Shifting Appraisal Landscape Sets Up New Developments for 2019

The Delaware Court of Chancery in 2018 sought to provide new guidance in appraisal litigation after two landmark rulings from the state's high court set a clear preference for deal price in determining fair value in corporate mergers.

December 28, 2018 at 12:09 PM

4 minute read

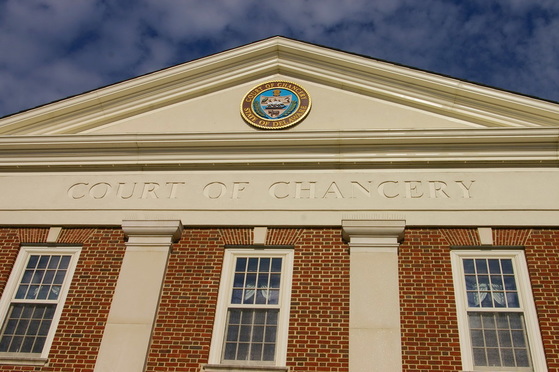

Delaware Court of Chancery.

Delaware Court of Chancery.

The Delaware Court of Chancery in 2018 sought to provide new guidance in appraisal litigation after two landmark rulings from the state's high court set a clear preference for deal price in determining fair value in corporate mergers.

The new developments followed major rulings last year from the Supreme Court in the Dell and DFC appraisal actions, which said merger price is the best metric for finding fair value when there is a “robust” sale process conducted in a well-functioning market for the target company's stock.

The rulings were widely seen as an unprecedented shift in the way Delaware handles what had become a vexing issue for the state's dockets. While Dell and DFC sent a clear message to litigators, it will be up to the courts to determine in 2019 what makes a transaction Dell compliant.

Both decisions, and some that have followed, have exposed a divide in Delaware's legal community and generated criticism among attorneys for appraisal seekers, who argue that the result could effectively strip dissident investors of a statutory remedy available under state law.

Attorneys for the companies counter that the rulings were needed to stem the rising tide of appraisal arbitrage, where firms would buy up large amounts of companies' stock on news that a sale was imminent in order to exercise appraisal rights under the Delaware General Corporation Law.

The next major shift in the appraisal landscape is likely to come from the Supreme Court in a hotly contested appeal from appraisal seekers who had withheld their support from Hewlett-Packard Co.'s 2015 deal to buy Silicon Valley wireless networking company Aruba Networks Inc.

Vice Chancellor J. Travis Laster in January dealt a striking blow to petitioners in the case, finding that the merger's $24.67-per-share deal price far exceeded Aruba's true value at the time. Laster later said that Dell and DFC had “changed things,” and that ruling was his best effort to grapple with Supreme Court precedent “altering the decisional landscape and authorizing greater reliance on market value.”

“I reasoned through the issues as best I could and reached what I believe is the correct determination of fair value for purposes of this case. At this point, the proper institutional remedy for correcting any errors lies with the senior tribunal on appeal,” Laster said in a May ruling denying motions for reargument on both sides.

The appeal, which is set to be argued in early 2019, is expected to parse out what exactly qualifies as a “robust” sales process. In DFC, Supreme Court Chief Justice Leo E. Strine indicated that a conflict-free and arms-length sale that featured a market search assessing both potential financial and strategic buyers would meet the mark.

However, the high court has since declined to set a clear rule governing appraisal cases.

Some scholars, like Lawrence Hamermesh of Widener University Delaware Law School, have argued for the use of the same tests developed in Revlon cases for determining whether a transaction would survive enhanced scrutiny. But absent further direction from the justices, attorneys and judges were left to sort through thorny issues as best they could in the trial court.

“I'm guessing this case [Aruba] will plumb that department a little more fully,” Hamermesh said.

While Aruba could produce a sweeping statement from the Supreme Court, other issues in 2019 could be addressed incrementally. Particularly, attorneys and observers will look to see how the Chancery Court fleshes out deal synergies and their impact on a company's fair value.

Chancellor Andre G. Bouchard, in the case In re Appraisal of Solera Holdings Consolidation, ruled that financial buyers, and not just strategic purchasers, could benefit from synergies, though it remains unclear how the court will measure synergistic value. In Solera, Bouchard did, however, did embrace empiracle industry studies to help answer the question.

Writing for Delaware Business Court Insider in November, Morris James partner P. Clarkson Collins Jr. said it would ultimately be up to the Supreme Court to resolve ”whether and how much” of a deal premium needs to be deducted from the merger price to determine appraisal fair value.

However, he said, one thing is clear at the moment: “Where the merger price was once thought to serve as a floor in an appraisal contest, it is now clear that it serves as a ceiling when the Dell market and process conditions have been established.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Del. Supreme Court Unanimously Grants Another Shareholder Win Over Pre-Vote Disclosure

4 minute read

Trump, Truth Social Attorneys Expect 'Solid' Chance at Shareholder Case Dismissal

3 minute readTrending Stories

- 1Carol-Lisa Phillips to Rise to Broward Chief Judge as Jack Tuter Weighs Next Move

- 2Data Breaches in UK Legal Sector Surge, According to ICO Data

- 3Georgia Law Schools Seeing 24% More Applicants This Year

- 4After Shutting USAID, Trump Eyes Department of Education, CFPB

- 5‘Keep Men Out’: Female Swimmers Sue Ivy Leagues Over Lia Thomas’ Sweep

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250