SEC payment signals support of whistleblower program

The award handed out on Sept. 30 was by far the largest, and may serve as incentive for more individuals to come forward.

October 02, 2013 at 07:00 AM

2 minute read

The original version of this story was published on Law.com

The 2010 Dodd-Frank financial reform act was meant to address many of the worst transgressions perpetrated by large financial institutions. The act established many methods of dealing with fraud and corruption but, now, one weapon to deal with fraud may become more of a factor.

To date, the Securities and Exchange Commission (SEC) has only given out three monetary awards to people who blew the whistle on corporate fraud, but the award handed out on Sept. 30 was by far the largest, and may serve as incentive for more individuals to come forward.

People who report violations of securities laws to the SEC are eligible for an award if that information leads to enforcement action with sanctions greater than $1 million. Whistleblowers can receive up to 30 percent of any monetary penalty. The award that was handed out on Monday was $14 million, which means that the monetary sanctions on the company totaled at least $46.7 million.

The SEC did not reveal much information about the award but such a large payout may encourage more people to come forward when they witness instances of fraud. The Wall Street Journal indicated that there are many cases pending at the SEC that could reap significant awards for whistleblowers.

Of course, that is the whole point – the SEC wants to encourage whistleblowing. “While it is certainly gratifying to make this significant award payout, the even better news for investors is that whistleblowers are coming forward to assist us in stopping potential fraud in its tracks so that no future investors are harmed,” said Sean McKessy, chief of the SEC's office of the whistleblower in a press release. “That ultimately is what the whistleblower program is all about.”

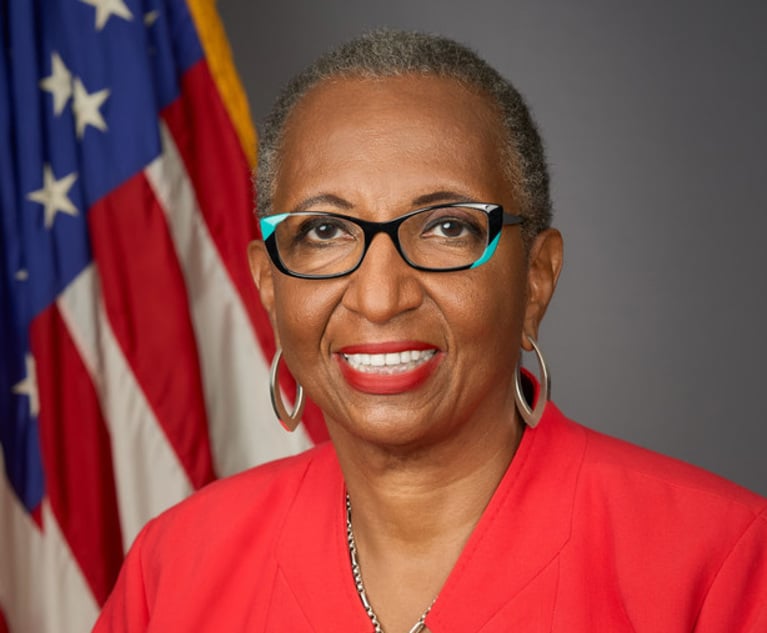

The chair of the SEC, Mary Jo White, will be present at the Women, Influence & Power in Law Conference, running from Oct. 2-4 in Washington, D.C. Chair White will discuss her personal story, her challenges and triumphs, and will take questions about topics that are relevant to the SEC today.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Compliance With EU AI Act Lags Behind as First Provisions Take Effect

State AG Hammers Homebuilder That Put $2,000-Per-Day Non-Disparagement Penalty in Buyer Contracts

3 minute read

Fired NLRB Member Seeks Reinstatement, Challenges President's Removal Power

GOP-Led SEC Tightens Control Over Enforcement Investigations, Lawyers Say

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250