Koch Can't Block Forced Sale of His Energy Company, Laster Rules

The Delaware Court of Chancery on Monday ruled that billionaire William I. Koch could not block a private equity firm from forcing the sale of his Oxbow Carbon energy company, finding gaps in the LLC agreement were being used to scuttle members' attempts to force an exit sale.

February 13, 2018 at 06:50 PM

5 minute read

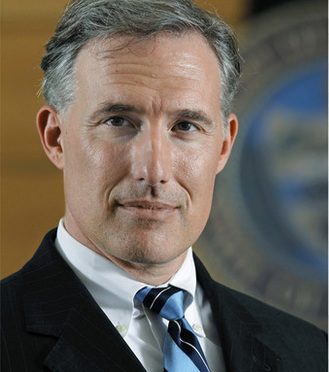

J. Travis Laster.

J. Travis Laster. The Delaware Court of Chancery on Monday ruled that billionaire William I. Koch could not block a private equity firm from forcing the sale of his Oxbow Carbon energy company, finding gaps in the LLC agreement were being used to scuttle members' attempts to force an exit sale.

In a 178-page post-trial opinion, Vice Chancellor J. Travis Laster said that the implied covenant of good faith and fair dealing allowed Crestview Partners and Load Line Capital to pursue the full-company sale the firms had bargained for when they invested in Oxbow back in 2007.

Laster also rejected Koch's claims that Crestview officials had conspired with Oxbow to oust Koch from the energy company in 2016 in order to force a quick sale. Rather, Laster said, it was Koch who did not follow proper formalities after attracting the investments and later failed to meet his contractual duties to use reasonable efforts to support the sale.

“It would be inequitable for the majority member to benefit now from Oxbow's failure to follow proper formalities then,” Laster wrote

Laster ordered the parties to submit briefs on how to handle the exit sale, dangling the possibility that he might appoint a receiver to oversee the process.

The ruling was the latest development in a bitter two-year fight over the future of Oxbow, one of the world's largest producers of petroleum coke, a valuable by-product of the oil refining process that is used in aluminum production.

In court filings, Koch, the brother of businessmen and conservative political activists Charles and David Koch, said Crestview had made bad faith efforts to sell its minority stake and hurry the company into an exit sale, including planting a “mole” on the Oxbow board to spy on him and to pressure him to resign.

Crestview has countered, accusing Koch of mismanagement and boardroom paranoia.

But the underlying dispute centered on whether the planned exit sale satisfied various terms of Oxbow's LLC agreement, which outlines the conditions for off-loading all of the company's equity securities or assets but intentionally left open the terms on which Oxbow would admit new members.

Oxbow and its board neglected to fill those gaps in 2011 and 2012, when a group of small investors became members in the company.

In 2016, Koch looked to capitalize by relying on a complex set of interlocking contractual provisions to effectively block the sale. But Laster said Koch's position would produce an “extreme and unforeseen” result that would have prevented Crestview from invoking its right to sell the company, which it had negotiated 11 years ago.

“Issues of compelling fairness call for deploying the implied covenant to fill the gap created when the company admitted the small holders,” Laster said. “Without it, the fortuitous admission of the small holders guts the exit sale right and enables the majority member to defeat a commitment he made in 2007 and otherwise would have to fulfill.”

Further, Laster found that Koch had set out to “obstruct, derail and delay” the sale by firing a key executive and then filing his Chancery Court lawsuit. Koch's allegations of conspiracy, he said, were not enough to overcome Crestview's legitimate request to sell Oxbow, and Crestview's officials were “not guilty of unclean hands such that they should be deprived of their right to an exit sale.”

Load Line was not implicated in any wrongdoing, and there was no basis to deny the firm its ability to pursue the sale, he said.

Laster stopped short of offering a final resolution to the dispute, but he did note that the fierce nature of the litigation may warrant the appointment of a receiver to handle the exit sale.

The parties were directed to submit supplemental briefing on a remedy, as well as a joint letter identifying any issues that need to be resolved before completing trial phase.

An attorney from Quinn Emanuel Urquhart & Sullivan, which represented Crestview, said the firm was “pleased” with the ruling. Attorneys for the other parties were not immediately available Monday to comment.

Oxbow is represented by Kenneth J. Nachbar, Thomas W. Briggs Jr. and Richard Li of Morris, Nichols, Arsht & Tunnell and Michael S. Gardener, Breton Leone-Quick and R. Robert Popeo of Mintz, Levin, Cohn, Ferris, Glovsky. Koch is represented by Stephen C. Norman, Jaclyn C. Levy and Daniyal M. Iqbal of Potter Anderson & Corroon and David Hennes and C. Thomas Brown of Ropes & Gray.

Crestview is represented by Kevin G. Abrams, Michael A. Barlow, J. Peter Shindel Jr., Daniel R. Ciarrocki and April M. Ferraro of Abrams & Bayliss; Brock E. Czeschin, Matthew D. Perri and Sarah A. Galetta of Richards, Layton & Finger; and Michael B. Carlinsky, Jennifer J. Barrett, Chad Johnson, Sylvia Simson, Silpa Maruri of Quinn Emanuel.

Load Line is represented by Dale C. Christensen Jr. and Michael B. Weitman of Seward & Kissel and J. Clayton Athey and John G. Day of Prickett, Jones & Elliott.

The case is captioned In re Oxbow Carbon Unitholder Litigation.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Chancery Court Exercises Discretion in Setting Bond in a Case Involving Share Transfer Restriction

6 minute read

SEC Calls Terraform's Dentons Retainer 'Opaque Slush Fund' in Bankruptcy Court

3 minute readTrending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250