Chancery Curbs Companies' Use of Business Judgment Rule to Thwart Books-and-Records Actions

Companies looking to avert books-and-records demands cannot rely on the Corwin doctrine to invoke the business judgment rule in order to stymie Section 220 actions, Delaware's Court of Chancery has ruled for the first time.

January 02, 2018 at 04:00 PM

4 minute read

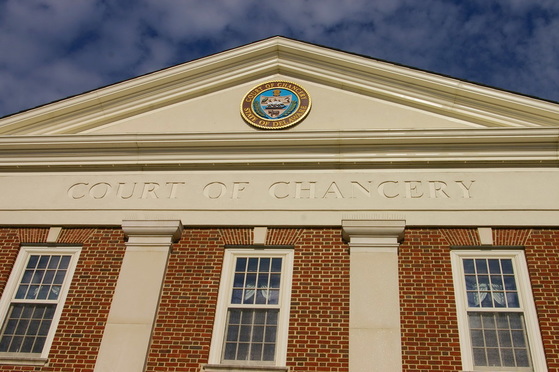

Delaware Court of Chancery.

Delaware Court of Chancery. Companies looking to avert books-and-records demands cannot rely on the Corwin doctrine to invoke the business judgment rule in order to stymie Section 220 actions, Delaware's Court of Chancery has ruled for the first time.

In a 38-page opinion, Vice Chancellor Joseph R. Slights III said the state Supreme Court's 2015 ruling in Corwin v. KKR Financial Holdings would not “stand as an impediment” for shareholders who have stated a proper purpose for accessing corporate documents.

“Simply stated, Corwin does not fit within the limited scope and purpose of a books-and-records action in this court,” he wrote in the Dec. 29, 2017, decision.

The ruling came as a win for Mark Lavin, an investor in telecommunications company West Corp., who sought to investigate board actions involving West's 2017 sale to Apollo Global Management.

In court documents, Lavin alleged that West's board had favored the $23.50-per-share cash sale of the entire company over a more valuable sale of West's individual business segments. The deal with Apollo, Lavin said, had allowed West's directors and senior management to reap personal benefits that, he said, would not have been available had the company gone the other route.

West's attorneys moved to dismiss the suit under Corwin, which invokes business-judgment protections when a majority of fully informed, disinterested and uncoerced shareholders approve a corporate transaction. Under that framework, they said, Lavin could only challenge the merger on the grounds of waste, which he had not stated as a basis for his demand.

Lavin, on the other hand, argued that applying Corwin in books-and-records litigation would distract from the fundamental question of whether there is a credible basis to suspect potential wrongdoing by a company's directors.

In his ruling, Slights said West's position would distort the purpose of books-and-records litigation and undermine Delaware law, which encourages stockholders to use the “tools at hand” to gather information before filing complaints that will be subject to heightened pleading standards.

“Any contrary finding would invite defendants improperly to draw the court into adjudicating merits defenses to potential underlying claims in order to defeat otherwise properly supported Section 220 demands,” he said.

“Equally compelling, the court should not (and will not here) prematurely adjudicate a Corwin defense when to do so might deprive a putative stockholder plaintiff of the ability to use Section 220 as a means to enhance the quality of his pleading in a circumstance where precise pleading, under our law, is at a premium.”

Slights did, however, limit the scope of production from the 13 categories Lavin initially sought to the five that most related to the purpose for his demand. Randall J. Baron, who represented Lavin, said he and his client would review the documents before deciding whether to file a class action.

“From our perspective, we are actually doing it the way the court wants us to do it,” by using book-and-records litigation to investigate allegations of corporate wrongdoing, said Baron a partner with Robbins Geller Rudman & Dowd.

An attorney for West declined to comment on Tuesday.

Lavin was represented by Baron, David T. Wissbroecker and Christopher H. Lyons of Robbins Geller; Peter B. Andrews, Craig J. Springer and David M. Sborz, of Andrews & Springer and W. Scott Holleman, of Johnson Fistel.

West was represented by Walter C. Carlson, Nilofer Umar and Elizabeth Y. Austin of Sidley Austin and Kevin R. Shannon, Christopher N. Kelly and Daniel M. Rusk of Potter Anderson & Corroon.

The case was captioned Lavin v. West.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

3 minute read

Etsy App Infringes on Storage, Retrieval Patents, New Suit Claims

Trending Stories

- 1New York State Authorizes Stand-Alone Business Interruption Insurance Policies

- 2Buyer Beware: Continuity of Coverage in Legal Malpractice Insurance

- 3‘Listen, Listen, Listen’: Some Practice Tips From Judges in the Oakland Federal Courthouse

- 4BCLP Joins Saudi Legal Market with Plans to Open Two Offices

- 5White & Case Crosses $4M in PEP, $3B in Revenue in 'Breakthrough Year'

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250