Del. Chancery Finding Could Lead to Reinstatement of $17M Judgment in Contract Dispute Over Metal Card Sale

The ruling, outlined in a 12-page report from Vice Chancellor J. Travis Laster, could put CompoSecure back on the hook for a nearly $17 million judgment that the state Supreme Court "reluctantly" vacated in the long-running contract dispute.

June 05, 2019 at 03:22 PM

4 minute read

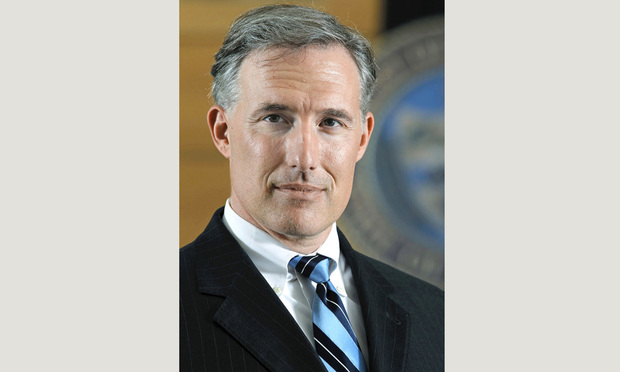

Vice Chancellor J. Travis Laster of the Chancery Court of the State of Delaware.

Vice Chancellor J. Travis Laster of the Chancery Court of the State of Delaware.

A Delaware Chancery Court judge on Wednesday said that a metal credit card manufacturer CompoSecure could not rely on a contractual provision to avoid paying a hefty commission to a company it had retained to market its products to high-end customers.

The ruling, outlined in a 12-page report from Vice Chancellor J. Travis Laster, could put CompoSecure back on the hook for a nearly $17 million judgment that the state Supreme Court “reluctantly” vacated in the long-running contract dispute, which was triggered by a massive sale to Amazon in 2016.

Last year, Laster rejected CompoSecure's bid to exit its contract with CardUX, ruling that the agreement was still enforceable even though it was not formally ratified by the company's board and investors. The ruling approved more than $14 million in compensatory damages for CardUX, plus almost $2 million in attorney fees and expenses and pre- and post-judgment interest.

A three-judge panel of the high court, however, vacated the award and sent the case back to Laster in November, finding that the judge had not fully accounted for a contractual provision that could cancel the arrangement with CardUX as a “restricted activity.”

Supreme Court Justice Karen L. Valihura wrote at the time that the court had done so ”reluctantly” because the “equities do not favor CompoSecure.” According to Valihura, Laster's original ruling was “rife with findings suggesting that CompoSecure consistently attempted to avoid its obligations” after the company realized the Amazon deal entitled CardUX to a $9 million up-front commission.

On remand, CompoSecure argued that the sales agreement had to be approved by the board and investors because it authorized the payment of commissions in excess of $500,000, which was listed as a restricted activity under the contract.

But Laster found that the provision did not include future payments, such as commissions, which were subject to two conditions, which prevented CompoSecure's management from unilaterally committing the company to large expenditures without oversight from its owners. He also noted that all of the involved constituencies wanted to go forward with the contract, until the Amazon deal changed their minds.

“Having chosen to go forward with the sales agreement, and having chosen to go forward with the Amazon sale, CompoSecure's management team and its owners are now invoking the restricted activities provision in an effort to enable their current selves to escape the consequences of actions taken by their former selves,” Laster wrote.

David J. Margules, who represents CardUX, said that in light of Laster's fact finding, the case would now go back to the Supreme Court, which could decide whether to affirm the original ruling.

“It's been a long time and a lot of money and effort to get to this point. I hope we are in the final chapter,” said Margules, a partner in Ballard Spahr's Wilmington office.

“I'm hoping CompoSecure will govern its conduct by the principles underlying [the sales agreement],” he said.

An attorney for Somerset, New Jersey-based CompoSecure did not return a call Wednesday seeking comment on the case.

CompoSecure is represented by Steven M. Coren of Kaufman, Coren & Ress in Philadelphia and Myron T. Steele, Berton W. Ashman Jr. and Andrew H. Sauder of Potter Anderson & Corroon in Wilmington.

CardUX is represented by Margules, Elizabeth A Sloan and Jessica C. Watt of Ballard Spahr.

The case is captioned CompoSecure v. CardUX.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250