Del. Supreme Court Urged to Look Past Deal Price in Hewlett-Packard's Acquisition of Wireless Network

The closely watched appraisal appeal, argued before the state's five justices in Dover, has magnified a deep divide in Delaware's legal community and is expected to provide guidance on the role that a firm's unaffected market price plays in appraisal cases.

March 27, 2019 at 05:02 PM

5 minute read

An attorney for Aruba Networks urged the Delaware Supreme Court on Wednesday to uphold a Chancery Court decision that looked to the company's stock price to determine fair value in a $3 billion sale to Hewlett-Packard Co. in 2015.

The closely watched appraisal appeal, argued before the state's five justices in Dover, has magnified a deep divide in Delaware's legal community and is expected to provide guidance on the role that a firm's unaffected market price plays in appraisal cases.

Last February, Vice Chancellor J. Travis Laster ruled that Aruba's $17.13 share price was the best indicator of the Silicon Valley wireless networking company's fair value, handing a stinging loss to appraisal seekers Verition Partners Master Fund and its Grant & Eisenhofer attorneys. The ruling followed a pair of Supreme Court rulings, in cases known as Dell and DCF, which indicated a strong preference for deal price as the indicator of fair value in third-party, arm's-length deals.

Laster's ruling, however, was the first to find share price, and not deal price, as the most reliable marker of fair value.

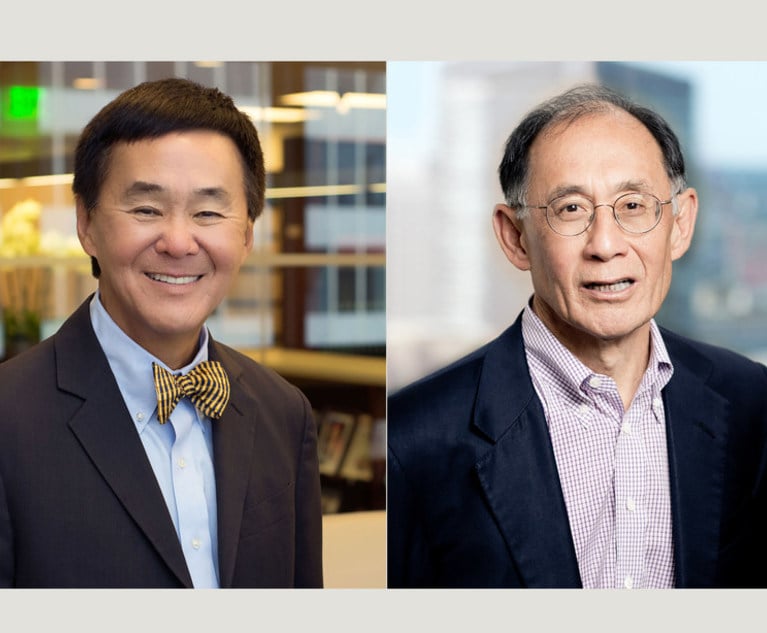

On Wednesday, Aruba attorney Michael P. Kelly said Laster went to “great pains” to reconcile the case with Dell and DFC, saying the ruling was a result of an “orderly and deductive” process that included three rounds of post-trial briefing.

“I submit that it was exemplary,” he said of Laster's 129-page memorandum opinion.

Kelly argued that Dell and DFC had endorsed using Aruba's market price because the firm's stock was traded in an efficient market, and he rejected Verition's argument that its discounted cash flow, or DCF, valuation at $32.57 per share best represented Aruba's value at the time of the sale.

Kelly, who called Aruba's analysis “stratospheric,” said Laster was forced to throw out the parties' DCF valuations as unreliable and next looked to the “market price minus synergies.” Both sides, he said, were unable to calculate synergies and Laster himself was reluctant to conduct his own calculation, leading him to settle on Aruba's market price.

“Maybe it wasn't the best price, but it was a fair price,” Kelly said. “This deal was not exploitative.”

Grant & Eisenhofer partner Christine M. Mackintosh, who argued on behalf of Verition, blasted many of Kelly's assessments as “simply not true.”

“I feel like we're watching two different shows,” she said.

Mackintosh argued that the deal process was riddled with flaws and conflicts and that HP had altered its bidding strategy in the lack of any significant competition, even though it had indicated it was willing to pay more than it did to acquire Aruba.

Laster, she said, had misinterpreted Dell and DCF by “automatically” equating Aruba's stock price with the company's fair value. Under the two Supreme Court rulings, the proponent of unaffected stock price is required to prove that the market is in fact efficient, all relevant information to determine fair value is available to the market and that the stock price reflects fair value at the date of the merger's closing.

“Aruba proves none of these things,” Mackintosh said.

Complicating the case, trial in Aruba was held before the Supreme Court published its rulings in Dell and DFC, leading Laster to request supplemental briefing on the cases' impact, as well as the market attributes of Aruba's stock compared to those of DFC and Dell.

Kelly said Verition had the opportunity to submit more evidence or call for another trial on market efficiency but declined.

“They swung for the fences. They went all-in, could have engaged and they didn't,” he said.

Oral argument in the appeal lasted just under an hour, with none of the justices interjecting to question the parties' lawyers. The lack of engagement from the court, however, belied the fraught nature of the case, and the fissure between counsel for appraisal petitioners and companies that had been subject to the suits in growing numbers.

Stuart M. Grant, who represents the Aruba petitioners before his retirement last year, had blasted Laster's decision as “ridiculous” and “absurd,” even suggesting in a motion for reargument that the judge did not believe in the legal theory he applied in the case.

Laster responded in an extensively footnoted opinion that Dell and DFC had “changed things,” saying that that his ruling was his best effort to grapple with Supreme Court precedent “altering the decisional landscape and authorizing greater reliance on market value.” In his ruling, Laster admitted that he may have made some mistakes, but denied accusations that he had used the case to set up a showdown with the high court.

Attorneys for corporate respondents have argued that Dell and DFC were needed to stem the rising tide of appraisal arbitrage, where firms would buy up large amounts of companies' stock on news that a sale was imminent in order to exercise appraisal rights under the Delaware General Corporation Law. They point to a steep decline in such cases as evidence that the Supreme Court has struck the proper balance in its rulings.

Counsel for appraisal petitioners, on the other hand, have said that the rulings encourage judges to find fair value below the deal price, which would effectively strip dissident investors of a statutory remedy available under state law.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

3 minute read

Amazon Faces Similar Patent Suit Over Alexa, Echo Technology After $46.7M Jury Verdict Against It

3 minute read

Antitrust Lawsuit Alleges Scheme to Block Digital-Wallet Competitors, Monopolize Cash Access at US Casinos

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250