Troutman Posts Revenue and Profit Growth as Merger With Pepper Hamilton Nears

"When you look across the firm, we are firing on all cylinders," said managing partner Stephen Lewis.

February 20, 2020 at 04:43 PM

6 minute read

Stephen Lewis of Troutman Sanders. (Photo: John Disney/ALM)

Stephen Lewis of Troutman Sanders. (Photo: John Disney/ALM)

Troutman Sanders wrapped up a healthy fiscal 2019, reporting significant increases in both revenue and net income, as the firm's impending merger with Pepper Hamilton, set to go live April 1, grabbed headlines.

"We feel very good about 2019," said Troutman's managing partner, Stephen Lewis, who attributed last year's revenue and profit growth to "focusing on our strengths."

"When you look across the firm, we are firing on all cylinders. All those things translate into numbers," he said.

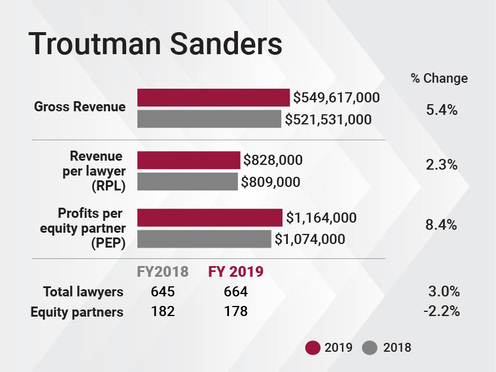

Troutman reported a 5.4% revenue increase to $549.6 million and a 6.2% jump in net income to $207.7 million for the year. Those numbers compared favorably with the Atlanta-based firm's 2.5% revenue growth and 3.3% net income growth in 2018.

Profits per equity partner jumped 8.4% to $1.164 million as the firm trimmed a net of four equity partners to reduce its total to 178. Troutman increased its nonequity partner ranks by 7.8% for a net of 110, giving it 288 total partners for the year.

Lewis said one factor in the higher rate of profit growth in 2019 was that its 2018 numbers were held back by expenses the firm incurred from closing its three China offices. "So 2018 was a little understated [financially], but in 2019 China was behind us," he said.

Troutman's profit margin reflected that, climbing 1 percentage point to 38%.

Taking into account a 3% increase in lawyer head count to 664, the revenue growth boosted revenue per lawyer by 2.3% to $828,000.

Lewis said the increased lawyer head count was in part due to "better leverage at the associate and staff attorney level. We did that in a very intentional fashion to help us serve our clients better and more efficiently."

That followed a 4% decline in head count in 2018, partly because of the closures in China, where Troutman had 90 employees, including 43 lawyers.

The Merger

Lewis, who has been Troutman's managing partner since 2011, said the firm employs a strategic plan "that we follow religiously" to chart its course over a three- to five-year period. The decisions to close the China offices, which handled Hong Kong securities and M&A work, and then engage in merger talks with Pepper Hamilton were aimed at building on the firm's strengths as outlined in the plan, he said.

"We serve middle-market clients across the board, and we have key practices serving the energy, banking and finance, and insurance industries where we have particular expertise, reputation and contacts," he said. "Those are the areas that we are really known for and good at."

The plan was part of what led Troutman to initially talk with Pepper Hamilton and eventually get the deal done, Lewis said. "From our side, the strong health care, life sciences and private equity practices at Pepper Hamilton were areas that we had said in our plan we wanted to grow," he said.

"We have the plan, we know what we want to be, and we are heading toward that," he added.

The tie-up with Pepper Hamilton, forming Troutman Pepper Hamilton Sanders, will transform Troutman, which now has about 700 lawyers, into a firm of more than 1,100 lawyers with combined revenue of about $900 million, based on the firms' 2019 revenue.

"Geographically it will be a true national firm," Lewis said. "We will have a much more robust presence in the Northeast and an increased presence on the West Coast and in the Midwest."

The combination will add strengths from Pepper in the aforementioned life sciences, health care and private equity areas, among others, and "some terrific practitioners in areas we are already strong in," Lewis said.

He said the cultural fit was also important. While the combined firm will be a changed entity as far as geography and practice areas, Lewis said, "at the individual level, our belief is it will be very much the same."

Pepper is "a firm with a great reputation that approaches the practice of law the same way that we do," he said. "We care about our clients. We take care of each other."

Right now, the two firms are busy working on integrating their systems, people, practices and offices, Lewis said. "It's a lot of work, but it's also fun," he said. "We see the opportunities to do great things together."

The Work

For the Pacific Gas & Electric Co. bankruptcy in California—one of the nation's largest to date—Troutman is representing renewable energy suppliers, including Consolidated Edison Development, and contractor Cupertino Electric.

The firm continued representing longtime client Georgia Power Co. in litigation over its Plant Vogtle nuclear reactor project, now billions of dollars over budget. In December, the Georgia Court of Appeals revived a challenge brought by three consumer watchdog groups against the Georgia Public Service Commission after it approved billions more in spending for the project, whose cost estimate has ballooned to $10.3 billion.

Troutman's multifamily housing practice continued to be busy in 2019. The firm served as lender's counsel for Berkadia Commercial Mortgage on an $867.9 million refinancing and a $688.3 million refinancing for two different property portfolios, among others. Overall, the firm handled more than 3,300 loans and serviced transactions for lenders worth more than $55 billion in loan value—up from $52 billion in 2018.

The Talent

Troutman added 15 lateral partners last year, tracking with its 2018 hiring rate, when it brought in 16. That included three New York partners from Dorsey & Whitney: corporate partner Steven Khadavi, who was formerly the managing partner for Dorsey's New York office; securities lawyer Genna Garver; and financing and restructuring lawyer Adam Jachimowski.

Troutman picked up a trio of Charlotte partners from K&L Gates—Jim Earle, Lynne Wakefield, and Emily Zimmer—who practice employee benefits and executive compensation law.

In Chicago, the firm added Misha Tseytlin, the former solicitor general for the Wisconsin Department of Justice, to head its appellate and Supreme Court practice, and Martha Conlin from London-based Kennedys CMK for its insurance and reinsurance practice.

Troutman's most notable departure was Pete Robinson, one of Georgia's most influential lobbyists. Robinson, who had headed the firm's Atlanta office and its lobbying arm, Troutman Sanders Strategies, decamped for King & Spalding at the beginning of 2019.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Sunbelt Law Firms Experienced More Moderate Growth Last Year, Alongside Some Job Cuts and Less Merger Interest

4 minute read

12-Partner Team 'Surprises' Atlanta Firm’s Leaders With Exit to Launch New Reed Smith Office

4 minute readLaw Firms Mentioned

Trending Stories

- 1Judge Denies Retrial Bid by Ex-U.S. Sen. Menendez Over Evidentiary Error

- 2Lawyers: Meet Your New Partner

- 3What Will It Mean in California if New Federal Anti-SLAPP Legislation Passes?

- 4Longtime AOC Director Glenn Grant to Step Down, Assignment Judge to Take Over

- 5Elon Musk’s Tesla Pay Case Stokes Chatter Between Lawyers and Clients

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250