Texas Company Agrees to $550,000 Settlement Over Subprime Auto Loans

The Delaware Department of Justice has reached a $550,000 settlement with a company accused of marketing subprime auto loans to hundreds of Delaware car buyers, Attorney General Kathy Jennings announced Monday.

April 08, 2019 at 05:54 PM

3 minute read

The original version of this story was published on Delaware Law Weekly

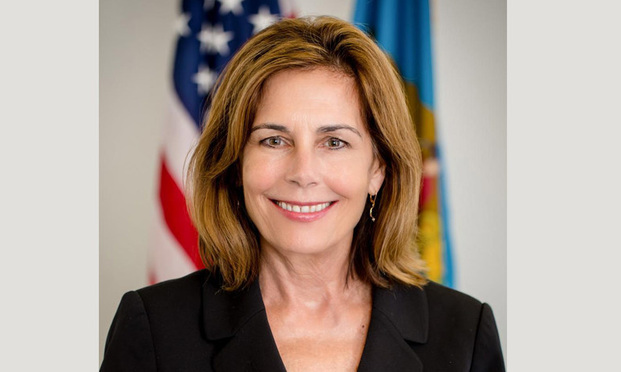

Delaware Attorney General Kathy Jennings.

Delaware Attorney General Kathy Jennings.

The Delaware Department of Justice has reached a $550,000 settlement with a company accused of marketing subprime auto loans to hundreds of Delaware car buyers, Attorney General Kathy Jennings announced Monday.

The DOJ said in a statement that Exeter Finance LLC had signed a cease and desist agreement, after a larger investigation revealed that it had facilitated car loans to consumers with poor credit. Under the agreement, which also included the Massachusetts Attorney General's Office, Texas-based Exeter will pay the state of Delaware $50,000 and ask major credit bureaus to wipe all trade lines on the credit reports of affected consumers, the department said.

“Protecting consumers from unfair lending practices is extremely important,” Jennings said. “Today's settlement with Exeter provides monetary relief to Delaware borrowers and repairs damaged credit.”

Exeter did not admit to breaking any state or federal laws and neither confirmed nor denied the allegations as part of the agreement. A company spokesman said Monday that Exteter was “pleased to have resolved this matter.”

“Exeter is committed to ensuring the highest standards of customer service in its business when delivering vital auto financing options to consumers,” the spokesman said.

The settlement with Exeter was part of Jennings' industrywide review of securitization practices in the subprime auto market. In March, the DOJ secured nearly $2.9 million from Santander Consumer Consumer USA Holdings Inc., another auto financier, for its role in financing similar loans.

“Our office will continue to investigate the subprime auto lenders to ensure that Delaware consumers receive a fair deal when they are extended credit to finance a purchase,” Jennings said.

According to the DOJ, subprime auto loans are often made through contracts signed at the car dealership, but funded by non-dealer financial institutions, like Exeter and Santander. As a part of the funding process, those institutions convert the loans to securities and fund them by selling investment notes.

Under the settlement, Exeter is required to pay $550,000 to an independent trust, which will be used to repay affected customers, as well as to cover the costs of implementation and the DOJ's investigation. An independent trustee, chosen by the DOJ and Exeter, would be responsible for administering the fund.

It will be up to the DOJ, however, to determine the amount of restitution provided to Delaware borrowers. The department is expected next month to provide the trustee with a list of consumers it believes are eligible for relief based on loans and certain subprime contracts that Exeter acquired between 2011 and 2015.

The case was handled by the DOJ's fraud division, which includes investor protection director Jillian Lazar, consumer protection director Christian Wright, Deputy Attorneys General William Green and Joseph Tabler, forensic accountant Clyde Hartman, and paralegal Courtney Patas. It was initiated by former investor protection director Owen Lefkon.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Elon Musk’s Tesla Pay Case Stokes Chatter Between Lawyers and Clients

7 minute read

Elon Musk Has a Lot More Than a 'Tornetta' Appeal to Resolve in Delaware

5 minute read

Tesla Shareholders Move to Consolidate Cases Over Musk's Focus on X, AI

4 minute readTrending Stories

- 1Big Law Partner Co-Launches Startup Aiming to Transform Fund Formation Process

- 2How the Court of Public Opinion Should Factor Into Litigation Strategy

- 3Debevoise Lures Another SDNY Alum, Adding Criminal Division Chief

- 4Cooley Promotes NY Office Leader to Global Litigation Department Chair

- 5What Happens When Lateral Partners’ Guaranteed Compensation Ends?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250