Chancery Court Blocks Direct Appeal of Directors' Liability for Insider Trading in Fitbit IPO

In a 12-page order, Vice Chancellor Joseph R. Slights III stood by his Dec. 14 opinion, which found that two of Fitbit's outside directors could potentially face liability for suspicious stock sales made by venture capital funds under their control.

January 14, 2019 at 03:39 PM

4 minute read

Photo: A. Aleksandravicius/Shutterstock.com

Photo: A. Aleksandravicius/Shutterstock.com

A Delaware Chancery Court judge Monday blocked a fast-track appeal of his decision last month to green light derivative claims for insider trading by the directors of Fitbit, stemming from the technology company's initial public offering in 2015.

In a 12-page order, Vice Chancellor Joseph R. Slights III stood by his Dec. 14 opinion, which found that two of Fitbit's outside directors could potentially face liability for suspicious stock sales made by venture capital funds under their control. According to the lawsuit, the transactions came after the board learned of possibly catastrophic problems with Fitbit's leading products, which accounted for about 80 percent of the company's revenue.

Slights' finding paved the way for a ruling that a majority of the board likely stood to personally benefit from allegedly improper stock sales ahead of the IPO and helped the plaintiffs to avoid early dismissal of their claims. At the time, Slights acknowledged that “no Delaware court” has considered whether to impose liability under the 1949 case Brophy v. Cities Service on directors for trades they didn't personally make, and he declined to craft a “hard and fast” rule.

The Fitbit directors argued in a Dec. 24 petition for interlocutory appeal that the opinion departed from a consistent line of Delaware cases and raised a novel issue of law. The maneuver, rarely granted in Delaware, would have sent the case directly to the state Supreme Court for review.

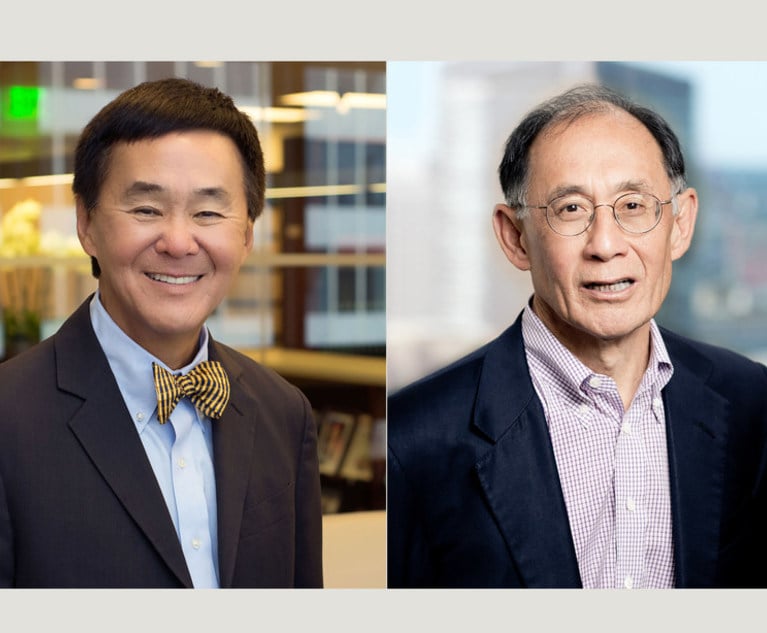

According to defense counsel from Morrison & Foerster and Young Conaway Stargatt & Taylor, Brophy claims must be premised on breaches by a fiduciary that worked “to his own profit.” But the trades in question, the lawyers said, were carried out by investment funds that were merely affiliated with Jonathan Callaghan and Steven Murray—and not the directors themselves. Nowhere in the complaint, they said, had the plaintiffs alleged that Callaghan and Murray had received any personal benefits.

“Holding that two directors who did not personally execute any trades are exposed to Brophy liability unsettles the bedrock corporate law principle that a corporation and its owners and directors are separate actors,” attorneys said in the brief.

Last week, lawyers representing the Fitbit investors argued that their clients were entitled at the pleading stage to an inference that Callaghan and Murray had profited from trades made by funds under their control and pointed to multiple allegations in the complaint that Callaghan and Murray had acted with the key element of scienter, or knowledge of their supposed wrongdoing.

On Monday, Slights said that the allegations would need to be fleshed out more in discovery. However, he stood behind the basic principle underlying his decision.

“I am satisfied that it is not particularly novel or controversial as a matter of Delaware law to declare that a fiduciary may not share inside information with a fund he controls so that the fund, in turn, can trade on that inside information as a means to avoid Brophy liability,” he wrote. “Surely defendants are not sponsoring this kind of end-run around insider trading liability.”

Slights also noted that he had gone “out of my way” in the original opinion to explain that he was not making a final determination on the merits of the case, but only providing the plaintiffs with the “liberal pleading stage inferences to which they are entitled.”

“The opinion does not decide a substantial issue of material importance that merits appellate review before a final judgment,” he said. “Specifically, it does not conflict with existing jurisprudence or involve a substantial issue of first impression. Although review of the appeal could terminate the litigation, this alone is insufficient to warrant certification of the appeal.”

Peter D. Andrews, a partner with Andrews & Springer who represented the plaintiffs, declined Monday to comment on the ruling, citing the pending nature of the case. An attorney for the directors did not immediately respond to a call requesting comment.

The plaintiffs are represented by Andrews & Springer in Wilmington, Kahn Swick & Foti in New Orleans, Schubert Jonckheer & Kolbe in San Francisco and Shapiro Haber & Urmy in Boston. The Wilmington firm Rosenthal, Monhait and Goddess is also acting as Delaware counsel in the case.

The Fitbit directors are represented by Morrison & Foerster in San Francisco and Young Conaway in Wilmington.

The case is captioned In re Fitbit Stockholder Derivative Litigation.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

3 minute read

Amazon Faces Similar Patent Suit Over Alexa, Echo Technology After $46.7M Jury Verdict Against It

3 minute read

Antitrust Lawsuit Alleges Scheme to Block Digital-Wallet Competitors, Monopolize Cash Access at US Casinos

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250