Group Urges Congressional Support for National Database for Secretive LLCs

A government transparency group has urged Delaware's congressional delegation to introduce legislation to create a national database of beneficial owners of corporations and limited liability companies.

March 19, 2019 at 05:03 PM

5 minute read

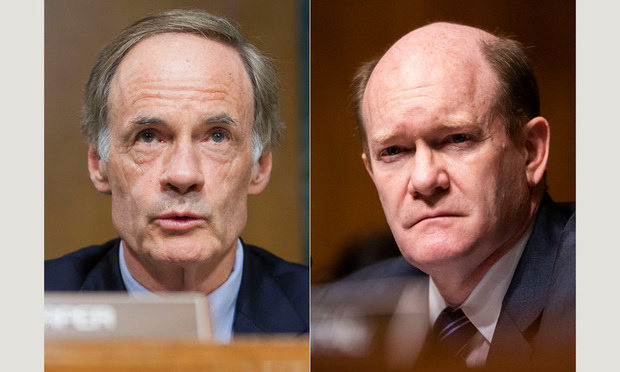

From left, U.S. Sens. Tom Carper and Chris Coons. Photos: Diego Radzinschi/ALM

From left, U.S. Sens. Tom Carper and Chris Coons. Photos: Diego Radzinschi/ALM

A government transparency group has urged Delaware's congressional delegation to introduce legislation to create a national database of beneficial owners of corporations and limited liability companies.

Delaware Coalition for Open Government said Tuesday that it had contacted U.S. Sen. Tom Carper, D-Delaware; U.S. Sen. Chris Coons, D-Delaware; and U.S. Rep. Lisa Blunt Rochester, D-Delaware, last week asking them to sponsor a bill aimed at helping law enforcement fight criminal activity associated with LLCs, after a series of high-profile cases involving the secretive entities came to light in recent years.

DelCOG said federal legislation was needed to disclose the identities of beneficial owners, who are not required in most states to provide names, telephone numbers and addresses when registering to do business.

“The secrecy of both domestic and foreign beneficial ownership, which results as a consequence of this gaping loophole in corporate statutes, enables bad actors to commit crimes, hinders law-enforcement investigations, and impedes accountability for illegal actions,” the group said in a statement.

“The problem must be addressed through federal legislation. Delaware's congressional delegation must act to maintain Delaware's preeminence as the gold standard of corporate law.”

Nick Wasileski, DelCOG's president, said he contacted the Wilmington offices of Coons, Carper and Blunt Rochester on March 11, but has not yet received a response.

On Tuesday, the delegation said in a statement that a “common sense, national framework would strengthen our ability” to fight financial crimes, but stopped short of saying whether they would sponsor such a measure.

“We continue to support federal efforts to prevent shell corporations from being used for nefarious purposes, such as financing terrorism or facilitating money laundering,” the delegation said.

DelCOG's request, however, highlighted an ongoing debate in Delaware about proper oversight of alternative entities, which are registered through the Department of State's Division of Corporations.

DelCOG has argued for greater transparency of LLCs, since the release of the Panama Papers in 2016 revealed how the wealthy secretly store assets in offshore shell companies.

LLCs have also been linked to separate schemes by Jack Abramoff, a disgraced lobbyist, and Russian arms dealer Viktor Bout, to launder money, and Michael Cohen, President Donald Trump's former personal attorney and “fixer,” created a Delaware LLC in October 2016 to make a hush-money payment to Stephanie Clifford, an adult-film actress who said she had engaged in a sexual relationship with Trump.

Last year, former Delaware Attorney General Matt Denn petitioned the Court of Chancery to shut down four Delaware limited liability companies linked to classified advertising website Backpage.com, saying the entities had been used to operate a sex trafficking conspiracy.

DelCOG argues that Delaware's lenient formation system enables criminal conduct among a small population of the more than 974,000 active LLCs in the state, and hampers efforts by law enforcement to weed out bad actors.

In 2017, the group partnered with state Rep. John A. Kowalko Jr., D-Newark South, to introduce a bill in the General Assembly that would have forced registered agents to screen for bad actors and required LLCs to detail the specific nature of their business if they plan to invest in industries “vulnerable to internal sabotage.”

The bill, however, encountered staunch opposition from many in Delaware's legal community, as well as Secretary of State Jeffrey W. Bullock and was eventually tabled in committee.

Opponents of that measure instead argued that changes should be made at the federal level, in order to preserve the enabling framework that makes Delaware the preferred state for business formation.

Last year, Bullock and Denn signed letters to the U.S. House Committee on Financial Services supporting the creation of the kind of national database that DelCOG is proposing.

A spokesman for Bullock said his position had not changed, but both Bullock and Denn declined to comment any further Tuesday. A spokesman for current Attorney General Kathy Jennings said she “shares the position” Denn and Bullock took last year.

Under the proposal, law enforcement would be able to access the information of beneficial owners through the U.S. Treasury Department's Financial Crimes Enforcement Network, which collects data for use in investigations into financial crimes.

Wasileski said that he believed he and Bullock were now “definitely on the same side of the table” when it comes to policing LLCs.

“I think the letter was pretty significant,” he said.

Wasileski said he reached out to Jennings and leadership from state Senate and House of Representatives regarding the proposal, but has yet to receive a response. A federal bill, he said, would protect Delaware's reputation and avoid the problems associated with the ill-stated state bill, which was seen as putting Delaware at a competitive disadvantage to other states.

“Federal legislation would put everybody on a level playing field,” Wasileski said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

3 minute read

What Went Wrong With Adeel Mangi's Long, Strange Trip Through the Judicial Nomination Process?

6 minute read

Democrats Give Up Circuit Court Picks for Trial Judges in Reported Deal With GOP

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250