending R.J. Reynolds Tobacco Co. in its ongoing Engle progeny litigation in Florida.

The Talent

The firm hired 41 lateral partners last year and promoted 21 lawyers to partner. Fourteen of the hires were in Washington, D.C., while New York and Atlanta each saw seven additions and the firm brought on 10 new partners outside the U.S.

King & Spalding opened new offices in Brussels and Northern Virginia last year, for a total of 22 offices. The firm hired Marie-Sophie Dibling, who headed the international trade law practice at Fidal, a French firm, to start its Brussels outpost in June, expanding King & Spalding's regulatory and investigations practice to the E.U. capital.

King & Spalding hired four corporate partners who serve defense contractor and technology clients from Morrison & Foerster in October to start a Northern Virginia office. The partners, Larry Yanowitch, Charles Katz, Tom Knox and Jeremy Schropp, who've practiced together for 15 years, advise their clients on M&A and tech outsourcing transactions. They are practicing out of King & Spalding's Washington office until the firm secures an office across the Potomac.

King & Spalding landed a number of high-profile government officials from the Trump administration, including Rod Rosenstein, the former deputy U.S. attorney general, who joined in January. The firm in 2018 had recruited another deputy U.S. attorney general from the Obama administration, Sally Yates.

Rosenstein's arrival followed the 2019 hires of national intelligence director Dan Coats and Stephen Vaughn, the general counsel for the U.S. Trade Representative. It also recruited Sumon Dantiki, who was the senior counselor to the FBI director, and associate deputy attorney general Alicia O'Brien.

Zack Harmon, a King & Spalding partner who'd become the chief of staff to FBI Director Chris Wray, returned to the firm, and Wray chose Paul Murphy, a longtime partner in the firm's special matters practice, to replace him. Wray headed King & Spalding's special matters and government investigations practice before taking the FBI's top job in 2017.

"We believe that Washington, as a jurisdiction, is a more important place than a decade ago," Hays said, explaining that, since the financial crisis, the federal government has increased its involvement in companies' activities, particularly with cybersecurity threats and the U.S. trade negotiations with China.

Atlanta

King & Spalding's addition of seven lateral partners to its Atlanta headquarters last year came after several years of focusing lateral partner investment on the firm's newer international offices and U.S. offices in California, Chicago and New York.

"It's been a big goal to grow in New York, which we did last year and the prior year more than in any other office," Hays said. "But we can walk and chew gum at the same time," he said of the renewed focus on Atlanta.

The most notable Atlanta hire was Pete Robinson, one of Georgia's top lobbyists, from Troutman Sanders, where Robinson headed that firm's lobbying arm. For its government matters practice King & Spalding recruited Aaron Lipson, who'd been the SEC's associate director of enforcement in Atlanta, and Matt Baughman, a former associate deputy attorney general at the DOJ.

For its tort litigation team King & Spalding added Doug Henderson from Troutman Sanders and Adam Spicer from Butler Snow. On the corporate side, the firm hired public finance partner Matt Nichols from Parker, Poe, Adams & Bernstein and M&A partner Erik Belenky from Jones Day.

In Atlanta, King & Spalding lost a high-profile debt-finance duo, partners Chris Molen and Chad Werner to McGuire Woods.

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

28 Firms Supporting Retired Barnes & Thornburg Litigator in Georgia Supreme Court Malpractice Case

7 minute read

Troutman Pepper Says Ex-Associate Who Alleged Racial Discrimination Lost Job Because of Failure to Improve

6 minute read

Law Firms Mentioned

Trending Stories

- 1Rejuvenation of a Sharp Employer Non-Compete Tool: Delaware Supreme Court Reinvigorates the Employee Choice Doctrine

- 2Mastering Litigation in New York’s Commercial Division Part V, Leave It to the Experts: Expert Discovery in the New York Commercial Division

- 3GOP-Led SEC Tightens Control Over Enforcement Investigations, Lawyers Say

- 4Transgender Care Fight Targets More Adults as Georgia, Other States Weigh Laws

- 5Roundup Special Master's Report Recommends Lead Counsel Get $0 in Common Benefit Fees

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250