Investment Firm Says $25M AOL Appraisal Suit Belongs in Delaware

The suit, filed by Verition Partners Master Fund, accuses Chicago-based litigation services firm Coherent Economics of failing to disclose disparaging remarks that expert witness W. Bradford Cornell made about the firm's appraisal claims in a suit over the fair value of AOL Inc. after it was acquired by telecommunications giant Verizon in a $4.4 billion deal in June 2015.

March 14, 2019 at 04:17 PM

4 minute read

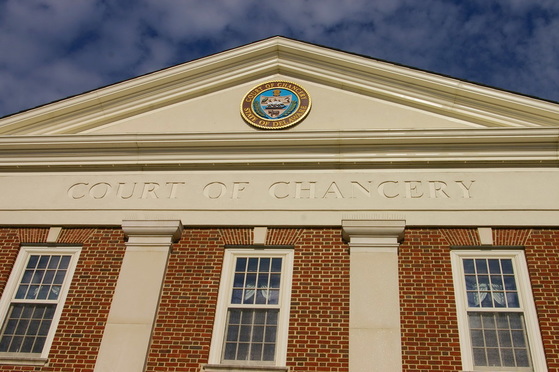

Delaware Court of Chancery.

Delaware Court of Chancery.

A Connecticut investment management firm is fighting to keep its $25 million fraud and breach-of-contract suit stemming from a high-profile Chancery Court appraisal case in Delaware, arguing that a proposed move to Illinois federal court would improperly deprive the firm of its chosen venue for litigation.

The suit, filed by Verition Partners Master Fund, accuses Chicago-based litigation services firm Coherent Economics of failing to disclose disparaging remarks that expert witness W. Bradford Cornell made about the firm's appraisal claims in a suit over the fair value of AOL Inc. after it was acquired by telecommunications giant Verizon in a $4.4 billion deal in June 2015.

According to court documents, Cornell had initially called the appraisal-seekers' appraisal case “shitty” in pretrial emails as he positioned himself to serve as Verizon's expert witness, but later flipped to the petitioner's side to settle a personal “grudge” when Verizon decided to hire a different expert to testify on its behalf.

In its complaint, Verition said the allegedly undisclosed comments were a “ticking time bomb” that eventually exploded at trial when company attorneys used them to attack Cornell's credibility on cross-examination. Verition claimed that the ordeal torpedoed its case and led Vice Chancellor Sam Glasscock III to value its AOL shares at $48.70, well below the $68.98 mark that Verition had argued for.

In a further blow to appraisal-seekers, Glasscock eventually scaled back the valuation to $47.08 last August, following post-trial briefing in the case.

Verition's suit, filed in Delaware federal court, sought $25.2 million in damages, plus $5.5 million in interest, that Verition said it would have received had Glasscock accepted its much higher valuation.

Cornell, Bradford and co-defendant San Marino Business Partners LLC moved last month to transfer the case to a federal court in Chicago, citing two lawsuits that claimed Verition had waived its claims as part of a settlement between Coherent and Verition's Grant & Eisenhofer attorneys in the appraisal case.

The defendants argued in a court filing that the venue change was warranted under Delaware's “first-filed rule,” which generally allows for cases to be transferred when related cases are already pending in a separate jurisdiction.

“In the prior-filed consolidated Illinois actions, defendants seek a declaratory judgment that the exact same claims asserted by Verition in the Delaware action were released and settled and confirmed in a written document,” defense attorneys from SFNR wrote in a Feb. 27 brief.

“As such, all of the claims and matters raised in the Delaware action can be resolved in a single proceeding in the Northern District of Illinois,” they said.

On Wednesday, Verition responded by calling the Illinois suits “anticipatory filings” meant to improperly “deprive Verition of its intended forum” in Delaware. The firm said that it had explicitly warned the defendants before they filed the Illinois cases that it was planning to file suit in Delaware over Cornell's “undisclosed bias and grudge.”

“From this correspondence, defendants knew that an action against them under Delaware law would be forthcoming. In these circumstances, the court should decline to apply the first-filed rule in favor of the anticipatory actions and instead maintain this case in Delaware, where it was intended,” Verition's Schlam Stone & Dolan attorneys wrote.

The attorneys also argued that “the critical facts underpinning” Verition's case had all occurred in Delaware, and only one of the five parties to the suit resided in Chicago.

Verition is represented by Erik S. Groothuis and Vera M. Kachnowski of Schlam Stone in New York and David A. Jenkins of Smith, Katzenstein & Jenkins in Wilmington.

The defendants are represented by Norman T. Finkel, Richard M. Goldwasser, William R. Klein and Matthew P. Tyrrell of SFNR and Peter M. Spingola, Robert J. Shapiro and John M. Owen of Chapman Spingola in Chicago. Shaun Michael Kelly and Ryan Patrick Newell of Connolly Gallagher and Alexandra Rogin of Eckert Seamans Cherin & Mellott are acting as local counsel.

The case, which has been assigned to U.S. District Judge Colm F. Connolly, is captioned Verition Partners Master Fund v. Cornell.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

3 minute read

Etsy App Infringes on Storage, Retrieval Patents, New Suit Claims

Law Firm Sued for $35 Million Over Alleged Role in Acquisition Deal Collapse

3 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250