Proposed $785M TransPerfect Sale Attacked in Marathon Hearing

The details of Philip R. Shawe's $785 million deal to buy TransPerfect Global Inc. emerged in a Wilmington courtroom on Wednesday, as attorneys for his rival, Elizabeth Elting, argued for the unraveling of the sale.

January 17, 2018 at 05:55 PM

5 minute read

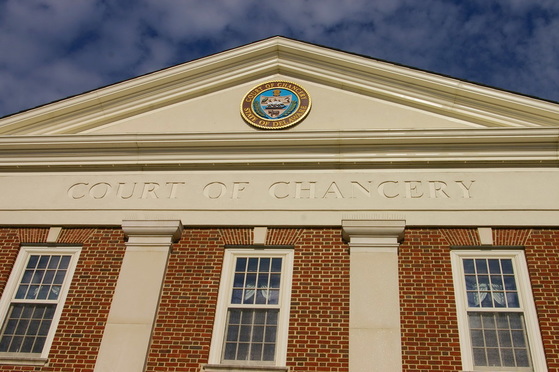

Delaware Court of Chancery.

Delaware Court of Chancery. The details of Philip R. Shawe's $785 million deal to buy TransPerfect Global Inc. emerged in a Wilmington courtroom on Wednesday, as attorneys for his rival, Elizabeth Elting, argued for the unraveling of the sale.

In a hearing that lasted more than four hours, it was revealed that Shawe beat out two other bidders in the fourth round of a court-ordered auction to maintain control of the company he and Elting started in 1992.

Shawe's final-round offer of $770 million, his attorneys said, was the highest offer on the table as bidding concluded on Nov. 15, 2017, prompting Robert B. Pincus, the court-appointed custodian of the company, to enter exclusive negotiations with Shawe in the three days that followed. Those talks produced an ultimate bid of $785 million, which Pincus accepted when he entered a securities purchase agreement on Nov. 19.

But attorneys for Elting argued that by that point Pincus' impartiality had been compromised by an unrelenting public campaign to discredit the custodian and undermine the sale process as whole. For more than an hour and a half, they told Delaware Court of Chancery Chancellor Andre G. Bouchard that Pincus was facing intense pressure to wrap up the modified auction and likewise extinguish lawsuits, filed by Shawe, that targeted him personally.

It was that conflict of interest, they said, that led Pincus on Nov. 19 to enter the agreement with Shawe and to rebuff a later attempt by private equity firm H.I.G. Capital to increase its offer to purchase TransPerfect from $750 million to about $900 million.

Bouchard, Elting's attorneys said, should invalidate the deal and force Pincus to negotiate directly with H.I.G. in order to meet the custodian's goal of maximizing value for the company.

However, they faced a tough line of questioning early from Bouchard that seemed to subside later in the hearing, which started around 10 a.m. Under the terms of a 2016 ruling granting Elting's request to sell TransPerfect, Bouchard must sign off on the sale agreement. That ruling would then be subject to appeal before the Delaware Supreme Court.

Philip S. Kaufman, a Kramer Levin Naftalis & Frankel partner representing Elting, acknowledged during the arguments that Bouchard appeared skeptical of Elting's position, but he pressed ahead with claims that Shawe's intentional misconduct during the sale process had scared away some bidders and depressed offers from others.

He also said that Pincus, a partner with Skadden, Arps, Slate, Meagher & Flom, had made critical and “fundamental” accounting errors surrounding tax liability, which undervalued H.I.G.'s bid and swung Pincus' decision in favor of Shawe.

Pincus' attorney, fellow Skadden partner Jennifer C. Voss, stood by Pincus' analysis and said she could respond to Elting's tax argument in writing within five business days.

Voss defended the agreement, saying that any challenge would have to meet the high bar of showing that Pincus had abused his discretion in striking the deal with Shawe. Pincus, she said, had not taken Shawe's litigation seriously and was not compromised by Shawe's public attacks.

She also noted that, under the agreement, Elting would receive approximately $300 million for her half of the company.

Meanwhile, Kaufman and his Potter Anderson & Corroon co-counsel Kevin R. Shannon, said that, even without the tax errors, Pincus failed to secure a better deal with H.I.G. that would have also kept TransPerfect's 4,000-employee workforce intact and maintained the company as a going concern.

According to Kaufman, H.I.G. planned to use its $900 million bid to buy TransPerfect and then enter into a merger with Lionbridge, a rival translation-services company, which H.I.G. also owns. H.I.G., he said, valued TransPerfect's business more than it did Lionbridge's and had committed to expanding its workforce.

Kaufman said there was also an informal agreement in place to make Elting president of the combined company, with an equity stake in the new firm. Negotiations between Pincus and H.I.G., he said, could be completed in a “matter of days.”

Meanwhile, Kaufman said, a third bidder had reduced its initial bid of between $900 and $950 million to $725 million in the third round, specifically citing the serious threats associated with Shawe's behavior.

“Locking up a deal with Shawe was an additional abuse of discretion, and an egregious one as well,” he said.

Voss, however, said that Shawe's offer, the highest at the end of bidding, maintained the status quo and avoided post-merger shake-ups that could have hurt TransPerfect's workers. As for Shawe's alleged misconduct, she said Elting could have moved for sanctions during the sale process, but opted instead to levy her allegations after the sale agreement was entered.

“She waited until after the recommendation was made, and filed it simultaneously with her objections,” Voss said, saying a “feeling of laches” attached to the strategy.

Bouchard wrapped up the hearing around 2:15 p.m., saying that he needed “a little time.”

“I'll deal with it as promptly as I can,” he said, saying there were other court matters that he had to attend to.

It was not clear when Bouchard would return a ruling on Pincus' recommendation.

Shawe, who was not in court on Wednesday, said Elting was “not a buyer” in the sale process and had been “dishonest” about her relationship with the bidders.

The case is captioned Shawe v. Elting.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

3rd Circ Orders SEC to Explain ‘How and When the Federal Securities Laws Apply to Digital Assets’

5 minute readTrending Stories

- 15th Circuit Considers Challenge to Louisiana's Ten Commandments Law

- 2Crocs Accused of Padding Revenue With Channel-Stuffing HEYDUDE Shoes

- 3E-discovery Practitioners Are Racing to Adapt to Social Media’s Evolving Landscape

- 4The Law Firm Disrupted: For Office Policies, Big Law Has Its Ear to the Market, Not to Trump

- 5FTC Finalizes Child Online Privacy Rule Updates, But Ferguson Eyes Further Changes

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250